Tax alert: Savers to 'pay extra £500m in huge hit' under Budget reforms, Coventry Building Society warns

GB News

Budget measures spark warnings of higher costs for investors, pension contributors and property owners

Don't Miss

Most Read

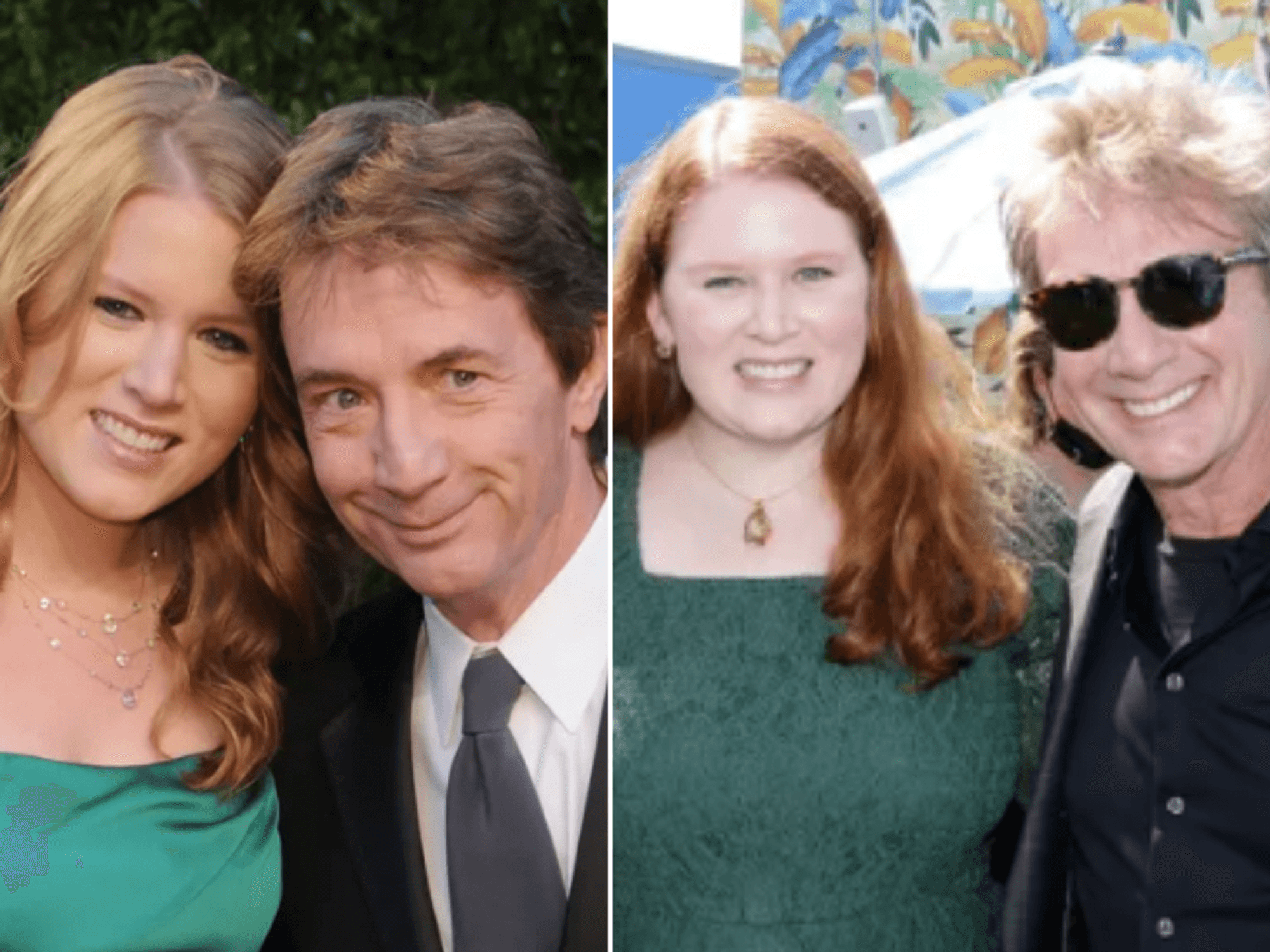

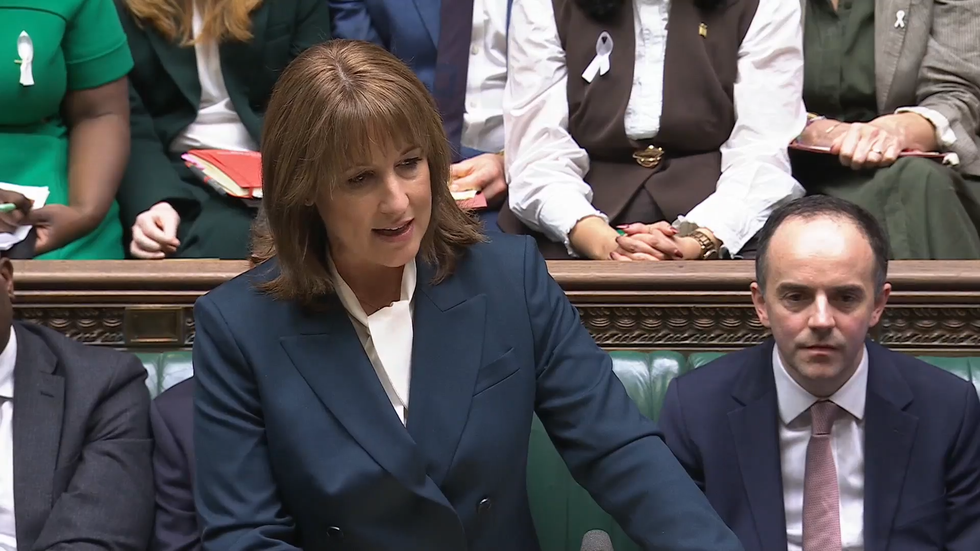

Chancellor Rachel Reeves has introduced a series of tax measures affecting savers, investors and property owners in her Budget, prompting criticism from sector specialists who say the policies will increase financial pressure on those attempting to build long-term security.

The changes cover dividends, savings income, pension contributions and property ownership. Industry figures said the combined impact would add further strain to households already managing high living costs.

Jason Hollands, managing director at wealth manager Evelyn Partners, said the reforms "penalise people trying to do the right thing".

Many of the measures will be phased in over several years, beginning with dividend tax increases from April next year and continuing through to the introduction of new property surcharges in 2028.

Analysts said the staggered approach could influence financial behaviour as individuals and employers attempt to adapt ahead of the rule changes.

Dividend taxes will rise by two percentage points from April next year.

Rates will move to 10.75 per cent for basic-rate taxpayers and 35.75 per cent for higher-rate taxpayers.

The Treasury expects these increases to generate £1.2billion a year on average from 2027-28.

The Government will also increase taxes on savings income by two percentage points across all bands from April 2027.

Jeremy Cox, head of strategy at Coventry Building Society, said: "A two per cent tax hike on savings interest is not small change.

The Budget unveiled tax changes hitting savers, investors and property owners, sparking warnings they’ll face greater strain in securing long‑term financial stability

|GETTY

"It means savers in banks and building societies will pay an extra £500million in tax from 2028-29.

"That's a huge hit for anyone trying to build a financial safety net."

Financial advisers have predicted that business owners who rely on dividend withdrawals may bring forward payments ahead of the April increase.

They also warned that households with significant cash holdings could face growing challenges in maintaining real-terms savings during a period of higher taxation.

LATEST DEVELOPMENTS

Rachel Reeves announced her Budget on Wednesday | POOL

Rachel Reeves announced her Budget on Wednesday | POOLA £2,000 annual cap on pension salary sacrifice contributions will take effect from April 2029.

