Car insurance prices drop for first time in two years but drivers will only save a few pounds

Drivers pay an average price of £622 for their car insurance

| GETTY

Insurance prices are still 21 per cent higher than they were last year

Don't Miss

Most Read

Drivers have paid the least amount of money on car insurance for the first time this year as prices begin to stabilise.

According to the Association of British Insurers (ABI), premiums for car insurance dropped two per cent in June with drivers saving roughly £13 and paying an average of £622.

The association explained that a decrease in pressure on the cost of claims has helped drivers save on insurance.

Despite the quarterly drop in premiums, average car insurance prices are still 21 per cent higher than they were in 2023.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The ABI paid out £2.9billion in car insurance claims in Q2 of 2024

| GETTYABI data found that in the second quarter of 2024, insurers paid out £2.9billion in claims, £400million more than for the same period last year.

While the number of payouts continues to rise, the average cost of vehicle thefts has started to decline by 10 per cent - down to £12,100.

Mervyn Skeet, director of general insurance policy at the ABI, explained that it's encouraging to see motor insurance premiums stabilising for drivers.

He said: “While this is good news, we need to continue our work focusing on claims costs, for the good of consumers. It remains a top priority for us and our member insurers.”

Rocio Concha, Which? director of policy and advocacy, added that while it is a positive step to see prices fall, “motorists will certainly hope this trend continues”.

However, she warned that with premiums rising significantly over the past year, “many drivers opening their renewal quotes will still get a nasty shock”.

“To make matters worse, drivers who can’t afford to stump up for annual cover all in one go, and instead pay monthly, can end up paying hundreds of pounds more over the course of a year due to the high levels of interest charged on payments,” Concha added.

Drivers have been told of some simple changes they can make to save on their car insurance premiums, including installing a dash cam in their vehicles.

Dash cams can provide video evidence in accidents and can help insurance companies get a better understanding of the incident when choosing to pay out.

They can also help deter theft and other crimes by recording incidents which can later be used as evidence.

Moneybarn Car Finance experts explained that by using a dash cam it might make it easier to claim insurance.

The expert said: "It could also mean paying less for insurance, as some companies offer lower premiums to drivers with dash cams.”

LATEST DEVELOPMENTS:

Drivers saved an average of £13 in June on their car insurance premiums

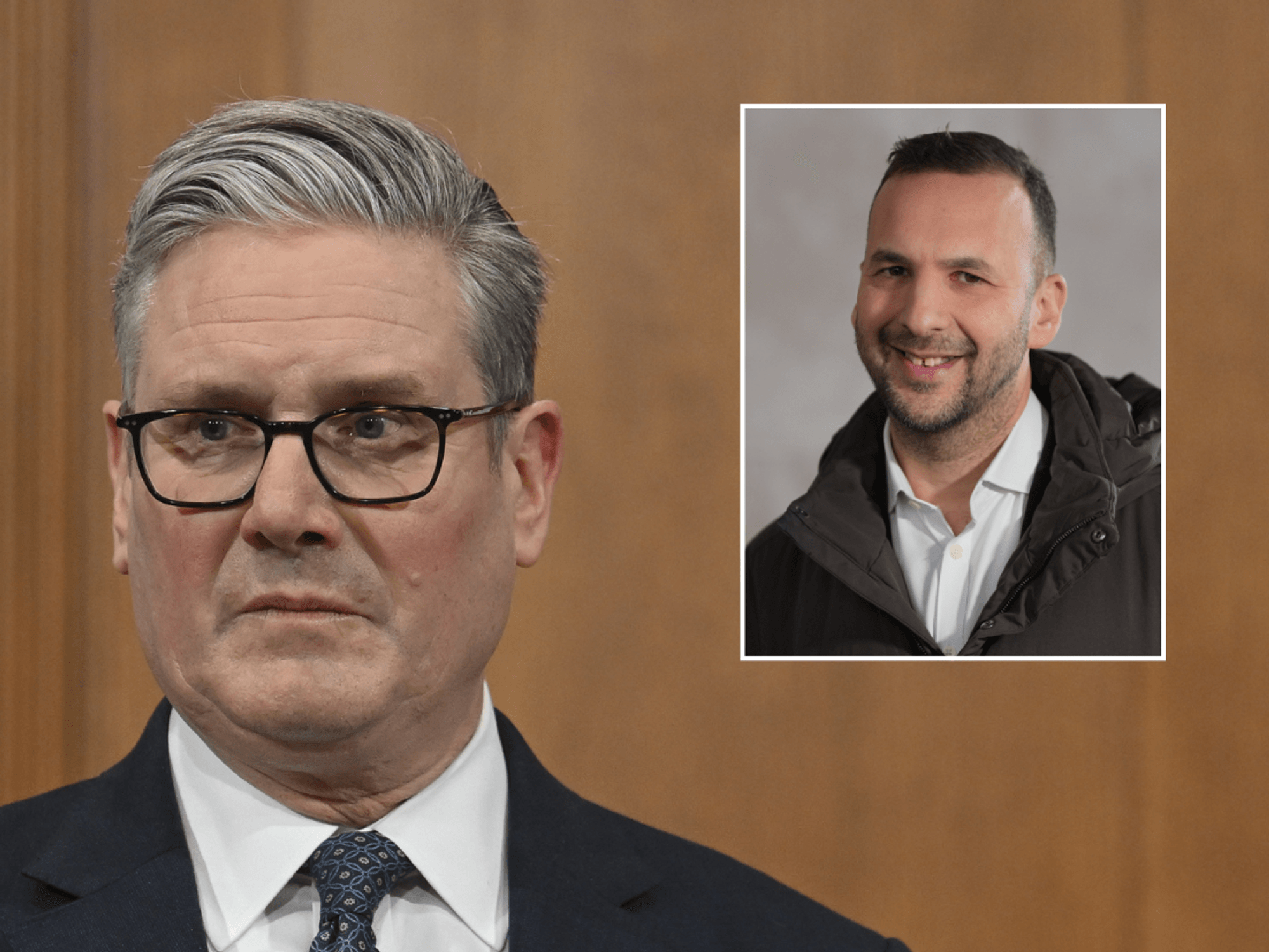

| GETTYTom Banks, motoring expert at Go.Compare car insurance, also commented on the new data, saying: "This is going to be really welcome news for customers - and our own price index for car insurance showed that the average cost of premiums fell £18 between Q4 of 2023 and Q1 of 2024.

“At the same time, though, the Go.Compare car insurance index revealed that while costs were falling, the average policy is still £100 more than it was a year before, meaning that car insurance is still a significant cost for motorists and continues to add pressure while we are in a cost-of-living crisis.

"This means that it’s just as important for policyholders to make sure that they are getting the best deal on their policy."