State pension future in doubt as triple lock 'tends to favour better off' retirees

Since 2010, the triple lock has determined how much retirees receive from the state pension

Don't Miss

Most Read

Latest

The state pension triple lock "favours better off" retirees and should be reformed, a leading think tank has claimed ahead of Chancellor Rachel Reeves's Autumn Budget on November 26.

Economists from the Institute of Fiscal Studies (IFS) are sounding the alarm that the mechanism used to raise the annual payment rate for the retirement benefit skews towards wealthier individuals

Under the triple lock, state pension payment rates are increased ever year by either the rate of consumer price index (CPI) rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

Heidi Karjalainen, senior research economist at the IFS, claims keeping the triple lock while raising the state pension age "will tend to favour groups that are better off” as longer-lived and richer Britons benefit the most from its generosity, while poorer people with lower life expectancy lose out.

The state pension is under fire 'favouring better off' retirees

|GETTY

"Raising the state pension age delays the point at which people can receive their state pension,” she said. "This delay affects poorer people, who on average have a lower life expectancy, more because the loss of a year of state pension income is more important for those with lower life expectancy.

"On the other hand, those with a higher life expectancy benefit relatively more from the triple lock, as they are more likely to be receiving a generously indexed state pension into their 90s.”

The warning comes ahead of new CPI inflation for the 12 months to September 2025 data being published tomorrow (October 22), which will determine how much the state pension rises next April.

This figure is expected to come in below the 4.8 per cent average earnings growth recorded between May and July, meaning the triple lock will once again be triggered by wages.

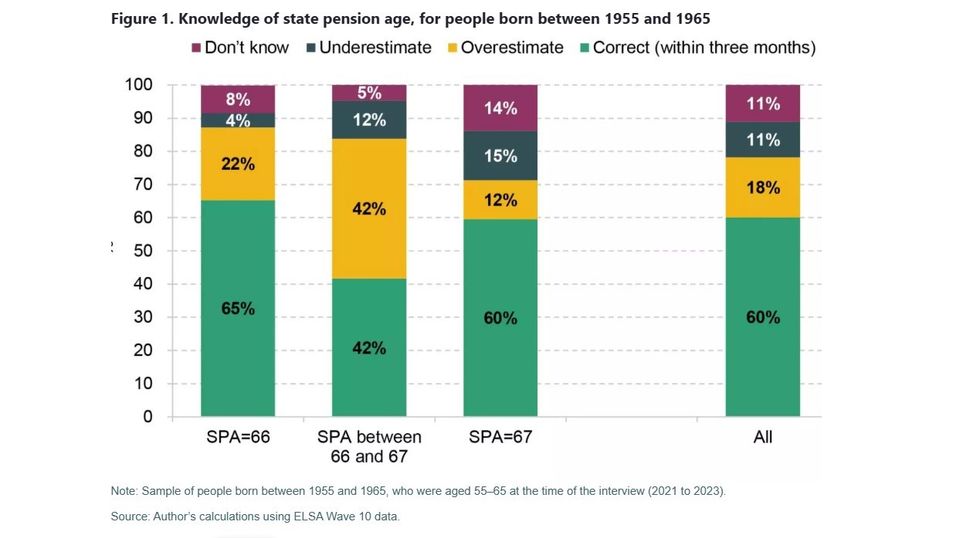

The IFS's research into the state pension age suggests thousands of Britons lack essential knowledge of looming changes | IFS

The IFS's research into the state pension age suggests thousands of Britons lack essential knowledge of looming changes | IFS It will lift the full new state pension by around £11 a week to roughly £241 per week from April 2026. Although not every pensioner receives the full amount, the majority of newly retired Britons get the new state pension rate or one close to it.

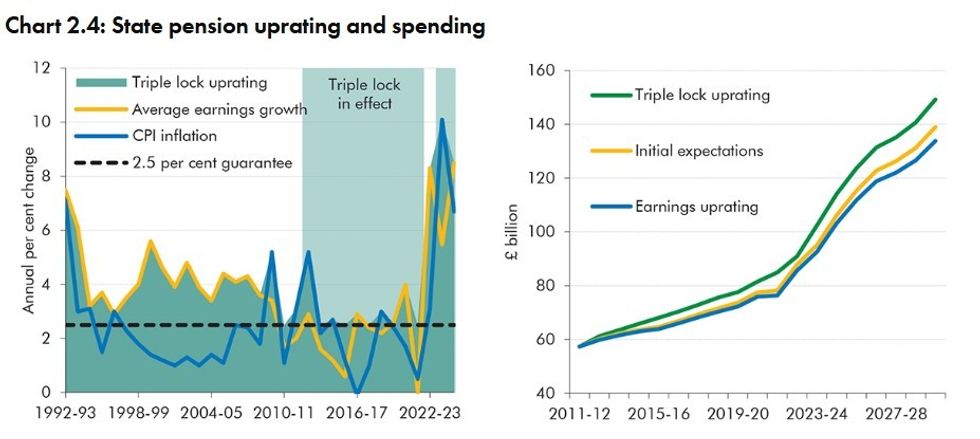

Since the triple lock was introduced in 2011, the value of the state pension has risen much faster than both earnings and prices. At £241 per week, the full new state pension is now £30 per week , or 14 per cent, higher than it would have been if it had simply tracked average earnings.

According to the Office for Budget Responsibility (OBR), the triple lock now costs the Government around £12billion more each year than an earnings-linked system would.

Ms Karjalainen asserts that while the controversial policy had boosted pensioner living standards, its long-term impact on public finances was becoming unsustainable.

How much is the state pension triple lock? | ONS

How much is the state pension triple lock? | ONS She added: "The generosity of the triple lock has a substantial and growing impact on public finances. Spending on the state pension will continue to increase due to the ageing population, but the triple lock also plays a part.

"And because the triple lock increases the value of the state pension based on the maximum of three figures, two of which are potentially volatile over time, forecasting state pension spending in the future also becomes more difficult under this indexation policy."

The fiscal watchdog estimates that state pension spending will rise by around £80billion in today’s terms by the 2070s, with over half of this increase driven by the triple lock.

In a more volatile economy, the policy could cost an extra 1.5 per cent of national income, or £44,billion in today’s terms,while in a more stable scenario it could cost £40 billion less.

LATEST DEVELOPMENTS

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR In light of these projections, the IFS is now calling for the Labour Government to consider moving to a new “smoothed earnings link” system, similar to that used in Australia.

This would see ministers set a target value for the state pension as a share of median full-time earnings. In normal years, it would rise with earnings, but if inflation outpaced wage growth, payments would instead increase with prices until earnings caught up again.

Ms Karjalainen said this would make the system “more sustainable and predictable” for both pensioners and policymakers.

She said: "While the triple lock has helped increase pensioner living standards over the last 15 years, a better approach is needed for the future. While the Government has committed to keeping the triple lock this parliament, a sensible approach would be to move away from it after the next election."

More From GB News