‘We're being totally hammered!’ Pensioner tells GB News ‘life is horrible’ under Rachel Reeves in explosive outburst

Pensioner says his life is 'horrible' with Rachel Reeves as Chancellor |

GB NEWS

The Chancellor has been urged to change her approach to National Insurance

Don't Miss

Most Read

Trending on GB News

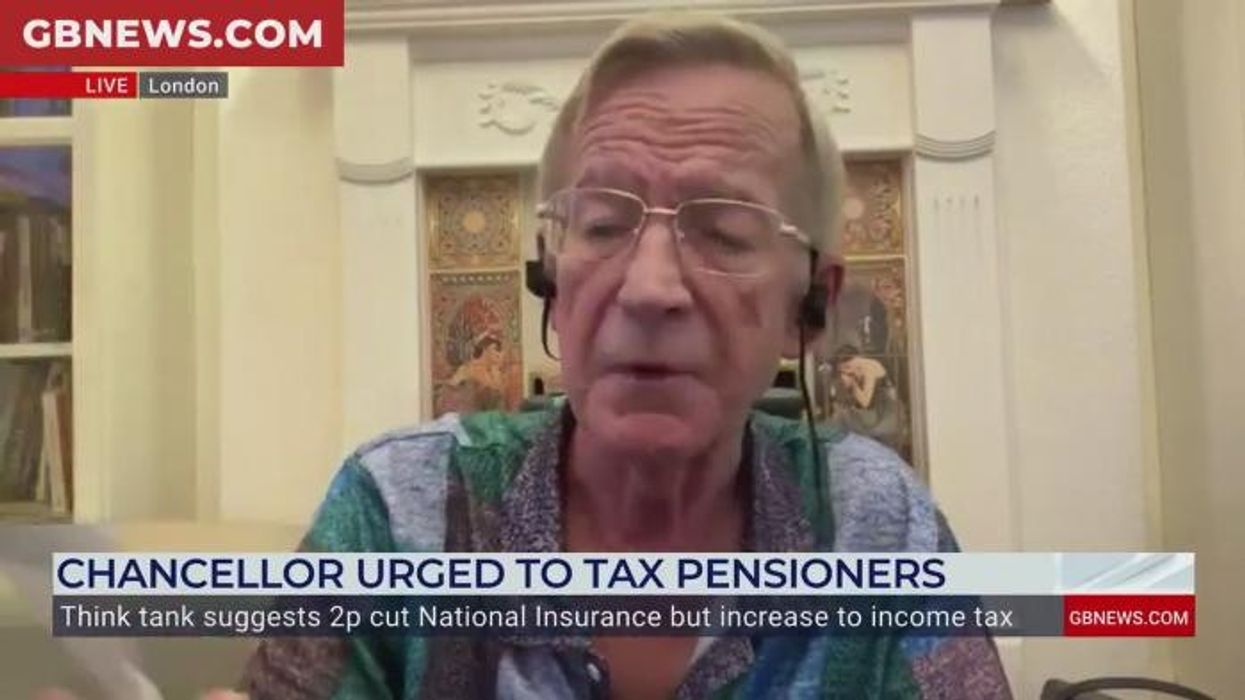

A pensioner has launched a scathing GB News attack on Chancellor Rachel Reeves, declaring that older people are experiencing severe financial hardship under current economic policies.

Fergus McElland expressed his frustration during a GB News interview, stating: "We are being hammered, totally. It's horrible. Rachel from customer service is wrecking the country. It's terrifying."

The pensioner, who revealed he began working at age 11 and has contributed income tax throughout his life, voiced deep concern about the financial burden facing retirees.

His comments emerge as speculation mounts about potential tax increases in the November budget, with particular anxiety about how various groups will be affected by Labour's economic strategy.

