State pension disaster as 250,000 older Britons stuck in poverty since retirement age raised

The state pension age is regularly reviewed and raised depending on life expectancy data and other factors

Don't Miss

Most Read

Latest

An estimated 250,000 older Britons have fallen into poverty since increases to the state pension age were implemented by the Department for Work and Pensions (DWP), shocking analysis has found.

Financial hardship among people approaching retirement has surged dramatically over the past 15 years, according to new research from the Standard Life Centre for the Future of Retirement.

Said analysis reveals that a quarter of a million additional individuals between 60 and 64 years old are now experiencing relative income poverty compared to 2010, when increases to the state pension age commenced.

This demographic has suffered the steepest decline in financial security of any adult age group. The proportion living in poverty within this age bracket climbed from 16 per cent in 2009-10 to 22 per cent by 2023-24, the report titled "Jam Tomorrow?" found.

250,000 older Britons have fallen into poverty since the state pension age started rising

|GETTY

Up until 2010, the state pension age remained fixed at 65 for men and 60 for women for six decades following its establishment in 1948, despite improvements in life expectancy.

However, since 2010 it has been rising in most years, with another increase set to begin next April that will gradually bring the state pension age threshold to 67 for everyone by 2028.

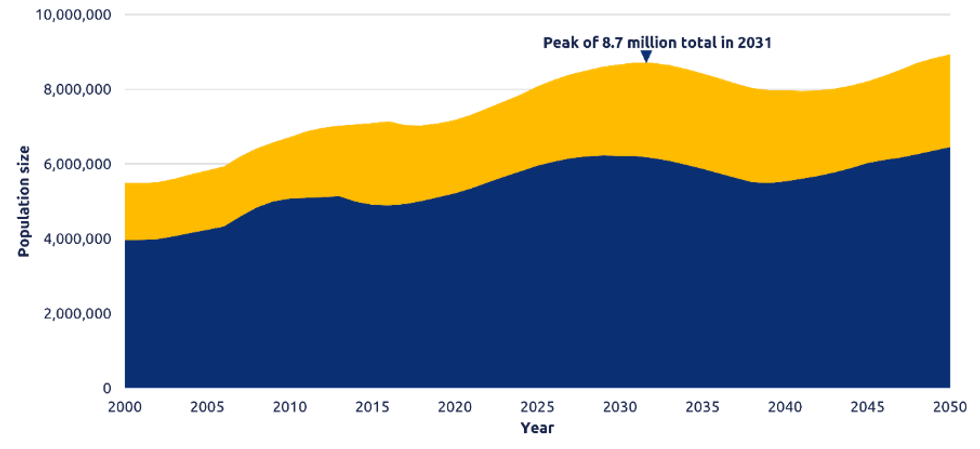

This rapid transition coincides with substantial demographic shifts. The UK now has eight million people in their sixties, up from 6.7 million in 2010, with numbers projected to reach 8.7 million by 2031.

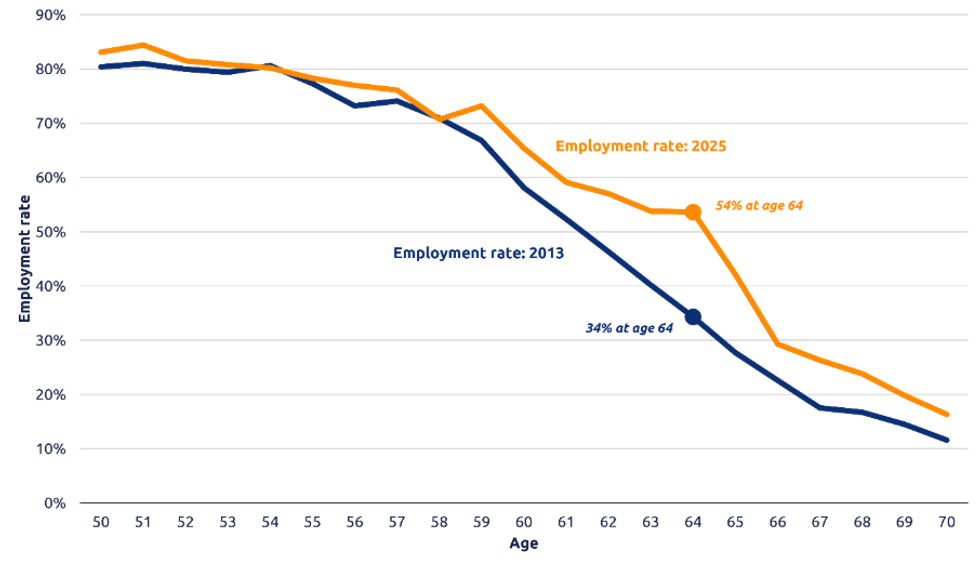

The report warns that pre-retirement poverty will likely intensify further as the pension age rises again. Many individuals have adapted to the later pension age by extending their careers, with employment among 64-year-olds jumping from 34 per cent in 2013 to 54 per cent currently.

Employment rate by individual year of age: UK from 2013 and 2025

|STANDARD LFIE

Yet this improvement is largely confined to those already in jobs. Workers who exit the labour market during their fifties or early sixties face slim chances of returning, leaving them vulnerable to prolonged low income.

The consequences of pension age increases have already proved severe for some. When the threshold moved from 65 to 66, the share of 65-year-olds experiencing income poverty more than doubled, rising from 10 per cent to 24 per cent.

The report proposes that some of the estimated £10 billion in annual public spending savings from raising the pension age to 67 should be redirected towards supporting those worst affected.

Suggested measures from Standard Life include programmes to help older British workers remain employed longer and improved guidance on accessing pension savings.

Patrick Thomson, the head of Research Analysis and Policy at the Standard Life Centre for the Future of Retirement, said: "For the first 60 years of its existence the State Pension age stayed the same.

"Since 2010 it has been rising in more years than not, and a growing number of people are falling into poverty as they wait for a higher state pension age. Next year we will begin to see another rise from 66 to 67 which will save £10bilionn a year but have knock on costs and consequences for poverty levels.

"The change will come at a huge cost to some - our analysis shows over 250,000 additional 60–64-year-olds now in pre-retirement poverty compared with 2010, and the proportion of 65-year-olds in poverty more than doubled when the State Pension age moved from 65 to 66.

"Our research with the public shows that most people accept that the State Pension age may need to rise over time, but this needs to be done in a way that is seen as fair between generations.

Projection of the total number of people aged 60-66 and 67-69: UK, 2000 to 2050

|STANDARD LIFE

"Any further increases must be matched by clear policies to help people stay in good work for longer and protect those who cannot. We know that there is a good chance that 66 year olds will see their rates of poverty double over the next few years unless we take action.

"We will spend £10billion less on them each year, and could target some of that to help people to stay in good work in their 60s and to cushion the impact on those most at risk. The state pension matters to people, and we need to build public confidence in a fair system for today and for tomorrow."

The DWP has launched a review into the state pension age which will "consider whether the rules around pensionable age are appropriate, based on the latest life expectancy data and other evidence".

During this year's Budget, Chancellor Rachel Reeves reaffirmed Labour's pledge to keep the triple lock in place which is the mechanism used to determine yearly payment hikes for the state pension.

More From GB News