Carlos Alcaraz immediately loses over £1million despite US Open victory over Jannik Sinner

Carlos Alcaraz dominated Jannik Sinner in a pulsating final at the US Open

Don't Miss

Most Read

Latest

Spanish tennis star Carlos Alcaraz secured the richest prize in tennis history on Sunday, defeating Jannik Sinner at the US Open to claim £3.7 million.

Yet the 22-year-old will see nearly half his winnings vanish to American tax authorities.

The Spaniard triumphed 6-2, 3-6, 6-1, 6-4 in front of President Donald Trump at the 145th edition of the New York tournament.

The victory marked Alcaraz's sixth Grand Slam title and his fourth win against Sinner in their last five encounters this year.

Carlos Alcaraz won a record amount in prize money - but still lost nearly half of it to tax

|REUTERS

Despite the record payout representing a 38.89 per cent increase from last year's prize, Alcaraz faces a substantial tax burden that will dramatically reduce his take-home earnings.

American tax regulations will claim a significant portion of Alcaraz's windfall.

JUST IN: Laura Robson risks backlash from US Open chiefs after Donald Trump comments during final clash

As a non-resident alien competing in the United States, the Murcia native faces federal income tax at the highest bracket of 37 per cent on his tournament earnings.

This federal levy alone amounts to approximately £1.37 million. Additionally, New York state imposes its own income tax, with rates reaching 9.65 per cent for earnings in Alcaraz's bracket.

The combined federal and state obligations mean the young champion will retain only around £2 million from his historic victory.

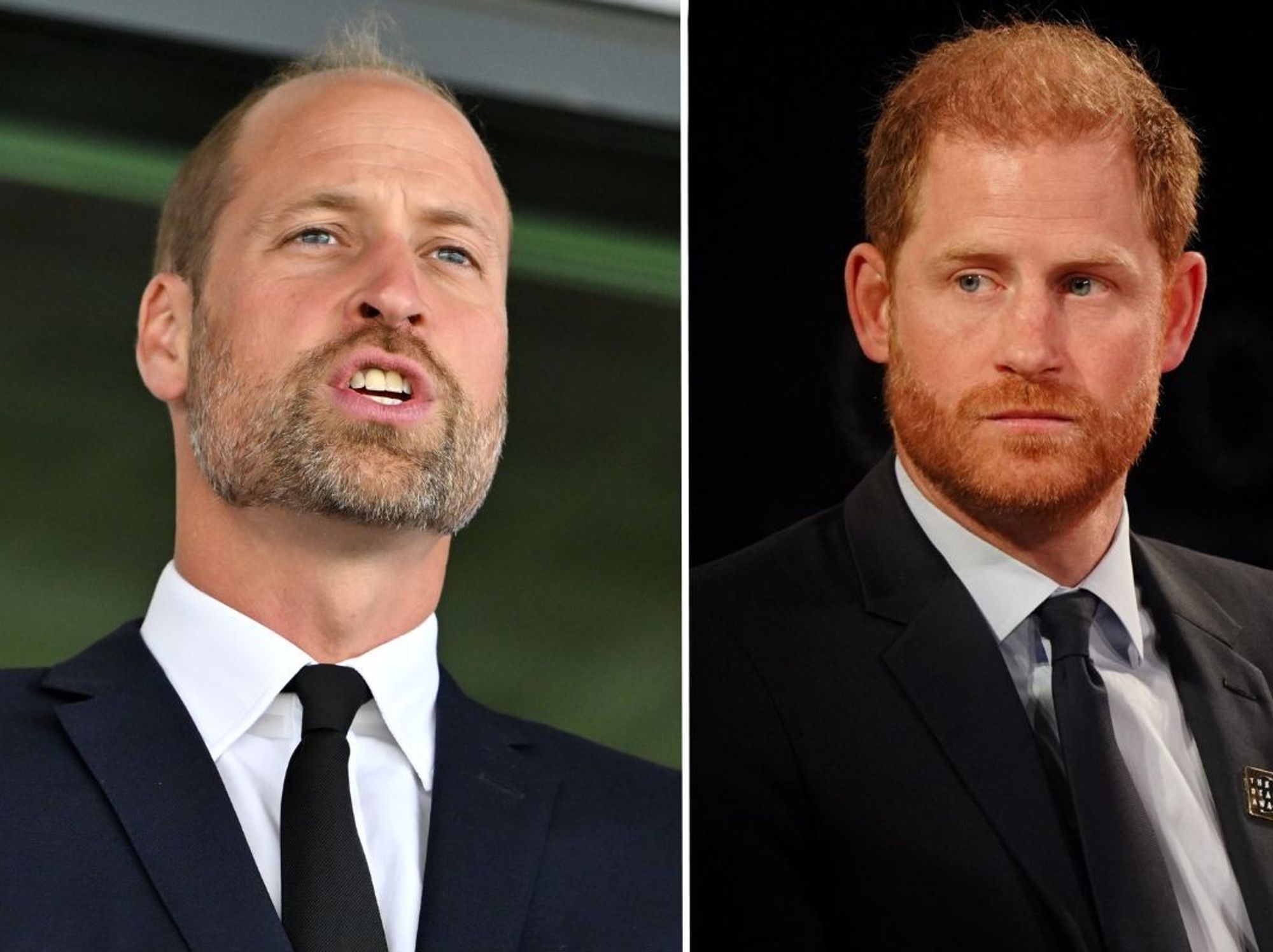

Jannik Sinner was forced to settle for being runner-up after being emphatically beaten by Carlos Alcaraz | REUTERS

Jannik Sinner was forced to settle for being runner-up after being emphatically beaten by Carlos Alcaraz | REUTERSThis represents a loss of nearly £1.7 million to US tax authorities before accounting for any additional expenses such as coaching fees, management costs and travel arrangements.

The tax burden highlights the disparity between players based on their residence.

Whilst Alcaraz must navigate complex US tax obligations, his Italian rival benefits from residing in Monaco, where no income tax applies.

A bilateral agreement between Spain and the United States provides some relief for Alcaraz, preventing double taxation on his American earnings.

Without this treaty, the Spaniard would face additional levies from Spanish authorities on top of his US obligations.

The financial impact extends beyond federal taxes. New York's tiered tax system applies additional charges to tournament earnings, with the state maintaining some of America's steepest personal tax rates.

These combined deductions transform the £3.7 million triumph into a considerably smaller payday.

**SIGN UP FOR OUR FREE DAILY GB NEWS SPORTS NEWSLETTER HERE**

Carlos Alcaraz and Jannik Sinner have dominated tennis in recent months

|REUTERS

Alcaraz has amassed approximately £40 million in career prize money since turning professional in 2018.

His 2025 campaign has yielded over £11.5 million in tournament winnings, including his second consecutive French Open crown in June.

The Spaniard's dominance over Sinner continues to grow, having won ten of their fifteen career meetings.

LATEST SPORTS NEWS:

King Carlos 👑

— US Open Tennis (@usopen) September 7, 2025

The Spaniard defeats Sinner in four sets to claim his second US Open trophy! pic.twitter.com/C2jBm7F178

The Italian has managed just one victory in their past eight encounters, that coming at Wimbledon earlier this summer.

Looking ahead, Alcaraz's next opportunity for a substantial payday arrives at November's ATP Finals in Turin.

Last year's champion Sinner collected £1.7 million at the season-ending tournament, offering another lucrative prize pool for the world's elite players.