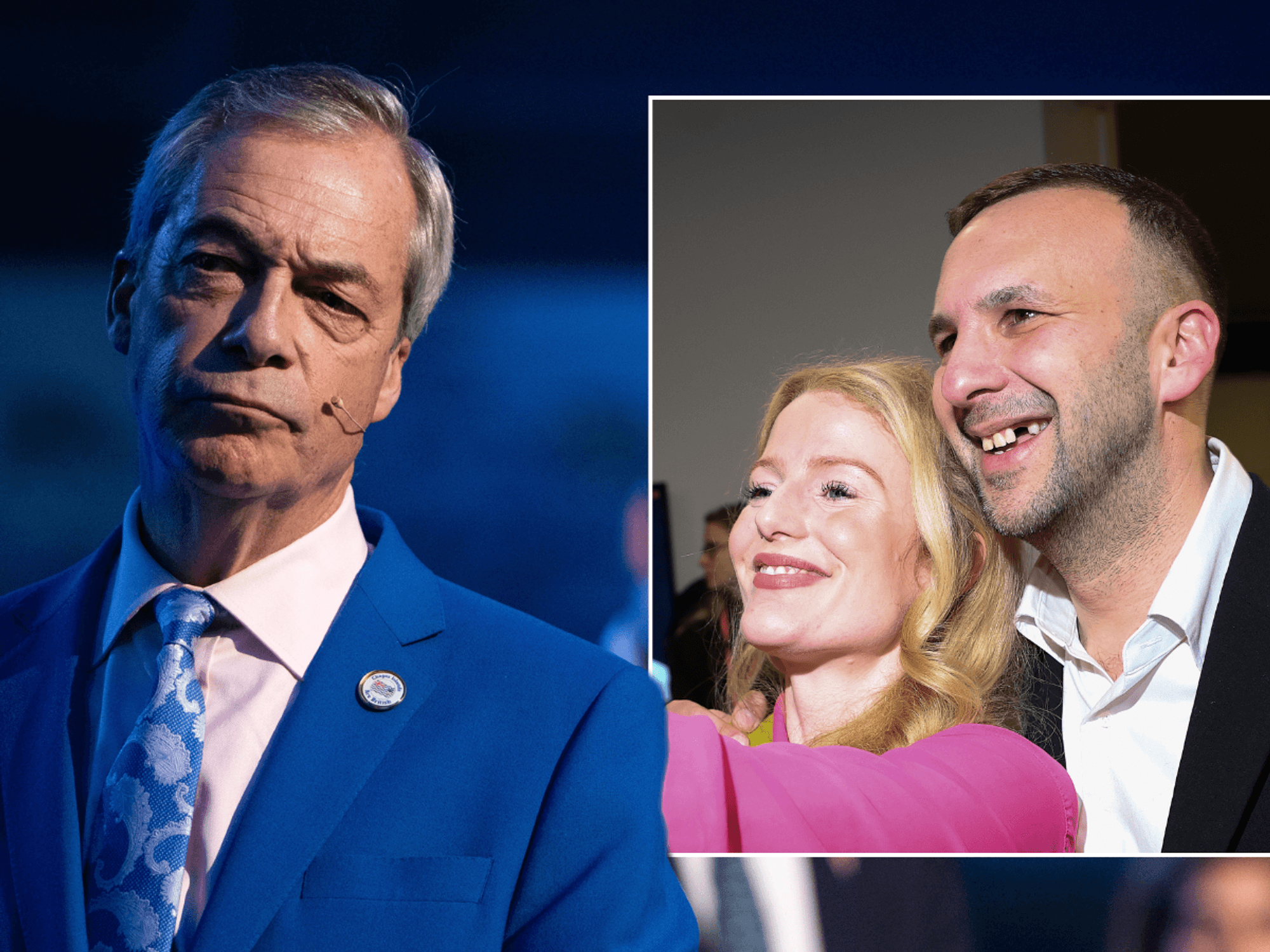

Keir Starmer promises 'more money in your pocket' in post-Budget address despite RECORD HIGH tax burden

WATCH: Keir Starmer issues post-Budget message to Britain |

X/KEIR STARMER

The Prime Minister insisted the Budget was 'fair and necessary'

Don't Miss

Most Read

Trending on GB News

Sir Keir Starmer has promised to put "more money in your pocket" in a post-Budget address to the nation despite the UK tax burden reaching a record post-war high.