Fergus McElland said life is 'horrible' with Rachel Reeves as Chancellor

|GB NEWS / PA

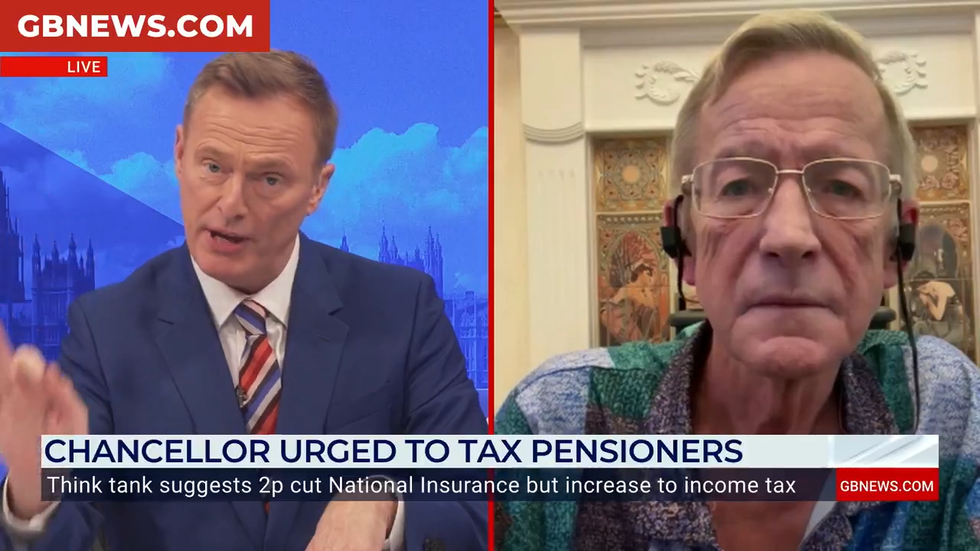

Mr McElland challenged Labour's interpretation of who qualifies as "working people" in relation to tax commitments.

"What do they mean by working people? Apparently it means people who only get a wage once a month, but really it's everyone," he said during the interview.

The pensioner highlighted that property owners, renters and flat dwellers like himself all face financial impacts from proposed policies.

GB News presenter Martin Daubney argued that Labour's pledge to protect working people from tax increases appears compromised, noting that self-employed individuals face higher income tax burdens despite not paying National Insurance directly.

Martin also pointed out that landlords, who have invested their earnings into property assets, face additional taxation despite being working people themselves.

The Resolution Foundation has proposed significant changes to the tax system that would particularly impact pensioners and other non-working groups.

The think tank recommends reducing national insurance by 2p whilst simultaneously increasing income tax by the same amount, a move that would affect pensioners who pay income tax but not national insurance.

Adam Corlett, the foundation's principal economist, argued these adjustments would create a "level playing field" and address systemic unfairness in taxation.

Mr McElland hit out at the Chancellor while speaking to Martin Daubney on GB News

|GB NEWS

The organisation, previously led by current Labour MP and pensions minister Torsten Bell, estimates this approach could help generate the £20 billion required by 2029/2030 to manage rising borrowing costs and stagnant growth.

Additional recommendations include lowering VAT thresholds for businesses, increasing dividend taxation, and implementing carbon charges on long-distance travel.

LATEST DEVELOPMENTS

- Donald Trump eviscerates the UN in full-throttled attack before swiping at Labour - WATCH IN FULL

- ‘How are we meant to live?!’ Pensioners accuse Rachel Reeves of piling on taxes in GB News outburst

- British tradespeople slapped with £3.5billion bill as tool theft epidemic spirals out of control

The Chancellor faces mounting pressure ahead of November's budget, with various sectors warning about potential economic consequences.

The British Retail Consortium cautioned that food inflation could exceed five per cent if retailers face increased taxation, particularly through business rates on larger properties.

Rachel Reeves says 'working people have more money in their pockets' thanks to GDP figures | GB News

Rachel Reeves says 'working people have more money in their pockets' thanks to GDP figures | GB NewsBRC chief executive Helen Dickinson urged the chancellor to exclude supermarkets from any new surtax on properties valued above £500,000, warning of inevitable price increases for consumers.

Food inflation currently stands at 4.9 per cent, its highest point in 18 months, contributing to the Bank of England's recent decision to maintain interest rates.

Industry groups including the Scotch Whisky Association have also appealed for an alcohol duty freeze, describing the current tax regime as placing unsustainable pressure on struggling businesses.

More From GB News