Labour £100,000 'tax trap' SLAMMED as couple hit with 62% HMRC charge and lose child benefit

Parents are speaking out about the HMRC 'tax trap', which is taking away much-needed child benefit from households

Don't Miss

Most Read

A couple is slamming the Labour Government over a little-known £100,000 "tax trap" that has left them unable to afford a third child despite both being in high-paying, good jobs.

Matthew and Nicole Griffiths are both employed in the technology sector, own their property and earn six-figure salaries of £125,000 and approximately £100,000 respectively.

However, the arrival of their daughter Olive in 2021 brought an unwelcome discovery about Britain's taxation system. Mr Griffiths, 35, estimated annual childcare expenses at roughly £19,000, yet their earnings meant they would receive no Government assistance until their children reached three years of age.

The couple, who are currently based in Brighton, also supplemented their income through several Airbnb holiday properties, generating between £80,000 and £100,000 in profitable years.

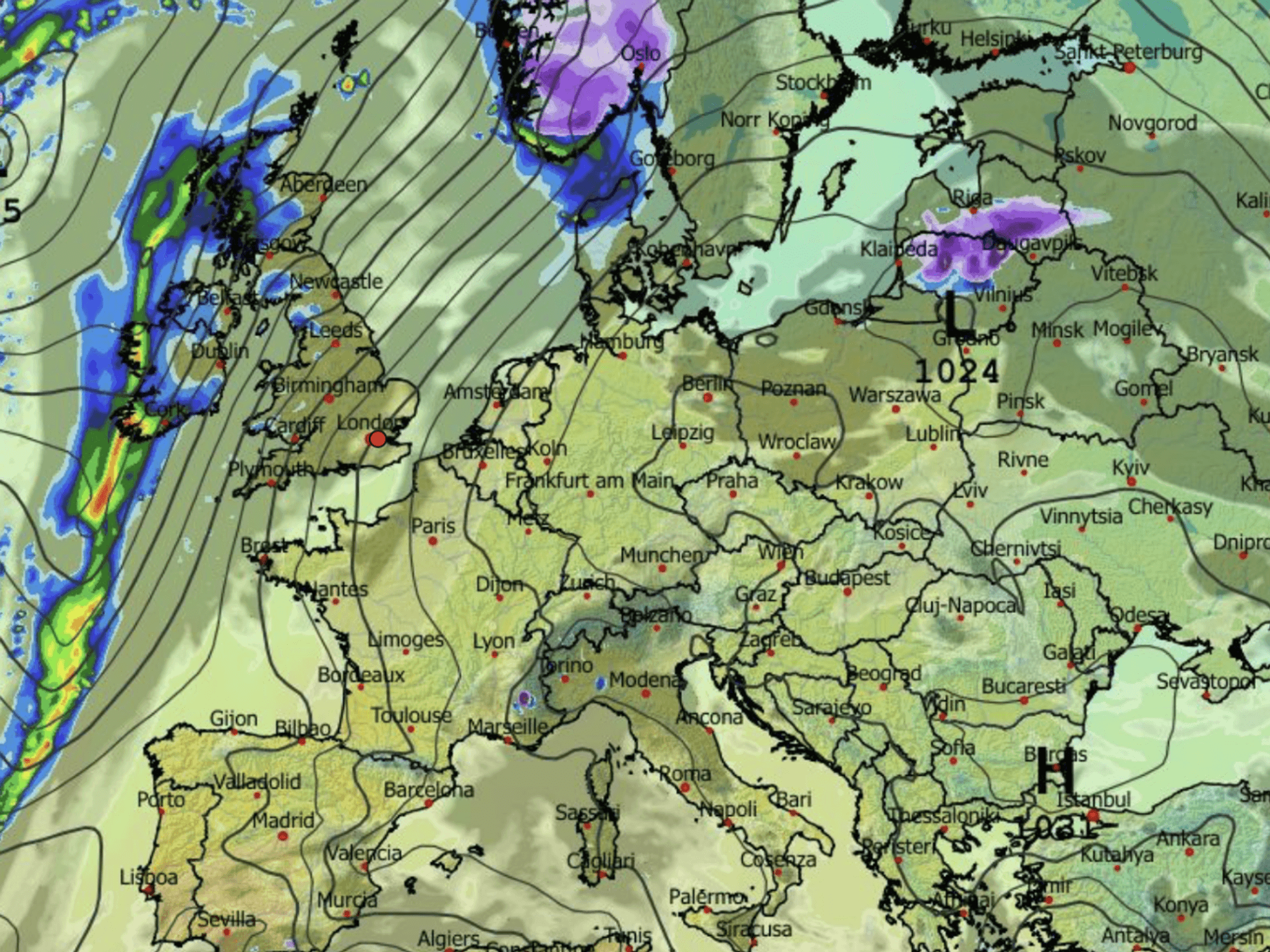

A couple is taking aim at Labour's £100,000 'tax trap'

|GETTY

Despite ranking among the nation's top four per cent of earners, the Griffiths family told The Telegraph they not consider themselves wealthy due to their 67 per cent marginal tax rate and not being eligible for child benefit.

Once either parent crosses a £100,000 earnings threshold, tax-free childcare worth £2,000 annually per child is immediately withdrawn. Access to state-funded nursery provision also diminishes significantly.

Eligible parents receiving 30 hours weekly from nine months, while those above the limit qualify for just 15 hours from age three. Child benefit faces its own cliff edge, with clawback beginning at £60,000 and complete withdrawal occurring at £80,000.

The personal allowance is reduced by £1 for every £2 earned above £100,000, disappearing entirely at £125,140. This mechanism produces an effective marginal tax rate of 62 per cent within this band, before dropping to 45 per cent for additional-rate taxpayers.

Households earning a certain amount are at risk of falling foul of the High Income Child Benefit Charge | GETTY

Households earning a certain amount are at risk of falling foul of the High Income Child Benefit Charge | GETTY Institute for Fiscal Studies (IFS) analysis indicates some workers gain no financial benefit from reaching six figures until their earnings exceed £144,500. The financial pressure intensified when the couple welcomed their second child. Their childcare expenditure doubled to nearly £40,000 annually.

