State pension crisis as retirees 'just £22 away' from paying tax on payments due to fiscal drag

Analysts are sounding the alarm over the Chancellor's decision to freeze tax thresholds on state pensioners

Don't Miss

Most Read

Latest

Older Britons are being warned that they are "just £22 away" from paying tax on state pension payments alone due to the impact of frozen thresholds and fiscal drag, analysts warn.

Retirees receiving the full, new state pension from the Department for Work and Pensions (DWP) will find themselves on the brink of paying income tax following a 4.8 per cent increase triggered by the triple lock mechanism.

Under the triple lock, state pension payment rates are hiked every year in line with either the rate of inflation, average wage growth or by 2.5 per cent; whichever is the highest.

On top of this, Chancellor Rachel Reeves confirmed the current freeze to HM Revenue and Customs (HMRC) tax thresholds will be extended an additional three years until 2031.

Retirees are close to paying tax on state pensions for the first time

|GETTY

From April 2026, analysts note the full, new state pension will rise to £12,548 annually, positioning thousands of recipients a mere £22 beneath the personal allowance threshold.

This razor-thin margin means that by April 2027, those claiming the complete state pension will become liable for income tax on their payments for the first time in history.

Tax specialists have recognised this phenomenon as fiscal drag as tax thresholds are frozen over a period of time when incomes rise, resulting in more people paying more to HMRC.

Notably, the Chancellor has confirmed retirees reliant on the state pension will not need to pay tax on payments alone for the duration of this Parliament, which is likely 2029.

Rachel Reeves has pledged to keep the triple lock while tax thresholds remain frozen

| PAJohn Chew, a technical specialist in Tax and Estate Planning at Canada Life, warned that this stealth tax would "continue to bite deeper into pensioners' incomes" as thresholds remain static until 2031.

He noted that retirees depending on additional income streams such as private pensions, annuities or dividend payments face even steeper tax bills in light of recent reforms.

"For those who will be relying on other assets to sustain their finances in retirement - such as private pensions, annuities, or dividends - the income tax bill will rise even further," Mr Chew stated.

As well as this, pensioners with dividend income will also contend with a two per cent rise in dividend tax within four months, further diminishing their retirement funds.

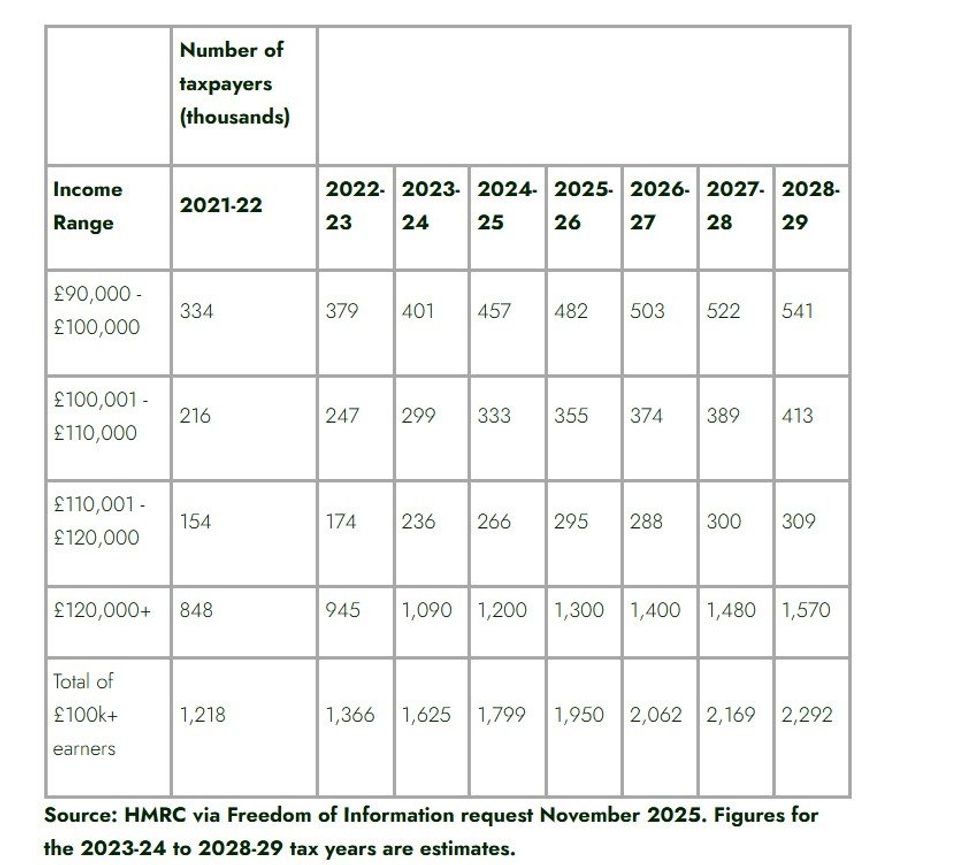

Analysis from wealth management firm Rathbones reveals the broader impact of fiscal drag across different salary levels for working-age Britons contributing to the economy.

Their calculations indicate that an individual earning £100,000 by April 2025 would shoulder an additional £4,043 in tax compared to £2,517 had the threshold freeze concluded in April 2030, with the burden growing further under the extended 2030/31 timeline.

Those on £80,000 face an extra £1,766, while workers earning £50,000 would pay £1,438 more. Even those with modest incomes of £35,000 will see their tax bill increase by £353 as frozen thresholds drag more earnings into higher bands.

Charlotte Kennedy, a chartered financial planner at Rathbones, described the threshold extension as "the Government's main lever to plug the multi-billion-pound fiscal gap".

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC She explained that this approach "quietly squeezes household budgets, dragging more people into higher tax bands even though their real purchasing power hasn't improved."

Ms Kennedy cautioned that fiscal drag could deter employees from seeking promotions or working overtime, as larger portions of pay rises disappear into the tax man's pockets.

"By reducing disposable income, fiscal drag weakens consumer spending a key driver of growth and could in turn exacerbate the UK's already sluggish recovery," she added, calling the policy "a regressive move that dents growth."

The Chancellor's Budget reforms have proven to be controversial as many analysts believe the tax threshold freeze extension constitutes a breach of Labour's manifesto promise to not raise taxes on "working people".

Following her fiscal statement, Ms Reeves conceded it would hit “working people” but denied it constituted breaking the Government's prior electoral pledge and claimed it would bring in £12.4billionn by 2030-31.

More From GB News