Fraudster sentenced to 7 and a half years in jail after taking £1.3 MILLION in Ponzi scheme

Piers Pottinger hits out at 'preposterous' benefits system as sanctions fall under Labour - 'Soft touch!' |

GB NEWS

Daniel Pugh spent money he received from the fraud scheme on restaurants and designer clothes

Don't Miss

Most Read

Trending on GB News

A fraudster has been jailed for more than seven years after running a £1.3million Ponzi scheme from his bedroom.

Daniel Pugh helped set up the fraudulent Imperial Investment Fund (IIF), taking money from 238 investors whom he largely targeted using Facebook adverts.

Investors who were victims of the Ponzi scheme were offered "impossibly high returns" of 1.4 per cent a day, seven per cent a week or 350 per cent a year, the Financial Conduct Authority (FCA) said.

Ponzi schemes are a form of fraud which pays returns to investors from their own money, or using money paid in by other recent investors.

TRENDING

Stories

Videos

Your Say

Pugh, from Devon, personally received £96,000 from the scam, using the money to fund his lifestyle, including designer clothes and restaurants, as well as withdrawing £18,000 in cash.

The 35-year-old duped investors into believing he was successfully trading and that their money was safe.

Even at the point he knew the scheme was collapsing, the fraudster continued to try to attract more investors.

Pugh was found guilty of one count of conspiracy to defraud following a trial at Southwark Crown Court.

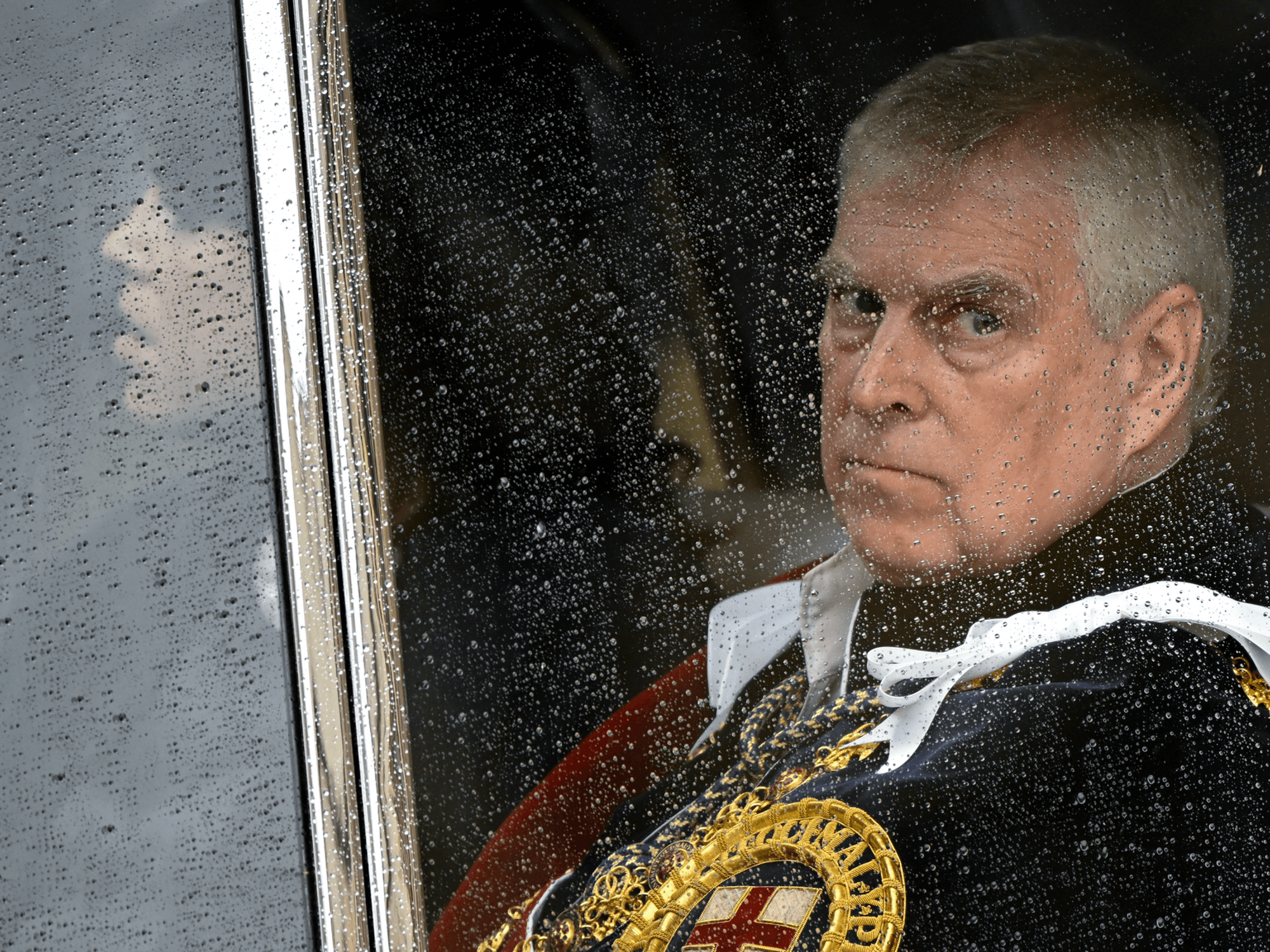

Pugh was found guilty of conspiracy to defraud following a trial at Southwark Crown Court

|PA

He had earlier pleaded guilty to carrying out unauthorised regulated activity under the Financial Services and Markets Act.

The fraudster has now been jailed for seven-and-a-half years and banned from being a director of a company for eight years, effective upon his release.

A further individual is wanted in relation to the same offences, the FCA said.

Speaking on his sentencing, His Honour Judge Weekes said there were "persistent and knowing breaches of the regulatory framework" by Pugh and that any remorse for his actions came "woefully late".

LATEST DEVELOPMENTS:

The Ponzi scheme netted more than £1million

|PA

He added: "The consequences for them [the victims] are marked and apart from financial loss they feel embarrassment."

Steve Smart, executive director of enforcement and market oversight at the FCA, said: "Pugh made outlandish claims to hook in victims but in reality this was nothing more than a massive fraud. Fighting financial crime is a priority for the FCA.

"We will take action to ensure criminals face repercussions for their actions, including being denied access to any ill-gotten gains."

The FCA said it is pursuing confiscation proceedings in a bid to compensate victims of the scam.

Ponzi schemes, also known as get-rich-quick investment scams, are primarily shared on social media.

Beth Harris, head of financial crime at the FCA, said unlawful financial influencers, or "finfluencers", will often "falsely flaunt lavish lifestyles including expensive cars and exotic locations" to draw in potential victims.

"Consumers are promised guaranteed returns but in fact these can be highly risky investments or outright scams, and people risk losing their money," she said.

"If they are dealing with an unauthorised firm or individual then they lose access to protections such as the Financial Ombudsman Service."

As these scams are often promoted online, research shows it is predominantly young people who are falling for them.

Ms Harris added: "Our research found that increasing numbers of young people are falling victim to scams, and unauthorised 'finfluencers' can be involved.

"Nearly two-thirds of 18 to 29-year-olds follow social media influencers, 74 per cent of those said they trusted their advice and nine in 10 young followers have been encouraged to change their financial behaviour.

"While some will also be targeted as they ‘doomscroll’, with reels of content fed to them in response to their consumer "profile."

Our Standards: The GB News Editorial Charter

More From GB News