State pension alert: Britons urged to work longer to be eligible for full DWP payments

Britons currently need 35 years of National Insurance contributions to be eligible for the full state pension

Don't Miss

Most Read

Britons should work for longer to qualify for the full, new state pension, analysts have claimed amid ongoing concerns over the long-term viability of the Department for Work and Pensions (DWP) benefit.

Recently, the Office for Budget Responsibility (OBR) warned the state pension triple lock will cost the taxpayer an estimated £10billion more than initially projected by the end of the decade.

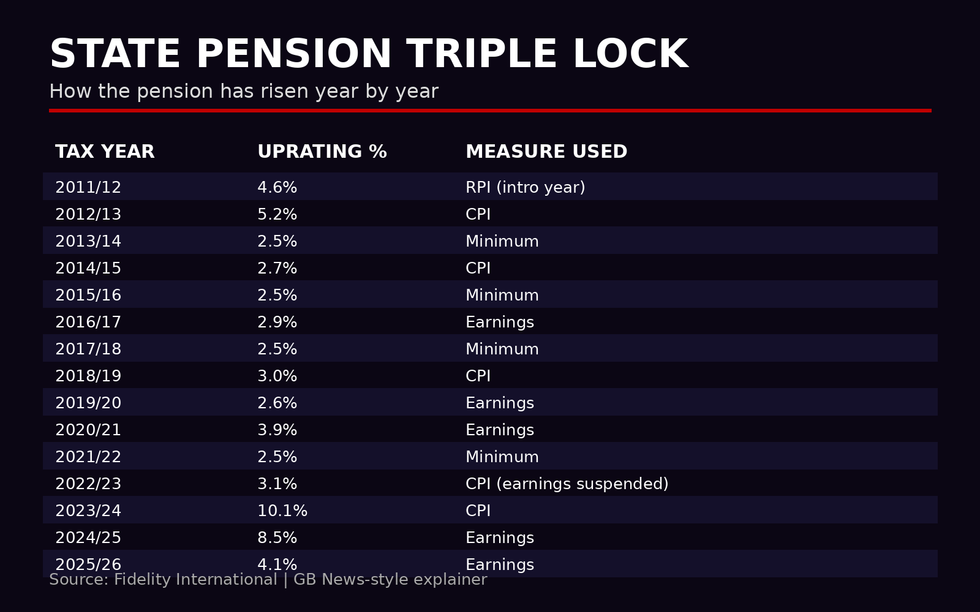

Under the triple lock mechanism, state pension payment rates are increased annually by either the rate of consumer price index (CPI) inflation, average wage growth, or 2.5 per cent; whichever is the highest.

To address the growing cost, retirement experts have suggested workers should earn more National Insurance credits to qualify for payments, with Britons currently needing 35 to be eligible for the full amount.

Britons should work longer to qualify for the full, new state pension

|GETTY

Henrietta Grimston, a chartered financial planner and partner at wealth management firm Saltus, said: "One of the ways the Government could look to raise additional revenue would be to increase the number of National Insurance contributions required to qualify for a full state pension.

"At the moment, people need 35 qualifying years, but even a small increase to 36 or 37 years would shift costs onto future retirees without the immediate shock of an outright tax rise.

"It makes sense from a policy perspective because the state pension age is already rising in line with longevity - so asking people to work and contribute for a few extra years aligns with that trend.

"While it would still impact retirement planning, it’s likely to be less politically damaging than freezing allowances or introducing new taxes, and it’s a relatively straightforward lever for the Treasury to pull."

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL Ms Grimston criticised Chancellor Rachel Reeves's looming reform to salary sacrifice, with the National Insurance savings benefit of pension contributions being capped at £2,000 annually, effective from April 2029

She added: “Crucially, this approach must go hand in hand with encouraging private pension saving. If the Government wants individuals to take on more responsibility for their retirement income, then the tax incentives for pensions should be considered carefully.

"You cannot reduce state support for tomorrow’s retirees while simultaneously making private saving less attractive. [The recent] announcement around National Insurance on salary sacrifice into pensions risks exactly this. Maintaining strong pension tax relief and allowances is essential to a sustainable long-term system.

"Ultimately, if the triple lock ever comes under pressure, changes should be a last resort - only after the Government has fully explored adjustments to qualifying years, the pension age, and measures that strengthen, rather than weaken, private retirement provision."

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR LATEST DEVELOPMENTS

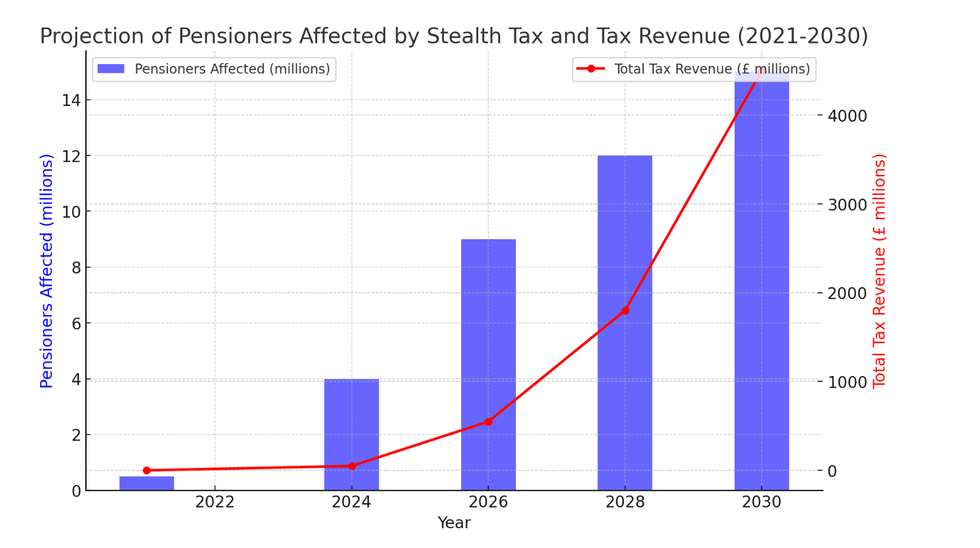

Analysts have also warned about the impact of fiscal drag, particularly due to the state pension triple lock, which occurs when incomes or inflation rise during a period when tax allowances are frozen.

As a result, taxpayers are pulled into higher brackets and forced to pay more to HM Revenue and Customs (HMRC) with state pensioners now set to pay tax on their payments alone.

John Chew, a technical specialist for Tax and Estate Planning at Canada Life, said: "The triple lock will trigger a 4.8 per cent rise in the State Pension from April 2026 to £12,548, meaning pensioners will be just £22 away from the income tax cliff edge.

"With income tax thresholds now extended until 2031, this stealth tax will continue to bite deeper into pensioners’ incomes. From April 2027, anyone receiving the full state pension will, for the first time, start paying income tax on it.

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT "For those who will be relying on other assets to sustain their finances in retirement - such as private pensions, annuities, or dividends - the income tax bill will rise even further. In months, pensioners relying on dividend income will also face a two per cent increase in dividend tax, further eroding their retirement income."

Mike Ambery, Standard Life's retirement savings director, added: "The commitment to keep the triple lock stays, for now, but there are significant questions around its long-term sustainability.

"The state pension is funded by the workers of today, and its costs are set to swell over the coming years as more of our ageing population reach state pension age.

"Any future reforms or changes to the triple lock will need to carefully balance its long-term affordability with the sizable political risks associated with changing a policy affecting millions of people."

More From GB News