State pension age overhaul calls grow as DWP told to 'not kick reform into the long grass'

Sir Geoffrey Clifton-Brown says pension reform needs to be addressed or the next generation is at risk of bankruptcy |

GB NEWS

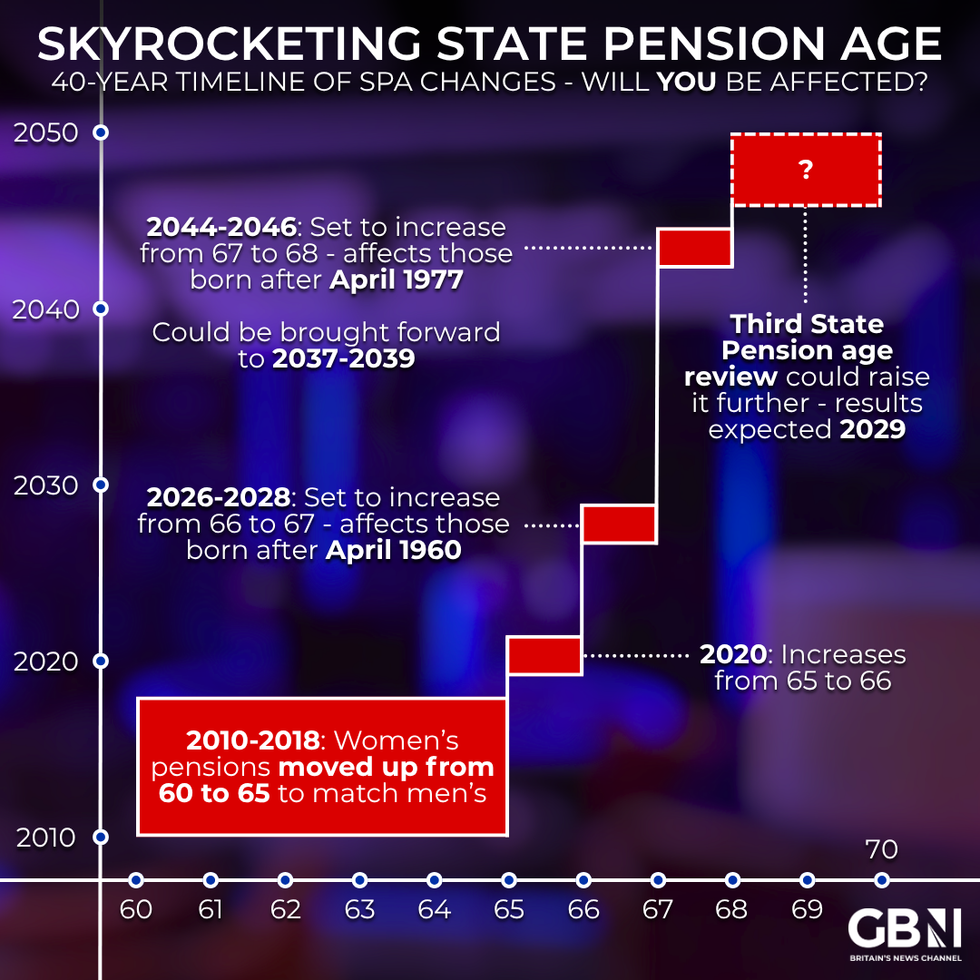

As it stands, the state pension age is 66 but is expected to rise to 67 in the near future

Don't Miss

Most Read

The Department for Work and Pensions (DWP) is being reminded that state pension reform is "not something to kick into the long grass" as analysts call for a mechanism to be put in place when determining retirement age changes.

As is stands, the Government's third state pension age review is in the process of examining intergenerational fairness and consider implementing an automatic adjustment mechanism.

The review, led by Dr Suzy Morrissey from the Pensions Policy Institute, differs from previous assessments as it contains no mandate to recommend increasing the pension age.

Industry leaders at the this week's Pensions UK expressed concern that any future rise in the pension age could worsen inequality, while acknowledging the need for reform to ensure the system's long-term viability.

Analysts are calling for a new mechanism to be introduced for determining changes to the state pension age

|GETTY

The DWP has specifically requested the review to explore how the pension age affects sustainability and to investigate automatic adjustment systems currently operating in other OECD countries.

Dr Morrissey explained to delegates that she had been tasked with examining fairness across generations and assessing the pension age's function in maintaining the state pension's sustainability.

"This is in place in a number of other OECD jurisdictions. It's not something that's in place in the UK at this time, but I've been asked to look at that, so we'll be doing a bit of an examination of where that's being used overseas, and how that's working," she said regarding automatic adjustment mechanisms.

According to Dr Morrisey, the review will analyse how changes would affect various demographic groups, including "people of different sexes, people located in different parts of the country, people who do different types of work".

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsShe encouraged submissions to the review's evidence call, which closes next Friday (October 24), particularly seeking research detailing diverse experiences in later life.

Ben Franklin, the International Longevity Centre's deputy chief executive cautioned that increasing the pension age would likely exacerbate existing inequalities and unfairness.

He highlighted that Britain's pension expenditure remains modest when measured against GDP compared to other developed countries.

"In the UK, we don't spend that much in terms of the proportion of GDP on the basic pension and the new state pension, but our issues around fiscal sustainability are broader than that," Mr Franklin stated.

He emphasised the urgency of reform, noting that debt payments are nearing 100 per cent of GDP."So my assessment here is that state pension reform is not something to kick into the long grass, into the next government potentially, but it's certainly something that we need to get to grips with today," he said.

Mr Franklin highlighted concerning health trends affecting the workforce, pointing to a 2.5-year decline in life expectancy for women in the East Midlands. He noted that 2.8 million working-age individuals remain economically inactive across the UK.

"We are unhealthier and working less," he observed. To create a more sustainable pension system, Franklin argued that broader societal reforms are essential. "We need better job design and flexibility in work for those with health needs," he said.

These health and employment challenges compound the difficulties of any potential pension age adjustments, suggesting that simply raising the retirement threshold without addressing underlying workforce issues could prove counterproductive.

LATEST DEVELOPMENTS:

DWP minister Liz Kendall has launched a new Pensions Commission | PA

DWP minister Liz Kendall has launched a new Pensions Commission | PALaurence O'Brien, a research economist from the Institute for Fiscal Studies (IFS), agreed that the pension system's inequities require attention, noting that raising the retirement age from 67 to 68 would eliminate approximately one-third of pension income for someone dying at 70, while having minimal impact on those living to 90.

The IFS proposed a four-point sustainability framework: maintaining the pension at a fixed proportion of average earnings, guaranteeing inflation protection, committing to avoid means-testing, and linking pension age increases to longevity gains.

"We don't think the state pension should be means tested, as this would interfere with the savings incentive to save privately for retirement," Mr O'Brien stated.

He suggested examining Australia's smooth earnings link system as a potential model for UK implementation.

More From GB News