The limit restricts how much workers can divert from their salaries into pensions without paying national insurance.

Contributions over the threshold will attract national insurance at eight per cent for those earning below £50,270 and two per cent for those earning above that figure.

The Office for Budget Responsibility (OBR) forecasts the measure will raise £4.7billion in 2029-30, and £2.6billion the following year.

Some industry observers expect employers to reduce contributions in response to the higher 15 per cent employer national insurance rate.

Critics said the change could mean many workers face lower retirement savings over the long term.

The annual tax-free Cash ISA allowance for people under sixty-five will fall from £20,000 to £12,000 from April 2027.

The Government has chosen to exempt those aged sixty-five and over, a move that has drawn scrutiny from pensions specialists.

Tom Selby, director of public policy at AJ Bell, said: "The decision to exempt over 65s from the cash ISA cut is frankly bizarre, given pensioners will in the main be prioritising taking an income from their funds rather than piling in £20,000 a year."

Mr Cox said it was "more important than ever for savers to make the most of their full £20,000 cash allowance in 2025 and 2026 before the cut kicks in".

A new council tax surcharge will apply to properties valued above £2million from April 2028.

Government documents indicate that more than 140,000 homes will be affected nationwide.

Annual charges will start at £2,500 for properties valued between £2million and £2.5million and rise to £7,500 for those valued above £5million.

The charges will grow each year in line with inflation.

London and the South East are expected to face the largest impact, accounting for 82 per cent of recent property transactions above the £2million threshold.

London and the South East are expected to face the largest impact

| GETTYThe Office for Budget Responsibility (OBR) estimates the surcharge will raise £400 million by 2031.

Property specialists have questioned the practical challenges involved in identifying which homes meet the valuation criteria.

Jeremy Leaf, former RICS residential chairman, said: "I wish the Government luck trying to revalue all those properties and dealing with the arguments around the 'pinch points'."

Industry analysts said households, savers and investors would require clear guidance as the measures take effect over the coming years.

They added that the scale of the changes meant many people may need to reassess their financial planning.