The Prime Minister released a video message on social media this morning in which he immediately leapt to the defence of Rachel Reeves's statement as "fair and necessary".

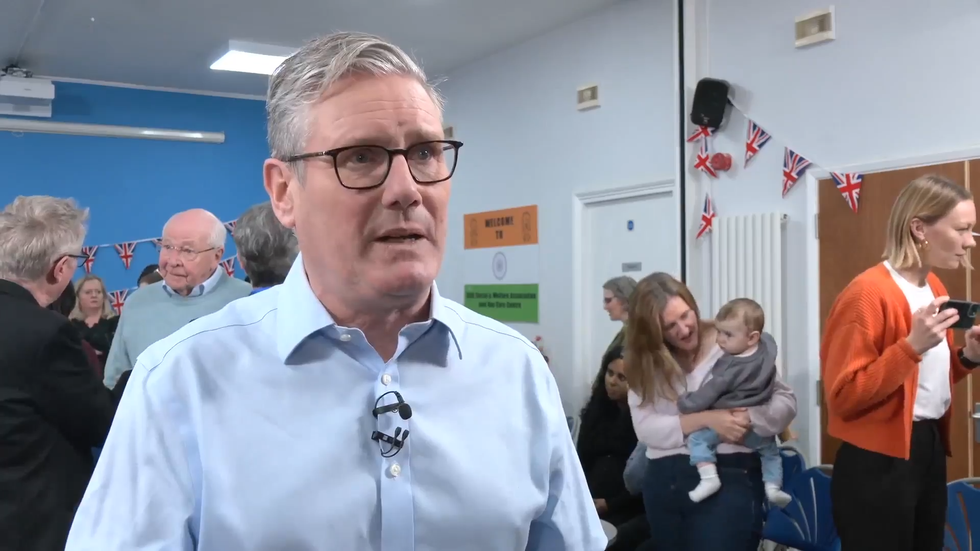

"Our first priority was to help with the cost of living," he said. "That's why we were determined to take action on energy bills - and that's what we've done."

He later added: "We're cutting our debt and our borrowing so we take no risks with the economy... by spending wisely and making fair tax choices."

TRENDING

Stories

Videos

Your Say

"We will deliver national renewal so people have more money in their pockets," Sir Keir said.