The 2022 mortgage rate surge compounded their difficulties, pushing monthly repayments from £2,000 to £3,200. The family found themselves losing ground financially despite substantial earnings.

Mr Griffiths attempted to reduce his taxable income below £100,000 by directing salary into his pension through his employer's sacrifice scheme. The strategy provided limited relief.

He told The Telegraph: "The first big mistake people make is that they don't investigate ways to solve it; they just take the 62 per cent marginal tax rate and pay the full price for childcare fees."

Working parents have less than twenty four hours remaining to apply for free childcare that could save families thousands of pounds each year | GETTY

Working parents have less than twenty four hours remaining to apply for free childcare that could save families thousands of pounds each year | GETTYLATEST DEVELOPMENTS

He suggests pension overpayments as one solution for those earning tens of thousands above the threshold as a way of avoiding this penalty from HM Revenue and Customs (HMRC).

Mr Griffiths reminded individuals that, despite the loss in take-home income, "putting money into your pension is not money gone" as it is an investment in someone's personal future.

Working as a contractor through a limited company offers another route, enabling lower salaries, business expense deductions and dividend payments taxed at reduced rates. Griffiths acknowledges this option remains impractical for many employees.

According to HMRC figures, uptake for the benefit peaked with 567,000 families using tax-free childcare for 693,000 children in July 2025, while the lowest point saw 453,000 families use the freebie for 535,000 children in August 2025.

Savers have days left to meet an important tax deadline | GETTY

Savers have days left to meet an important tax deadline | GETTY Government spending on the tax-free childcare top-up also saw fluctuation over this quarter quarter, ranging between £41.5million in August 2025 and £52.9million in July 2025.

Speaking to Newspage, Kate Underwood, the founder of Kate Underwood HR and Training, shared: "Tax-free childcare is not a perk, it is the only reason half the parents I know can afford to turn up to work at all.

"The numbers just prove what we already see on the ground. Parents are clinging on to work with tax-free childcare doing all the heavy lifting. Take that away and a lot of them are back to 'I would love to do more hours, but nursery says absolutely not.

"From a small business view, it is maddening. We are desperate for experienced people who can do more than school hours, and we are happy to be flexible, juggle shifts, offer hybrid, all the things."

More From GB News