Car insurance prices remain 'incredibly high' as drivers could see premiums hit £1,000 within months

Drivers in London and young people face the most expensive car insurance premiums

Don't Miss

Most Read

Latest

New data has shown how drivers may need to prepare for car insurance prices to hit another grim milestone of £1,000 as costs continue to rise.

Car insurance has been rapidly increasing in the past 12 months as drivers are left paying unaffordable amounts with the costs of taking out a new policy now as high as £941.

Prices have risen by almost half in the last year with data of more than six million quotes finding that policies went up £284 in the period.

While costs continue to rise year-on-year, in the first quarter of 2024, car insurance prices dipped slightly by £54, giving drivers a small boost.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

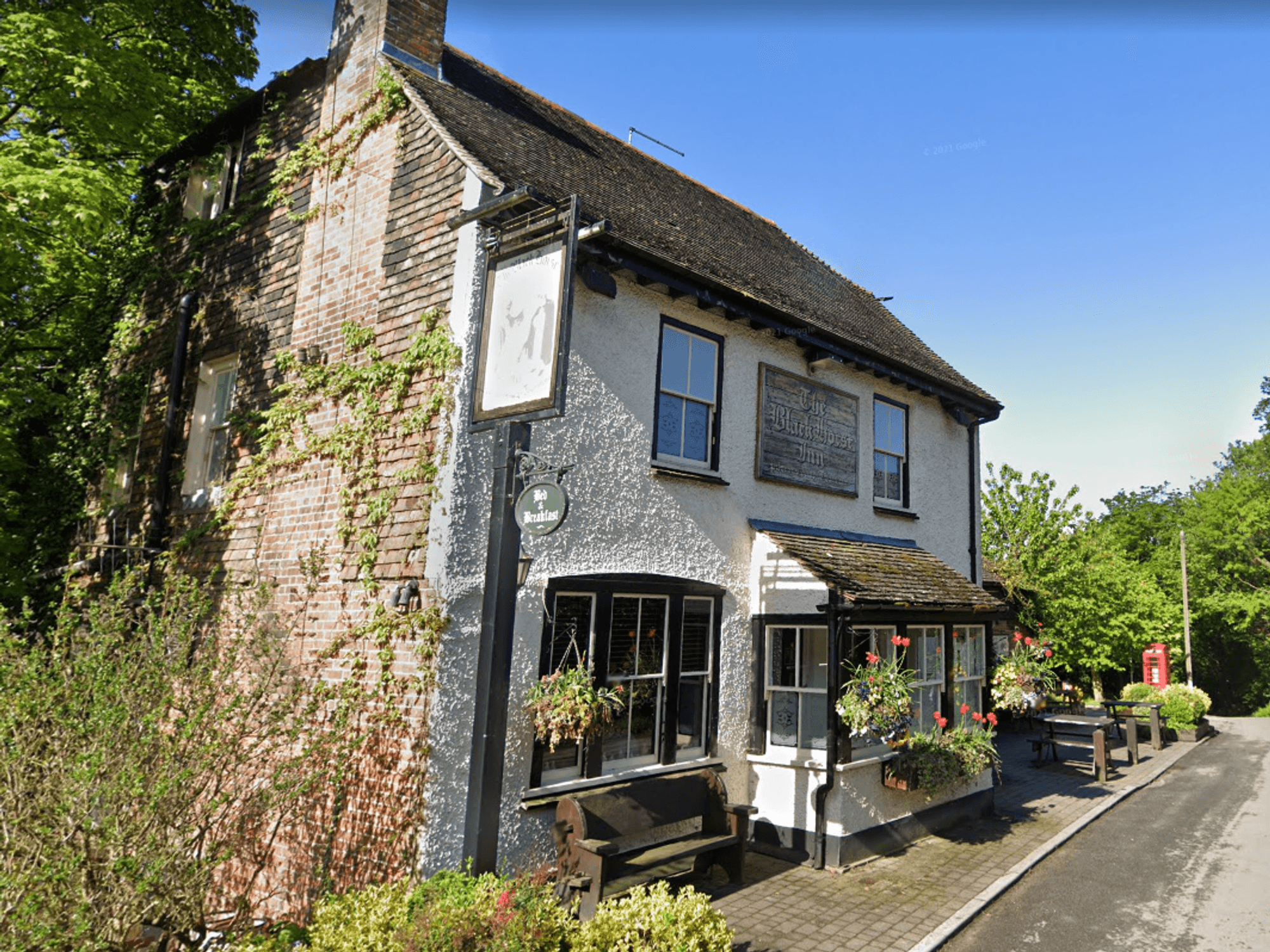

The average price for car insurance is now £941

| PAYoung drivers fare worst of all when it comes to paying for car insurance as prices for an average 22-year-old are £667 more expensive than five years ago.

Today, young drivers are forced to pay roughly £1,930 for their car insurance with research from Confused.com finding that more than two in five drivers are paying more for their insurance.

Louise Thomas, motoring expert at Confused.com, said: “For the first time in a while car insurance prices have stalled slightly for most drivers, and this may come as a relief.

“However, prices are still incredibly high and so people can expect to see their price increase compared to the previous year.”

According to research, three in four drivers who received their renewal between January and March this year were given a more expensive price compared to the previous year.

These motorists saw renewal prices go up by an average of £94, prompting 45 per cent of them to shop around and switch insurers to save money.

