UK borrowing soars by £18bn in August amid fears Rachel Reeves to be forced to hike taxes at budget

Mel Stride - Labour's 'COLOSSAL' borrowing and spending is fuelling their own debt crisis |

GB News

Public finances hit a five-year high as borrowing jumps £3.5billion compared with last year

Don't Miss

Most Read

Latest

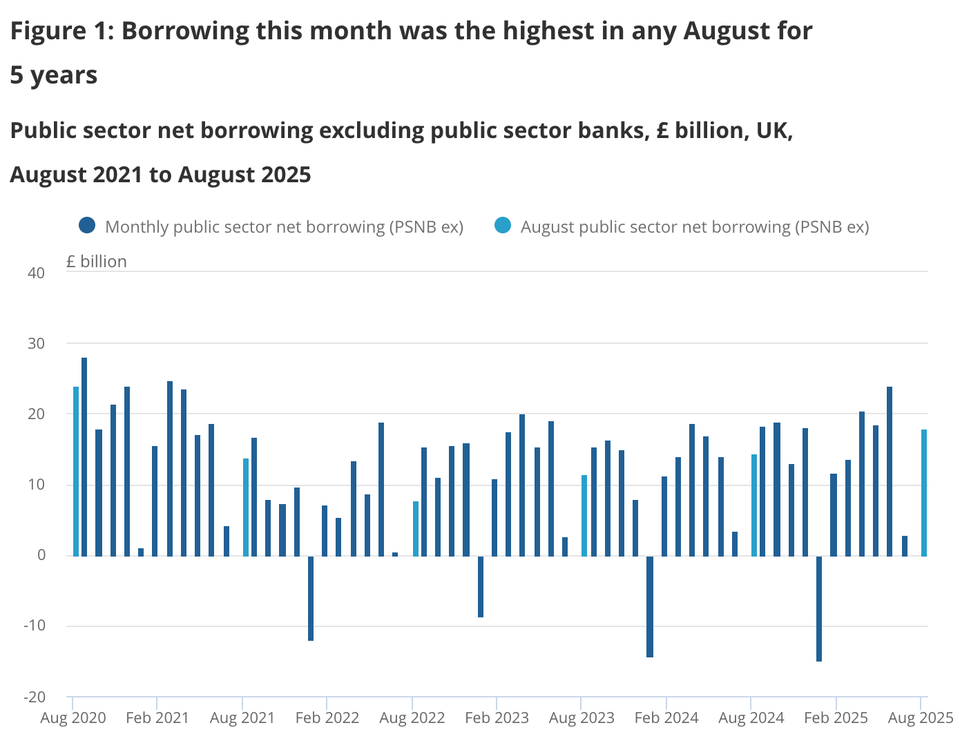

UK public sector net borrowing rose to £18billion in August, the highest for the month in five years, according to the Office for National Statistics (ONS).

The surge raises pressure on Chancellor Rachel Reeves ahead of the upcoming Budget.

The deterioration comes as Chancellor Rachel Reeves faces pressure ahead of her autumn Budget, with speculation about possible tax increases to address the widening gap.

The August figures add to concerns about the Government’s financial position as ministers grapple with rising costs across public services while attempting to maintain discipline.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

TRENDING

Stories

Videos

Your Say

It is the second-worst April to August performance since monthly records began in 1993, behind only 2020.

The five-month total has already exceeded official forecasts by £11.4billion, raising doubts over Treasury projections.

Day-to-day Government operations required £62billion in borrowing over the five-month period.

Public sector net investment added a further £21.8billion to the overall deficit.

The deterioration comes as Chancellor Rachel Reeves faces pressure ahead of her autumn Budget

|PA/Google Finance

Commenting on today’s public sector finances figures for August 2025, ONS Chief Economist Grant Fitzner said: "Last month's borrowing total was the highest August total since the pandemic.

"Although overall tax and National Insurance receipts were noticeably up on last year, these increases were outstripped by higher spending on public services, benefit and debt interest. Total borrowing for the financial year to date was also the highest since 2020.

"As usual for this time of year, we have included some routine annual data updates."

Reacting to the figures, Reform UK deputy leader Richard Tice told GB News: "Public spending is completely and utterly out of control.

"It's almost 10 per cent higher than it was this time last year primarily because of significant public sector pay increases and all the related costs.

"The bond markets are applying what they call the 'moron premium' to the UK economy."

Day-to-day Government operations accounted for £13.6billion of borrowing in August.

That brought the current budget deficit to £62billion so far this year, £13.8billion more than the same five-month period last year.

Public sector net investment added a further £21.8billion to the overall deficit.

Central Government made up the bulk of the shortfall, with £13.1billion of net borrowing in August.

Departmental spending on goods and services rose by £3.7billion to £38billion.

The latest ONS figures will be painful for the Chancellor

| GBNEWSInterest payments on central government debt reached £8.4billion in August 2025, broadly matching the £8.5billion forecast by the Office for Budget Responsibility (OBR) in March.

Much of the volatility in debt servicing costs came from index-linked gilts, where payments rise and fall with the Retail Price Index.

The RPI’s latest movements added £2.6billion in “capital uplift,” which increases the value of gilt principals and fed directly into higher borrowing costs.

The ONS noted this uplift reflected a 0.4 per cent rise in the RPI between May and June 2025, with the costs accrued over the life of the bonds before being paid out at redemption.

Borrowing this month was the highest in any August for 5 years

|ONS

Growth Commission member Ewen Stewart issued the following response to the public sector net borrowing figures for August released by the ONS this morning: “The government borrowing numbers for August – running to £18 billion in a single month – provide serious cause for alarm ahead of the Budget.

"The figures are much worse than the OBR forecasts and reinforce both our assertion that public spending is out of control and our prediction that the Government’s current policies will not deliver sustainable growth.

“The slightly improved trend in spending control over the previous couple of months has been obliterated in a flash, creating a massive headache for the Chancellor.

"Her capacity for cutting spending is restricted by the political demands of government backbenchers, while any further tax rises will impede growth even further.

She’s in an economic doom loop and has increasingly little time to come up with an escape plan.”

Public sector net financial liabilities excluding public sector banks were provisionally estimated at 84.5 per cent of GDP at the end of August 2025.

This was 2.5 percentage points more than at the end of August 2024, but 11.9 percentage points less than for public sector net debt.

Martin Beck, chief economist at WPI Strategy, said: “The £10 billion buffer the Chancellor pencilled in against her key fiscal rule in March has almost certainly gone. That means tax rises in November look inevitable.”

James Murray, Chief Secretary to the Treasury, insisted the Government “has a plan to bring down borrowing because taxpayer money should be spent on the country’s priorities, not on debt interest”.

“Our focus is on economic stability, fiscal responsibility, ripping up needless red tape, tearing out waste from our public services, driving forward reforms and putting more money in working people’s pockets,” he said.

Mel Stride, Shadow Chancellor of the Exchequer, hit out at the Labour Government, taking to social media to say: "Keir Starmer and Rachel Reeves are too weak and distracted to take the action needed to reduce the deficit.

"The Chancellor has lost control of the public finances, and Labour's weakness means much needed welfare reforms have been abandoned. No wonder our borrowing costs recently hit a 27-year high. The Conservatives are the only party committed to fiscal responsibility and living within our means."

More From GB News