Government reaffirms commitment to state pension triple lock but Hunt ‘under pressure to break' policy

Chancellor Jeremy Hunt is under increasing pressure to adjust or break the state pension triple lock, experts have warned

|PA

Rising life expectancy means the state pension triple lock is fast becoming a costly financial commitment, experts are warning

Don't Miss

Most Read

Latest

High inflation and rising earnings data is fuelling concerns about the affordability of the state pension triple lock in the future.

It’s sparked concern that Chancellor Jeremy Hunt could have to adjust or break the triple lock, although the DWP told GB News today the Government "is committed to the triple lock".

Becky O’Connor, director of public affairs at PensionBee, said: “As scrutiny increases on the cost of the state pension to the public purse, the Government will be under pressure to break or at least adjust the triple lock.

“The Government broke the triple lock in the wake of the pandemic when earnings growth soared above eight per cent that year, so there is precedent for a change on the basis of data that seems too high.

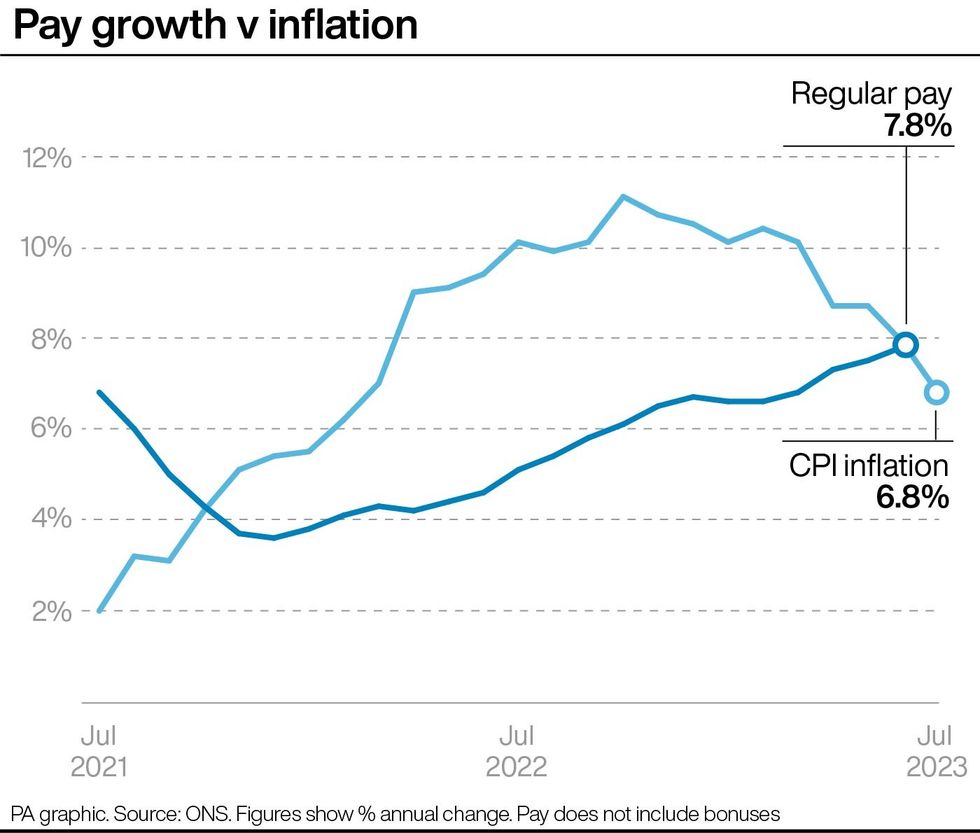

Earnings have been rising recently while UK CPI inflation is falling

|PA

“However, breaking a promise on pensioner incomes now would be enormously unpopular.”

Figures published today show Consumer Price Index inflation has eased to 6.8 per cent in the year to July, but it’s the figure published in October which is the one used for the inflation element of the triple lock.

However, wage increases have soared to a new record high, according to data released yesterday, jumping to 8.2 per cent.

The earnings figure used in the state pension triple lock – which is a commitment to increase the state pension by whichever is highest out of wage growth, inflation or 2.5 per cent – will be published next month.

Ms O’Connor said: “For pensioners, it now looks likely that the state pension could rise in line with earnings rather than inflation next April, as the triple lock dictates that it increases with whichever is the highest of earnings, inflation or 2.5 per cent.

“The state pension is a vital part of retirement income and removing guarantees now could worsen the outlook for today’s workers when they come to retire.”

Tom Selby, head of retirement policy at AJ Bell, said spiralling wage growth presents “another fiscal nightmare for the Chancellor and Prime Minister”, as it potentially adds “billions of pounds to the nation’s state pension bill as a result of the triple lock”.

He said: “If wage growth and inflation continue on their current trajectories, then it will be wage growth in the three months to July that determines next year’s triple-lock increase.

LATEST DEVELOPMENTS:

“Should that wage growth figure come in at over eight per cent again, the full new state pension could surge past £220 a week, or almost £11,500 a year.”

Former Chief Secretary to the Treasury David Mellor told GB News today: "Of course, for people who live on pensions and that's their sole source of income, you cannot begrudge them an increase.

"But we do have to point out that that triple lock means purging inflation from the system becomes that much more difficult because when you look at the monumental cost of increases in pensions, increases in Social Security and so on, it becomes near to unaffordable."

However, a DWP spokesperson said: “The Government is committed to the triple lock. As is the usual process, the Secretary of State will conduct his statutory annual review of benefits and state pensions in the Autumn, using the most recent prices and earnings indices available.”