UK growth slows to 0.3% as Rachel Reeves warned 'sluggish' performance threatens fiscal plans

Labour's history of economic woes and recessions |

GBNEWS

Economists warn this slower growth may force tax hikes in the Autumn Budget

Don't Miss

Most Read

Latest

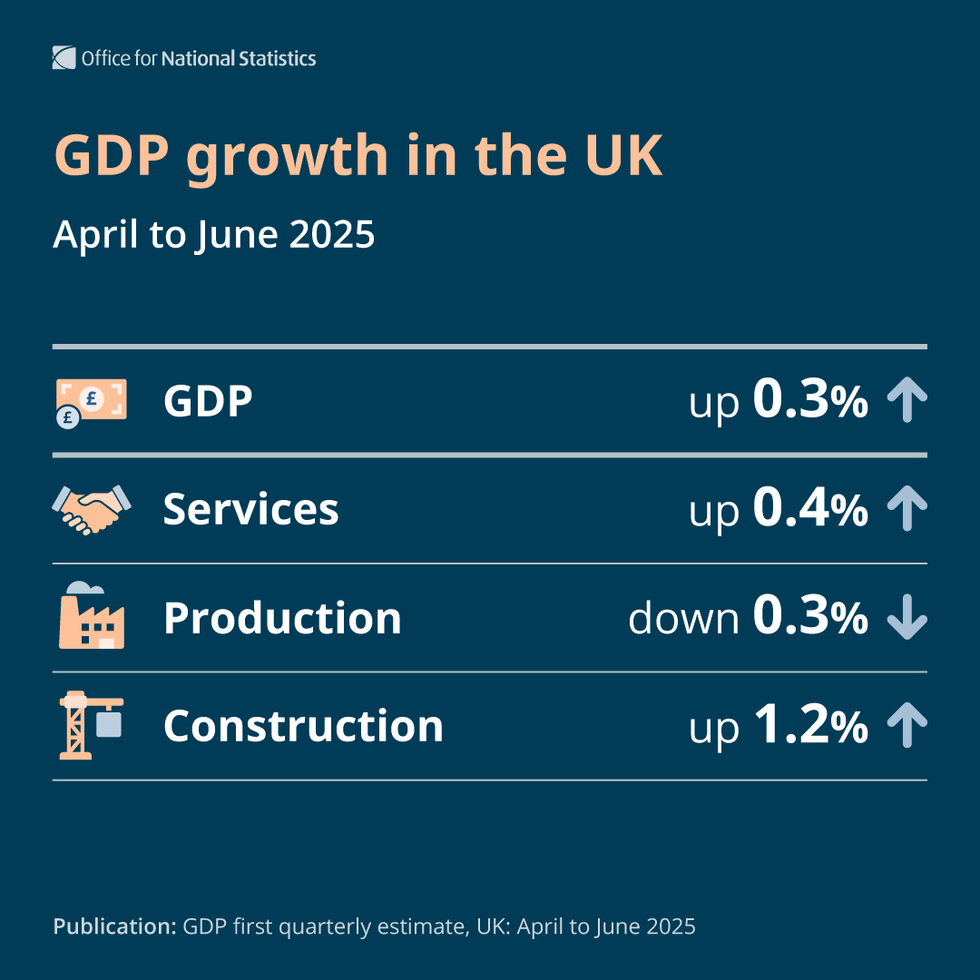

The UK economy grew by just 0.3 per cent in the second quarter of 2025, raising fresh concerns over Chancellor Rachel Reeves' ability to deliver on her fiscal plans.

The latest Office for National Statistics figures show growth has slowed sharply from the 0.7 per cent recorded in the first quarter, when exports surged ahead of new tariffs

A stronger June, with month-on-month growth of 0.4 per cent, helped offset weaker performance in April and May.

Economists have warned the "sluggish" performance means tax revenues are unlikely to reach the levels needed to fund the Government's current spending commitments without further tax rises or spending cuts.

A slowing economy will make it harder for Reeves to meet her fiscal targets in the Autumn Budget. Weaker GDP growth is expected to mean lower tax revenues and a higher welfare bill, forcing Reeves to look at either tax rises or spending cuts to stay on track to balance the public finances by the end of the decade.

Professor Joe Nellis, economic adviser at MHA, said: "The GDP figures highlight the scale of the Chancellor's challenges. Sluggish economic growth means that tax revenues will not reach the levels that the government needs to maintain its current fiscal strategy. Rachel Reeves may be forced to raise taxes in the Autumn Budget to keep the ship afloat."

He added that weak growth is "at the heart of the Chancellor's worries in the lead-up to the Budget."

With Reeves sticking to her self-imposed fiscal rules, strong opposition to spending cuts within Labour "may leave Reeves with no option but to raise taxes, stifling economic growth even further."

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners echoed this sentiment and said: "The slowdown in the second quarter raises questions about whether current output levels are strong enough to prevent further tax hikes in the Autumn Budget.

"Recent U-turns on welfare and winter fuel payments have added pressure to the public purse, with mounting speculation that Reeves may target Inheritance Tax gifting rules or gambling levies to raise revenue."

The total underlying trade deficit widened £1.7bn to a deficit of £9.2bn in Quarter 2 (April to June) 2025 because of a larger rise in imports than exports

|ONS

Despite the slowdown, the Bank of England is unlikely to cut interest rates next month, with policymakers warning about inflation pressures. The rate of price growth is forecast to peak at four per cent in September, double the Bank’s two per cent target.

A key factor holding back growth is the persistently high household savings ratio, which stood at 12 per cent in late 2024 and has remained above 10 per cent since.

Experts say this reflects a lack of consumer confidence, with many households holding back on spending despite real wages rising.

Lower consumer spending reduces demand for goods and services, slows business revenues, and can ultimately dampen job creation, increasing the risk of recession.

UK growth slows to 0.3%

|ONS

Ms Haine said: "For consumers, weaker growth in the second quarter is worrying. If earnings stagnate and redundancies ramp up – as suggested by the latest jobs data this week with unemployment remaining at a four-year high of 4.7 per cent, vacancy levels falling and wage growth easing – many households could face renewed financial strain.

"A softening labour market, stubbornly high inflation, slowing wage increases and a higher tax burden present a troublesome combination for household budgets.

"While five interest rate cuts since August last year have offered some relief, the latest 25 basis-point reduction to four per cent may not be reflected in lower borrowing costs across the board as some lenders remain cautious about future rate cut expectations amid niggling inflationary pressures.

"With food prices continuing to surge, the Bank of England has signalled that interest rates may need to remain elevated for longer as it expects consumer price inflation to peak of four per cent in September."

The Chancellor responded to the figures saying: "Today’s economic figures are positive with a strong start to the year and continued growth in the second quarter. But there is more to do to deliver an economy that works for working people."

A strong performance in June spared the Chancellor from an overall contraction in the second quarter. UK GDP grew by 0.4 per cent in the month, double the 0.2 per cent increase forecast by economists.

This followed declines of 0.1 per cent in both April and May. The April figure was also revised up from an earlier estimate of a 0.3 per cent fall, softening the picture of the spring slowdown.

Experts warn the next few months will be critical for the Government, as they look to restore confidence in consumer and investment spending

| PAMr Nellis explained that "the next few months will be critical for the Government, as they look to restore confidence in consumer and investment spending."

While the recent interest rate cut offers "some relief to businesses facing tight margins," further cuts would be welcome.

He noted that economic recovery will also depend on global conditions and the ease of exporting, and that "the Government needs to find a way to inject some momentum into the UK economy for its own political survival - unfortunately, this is likely easier said than done."

More From GB News