Thomas added: “Choosing a higher voluntary excess can bring down your overall premium - but remember to only choose a price you can afford should you need to make a claim. And if you can, paying annually will save you money too, as monthly payments can incur an interest charge.

“If these aren’t viable options, things like increasing your security or reviewing your mileage to be more accurate could make a difference when quoting.

“Ultimately, shopping around is the only way to know you’re paying the cheapest price available to you. With prices so high, it’s a very competitive market.

“So if you look around, there’s likely to be an insurer out there willing to offer a cheaper price.”

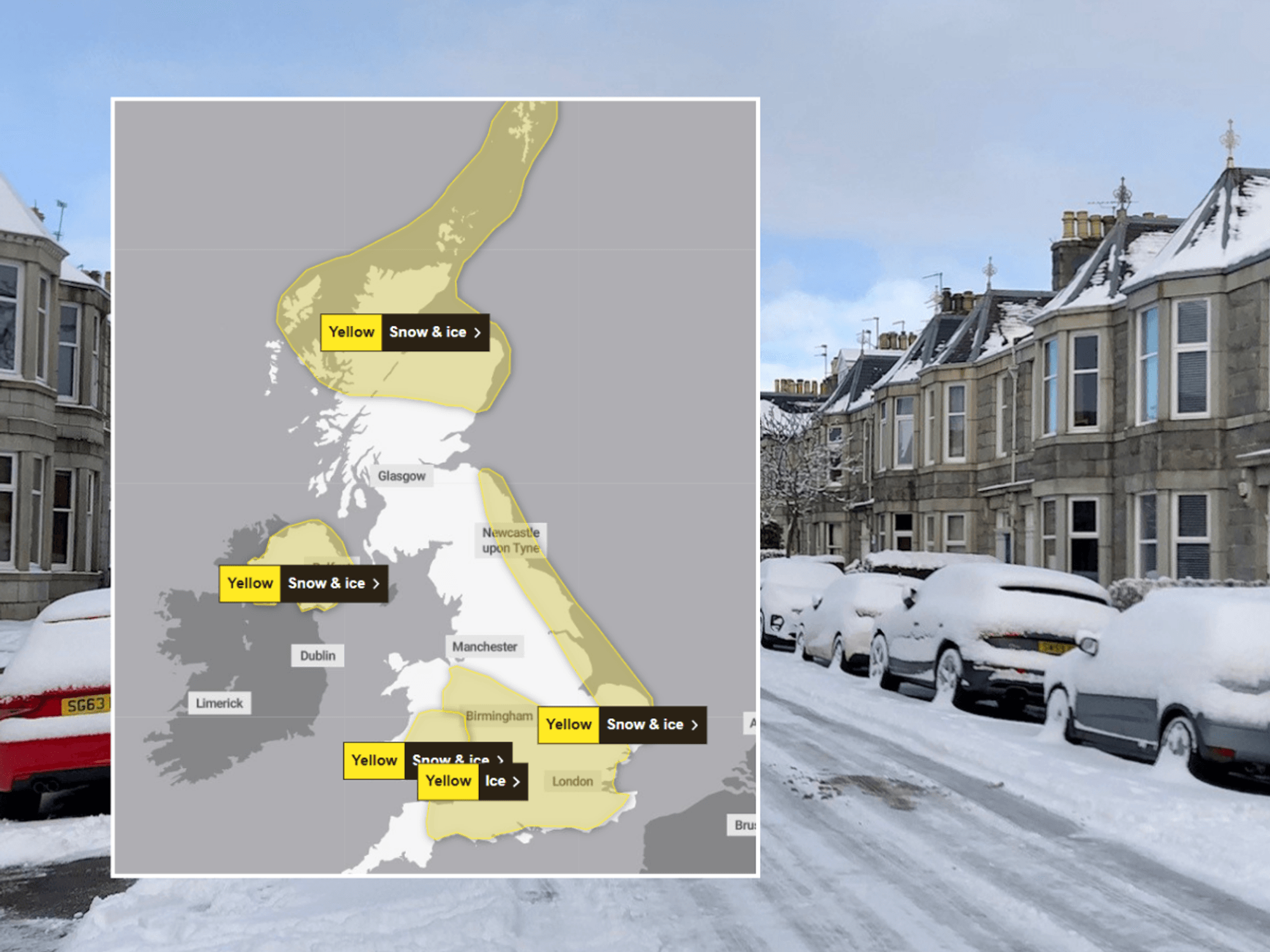

Insurance prices also vary depending on location, age and, in some cases, gender. Men are reportedly paying £1,001 for car insurance, while female drivers are paying £841 for the same cover.

Motorists in the capital also pay more by forking out as much as £434 more than in other regions. Prices in Northern Ireland have dropped the most with premiums eight per cent (£83) lower than three months ago.

LATEST DEVELOPMENTS:

- Diesel drivers warned of calls to ban fuel 'as soon as possible' and launch more Clean Air Zones

- M1 closure: Drivers warned of potential congestion and delays with major motorway set to shut this week

- Drivers could slash car insurance bills to just £241 with the cheapest vehicles to insure - full list

Young drivers saw the sharpest insurance price rises

| PADrivers aged 28 saw the biggest drop in premium costs with a nine per cent drop cutting prices by £139 - more than any other age group.