Car tax 'U-turn' hopes to go 'unnoticed' as money from UK drivers removed from road improvement projects

'We believe the creation of the National Roads Fund would have been a massive step in the right direction'

Don't Miss

Most Read

Latest

Motoring experts have accused the Tories of “performing a U-turn” in relation to dedicating funds from car tax to road projects.

Under previous Conservative plans, money raised through Vehicle Excise Duty (VED) would have gone towards funding schemes to improve and maintain roads.

In 2020, the Government promised to launch a new National Roads Fund (NRF) after first being announced in the 2018 Budget.

It would have delivered £28.8billion to meet the Government’s commitments to spend VED from English drivers on the road network between 2020 and 2025.

Money raised from VED goes into the Consolidation Fund

|GETTY

Documents suggested that the National Roads Fund would receive £27.4billion through the Roads Investment Strategy 2, with further cash coming from the Major Road Network and Large Local Major Schemes.

However, the Treasury has confirmed that revenue raised from VED would go into the Consolidation Fund which is a general pot of tax receipts, according to the PA news agency.

Despite this, it insisted that VED “is being reinvested” into road schemes, prompting the RAC to say that the Government “seems to have done a U-turn and are quietly hoping it goes unnoticed”.

The Department for Transport said in 2016 that the Government “guarantees that all revenue raised from VED” would be allocated to the NRF and that it would be “underpinned by legislation”.

Examples of projects which could receive funding include the A66 Trans-Pennine upgrade, the Lower Thames Crossing and the Oxford Cambridge Expressway - all of which have since been delayed or cancelled.

Simon Williams, head of policy for the RAC, said: “We welcomed the Treasury announcement that revenue from vehicle tax in England was to be ring-fenced for future investment in our busiest roads.

“The Government seems to have done a U-turn and are quietly hoping it goes unnoticed.

“We believe the creation of the National Roads Fund would have been a massive step in the right direction as it ensured around £6billion of the circa £45billion collected from drivers in all forms of motoring taxation each year would go directly back into the roads that carry the most traffic.”

In October 2023, the Department for Transport announced that money saved from cancelling the northern leg of HS2 would provide English councils with £8.3billion in funding over 11 years.

Williams described this as a “drop in the ocean” with roads going untreated causing a plague of potholes, as he accused the Government of contributing to “years of underinvestment and neglect”.

He called on lawmakers to ring-fence “a small proportion” of money raised from fuel duty receipts to go towards road projects.

Data from the Asphalt Industry Alliance suggests that the cost to repair all potholes in Britain has soared to £12billion and could take more than nine years to address.

LATEST DEVELOPMENTS:

- Major car tax changes 'will happen at some point in the next couple of years' despite U-turn last month

- Electric cars backed by Dragons' Den as Deborah Meaden invests £50k in 'cost-effective' charging solution

- Drivers warned of number plate issue which may see Britons hit with Ulez fines without being in London

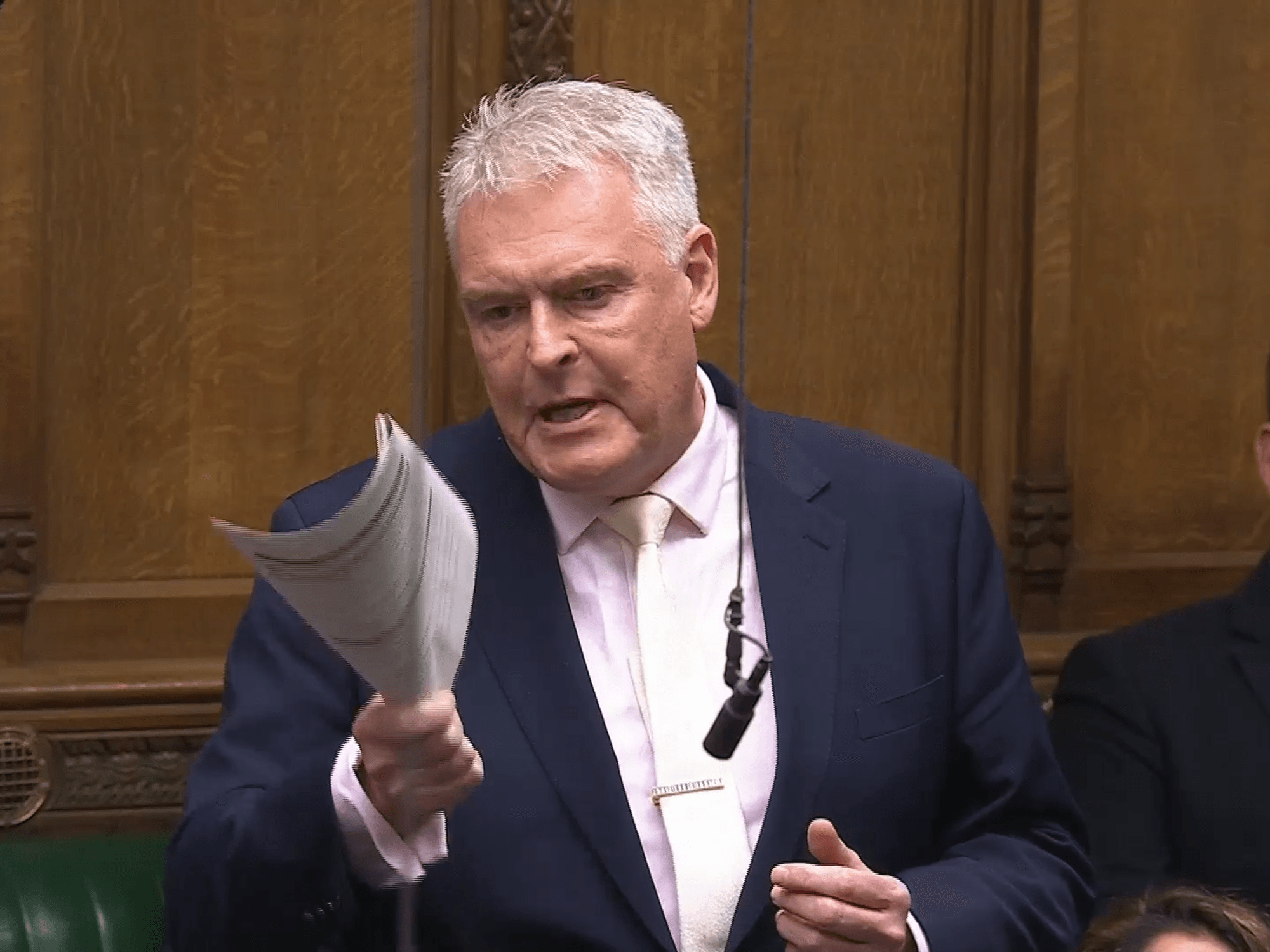

Many drivers and MPs have spoken of the need for more pothole repair funding

|PA

A spokesperson for the treasury said: “The Consolidated Fund receives the proceeds of Vehicle Excise Duty and most other tax revenues, such as those collected by HMRC.

“VED is being reinvested into the English road network between 2020-2025 to fund road enhancement projects.”