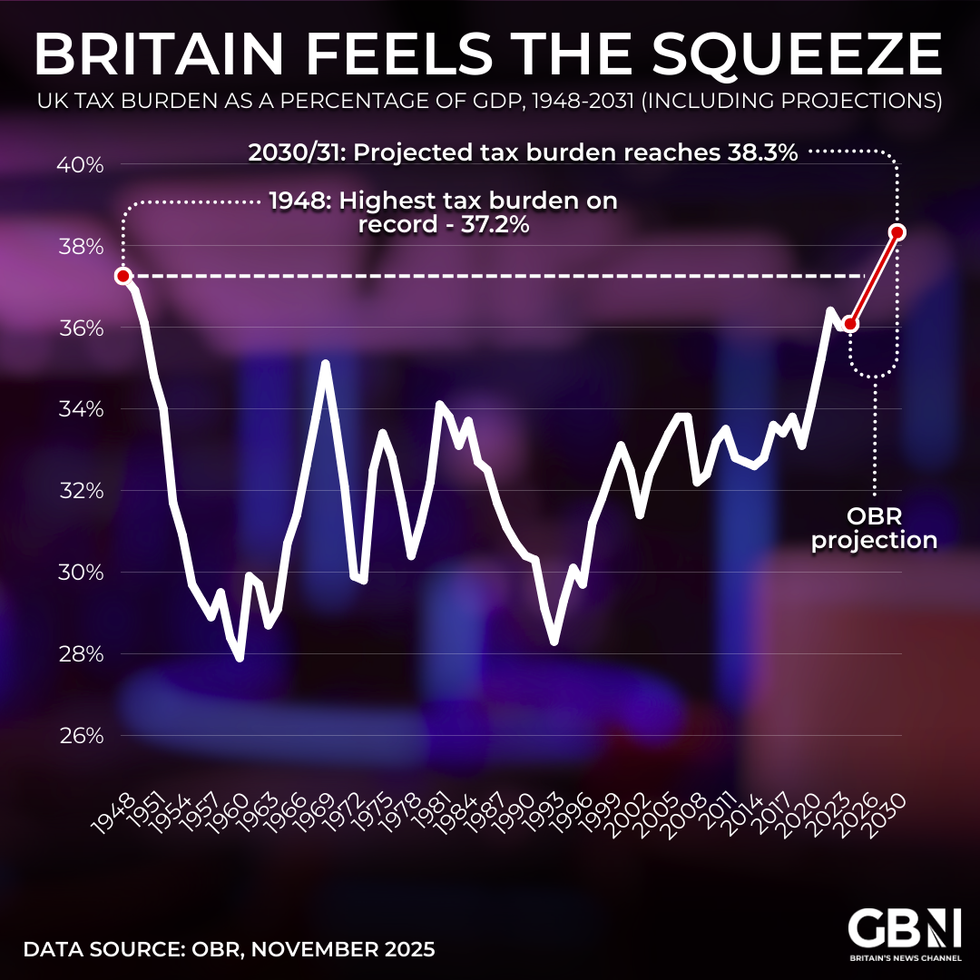

Labour's Budget put Britain on course for a record tax burden as Ms Reeves hiked levies by £26billion after weaker economic forecasts left holes in her previous spending plans.

The increases are also needed to pay for increased welfare spending, with the abolition of the two-child benefit cap costing £3billion a year by 2029/30.

Sir Keir said he was "not going to apologise" for taking 500,000 children out of poverty.

Sir Keir Starmer has insisted the Budget was 'fair and necessary'

|X/KEIR STARMER

When asked by GB News if he was raising taxes and giving money to Britons claiming benefits, the Prime Minister said: "No, it's going to our NHS, it's going to our schools and it's going on cost of living measures.

"But I won't apologise for the fact that we are also lifting 500,000 children out of poverty.

"I don't want to live in a country where children pay the price in poverty, and three quarters of the families in which children are living in poverty are working families. They're the working poor."

"I'm not going to apologise for taking children out of poverty. It's desperately needed," he added.

LATEST DEVELOPMENTS:

The PM told GB News he was 'not going to apologise for taking children out of poverty

|GB NEWS

Having abandoned plans for a manifesto-busting income tax rise, Ms Reeves opted for a range of smaller tax increases to pay for Government spending and build a larger buffer against her borrowing rules.

These include a new pay-per-mile tax for electric vehicles, increased taxes on online betting and a so-called "mansion tax" on homes worth more than £2million.

But she continued to face accusations of breaching Labour’s election promise not to raise taxes on working people after deciding to keep tax thresholds frozen until 2030/31 and levying national insurance on some pension contributions.

The freeze in thresholds will result in 780,000 more basic-rate, 920,000 more higher-rate, and 4,000 more additional-rate income tax payers in 2029/30 as earnings rise over time.

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR

|GB NEWS/OBR

People are dragged into paying 20 per cent income tax if their earnings rise above £12,570, with the 40 per cent rate from £50,271 and the 45 per cent band from £125,140.

The Chancellor told GB News she had kept taxes at "an absolute minimum on ordinary working people", insisting her measures meant "more money in people's pockets".

Influential think tank, Resolution Foundation, has however said low-to-middle earners would have been better off with their tax rates rising than their thresholds being frozen.

It said that raising all rates by 1p would have been less costly than freezing thresholds for anyone with an income below £35,000.

Tory shadow chancellor Sir Mel Stride said Labour’s "very poor" measures would "lead to 25,000 more people going on to benefits as a direct consequence of making them more attractive".

Our Standards: The GB News Editorial Charter

More From GB News