Car tax changes urgently needed to 'get rid of grey areas' after driver backlash and major U-turn

'The industry must consult with HMRC to get the right decision over the line'

Don't Miss

Most Read

Latest

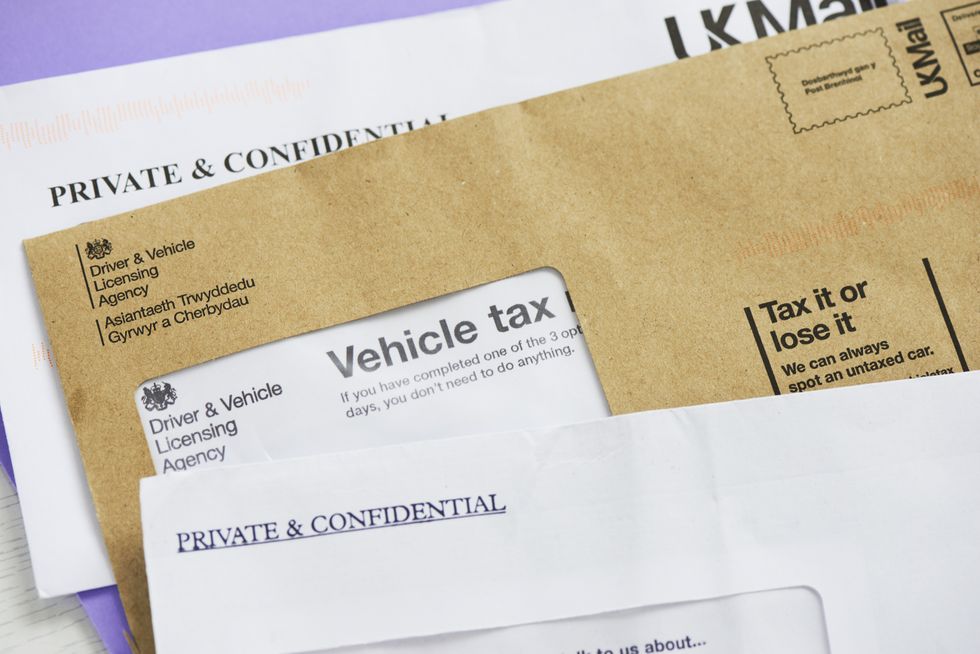

Experts have called for new car tax changes to be launched to protect drivers, months after the Government was forced into a major U-turn in response to serious concerns from motorists.

In February, rules were introduced to deal with double cab pick-up trucks and how they should be classed when it comes to taxation and would have seen these trucks charged as company cars.

Under the plans, anyone who purchased such a vehicle after July 1, 2024, would have been hit with a near-fivefold increase in their motoring taxes.

This would have applied to any vehicle with a payload of more than 1,000kg, with most of these vehicles having an internal combustion engine, resulting in higher Benefit-in-Kind (BiK) taxes.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The expert has called the HMRC to introduce new rules

| GETTYDespite the initial announcement, HMRC said it had "listened carefully" to backlash from drivers and decided against introducing the unpopular move.

Shoreham Vehicle Auctions (SVA) has now called on the Government to introduce new rules for certain vehicles and suggested that key stakeholders in the sector should back the proposals.

The organisation called on HMRC to look into new rules dealing with the taxation system of one-tonne double cab pick-ups.

Alex Wright, managing director of the SVA, said any changes must work to avoid penalising the business use of the vehicles.

He said: “The industry must consult with HMRC to get the right decision over the line.

“HMRC is looking to settle a taxation issue that has been bubbling for more than two decades.

“It wants to get rid of the grey areas that are in place that encourage tax avoidance which we can understand.”

He added that there could be a luxury tax on pick-up trucks that cost more than £35,000 by distinguishing them as being recreational rather than vehicles used for business.

This aims to crack down on people buying more expensive pick-up trucks for their own use, rather than slightly cheaper models which tend to be used by legitimate business use.

Wright stated that this would also be helpful for rental companies by ensuring the vehicles can retain value for longer periods of time.

He continued, saying: "If a future date is confirmed to roll out new legislation, risk managers can plan accordingly to make the right decisions for their companies and not have to make provisions for residual value losses when disposing of existing stock.

“Companies are investing in DCPUs to safely carry people, equipment and tools. We don’t want a situation where HMRC taxation might compromise work efficiency and safety."

LATEST DEVELOPMENTS:

Double cab pick-up trucks are very popular among tradespeople | PA

Double cab pick-up trucks are very popular among tradespeople | PAWright concluded by calling for feedback in response to the luxury tax proposals from any industry group that could work alongside the HMRC to introduce meaningful change.