State pensions will NOT be taxed while Labour is in power, Rachel Reeves reveals to Martin Lewis

Dawn Neesom fumes ‘Labour hates old people’ as Rachel Reeves plots to ‘take everything she can’ from pensioners |

GB NEWS

Analysts have warned frozen tax thresholds and the state pension triple lock will result in retirees paying more to HMRC

Don't Miss

Most Read

Chancellor Rachel Reeves has confirmed older Britons will not need to pay tax on state pension payments for the duration of the current Parliament during an interview with Martin Lewis.

While speaking to the Money Saving Expert founder, the Chancellor reaffirmed that pensioners will not need to fill out a Self-Assessment tax form on their retirement benefits.

However, Ms Reeves suggested the state pension will be completely exempt from tax until at least 2029; which is when the likely next General Election will have to take place.

This comes amid concerns over the growing impact of fiscal drag, which is seeing Britons pulled into higher tax brackets due to rising incomes and frozen HM Revenue and Customs (HMRC) thresholds.

The Chancellor confirmed those who rely on the state pension alone will not be axed

|GETTY / ITV

During this week's Budget, Ms Reeves confirms she will extend the existing freeze to personal HMRC thresholds by three more years until 2031 in what is widely considered a stealth tax.

As well as this, the Chancellor recommitted to the state pension triple lock which guarantees payment rates increase annually by either the rate of inflation, average wage growth or 2.5 per cent.

From April 2025, the full, new state pension will rise by 4.8 per cent to £12,548. Under the current tax regime, the personal tax-free allowance threshold is sitting at £12,570.

Analysts, including Martin Lewis, have warned the retirement benefit from the Department for Work and Pensions (DWP) will likely exceed this threshold by 2027 due to fiscal drag.

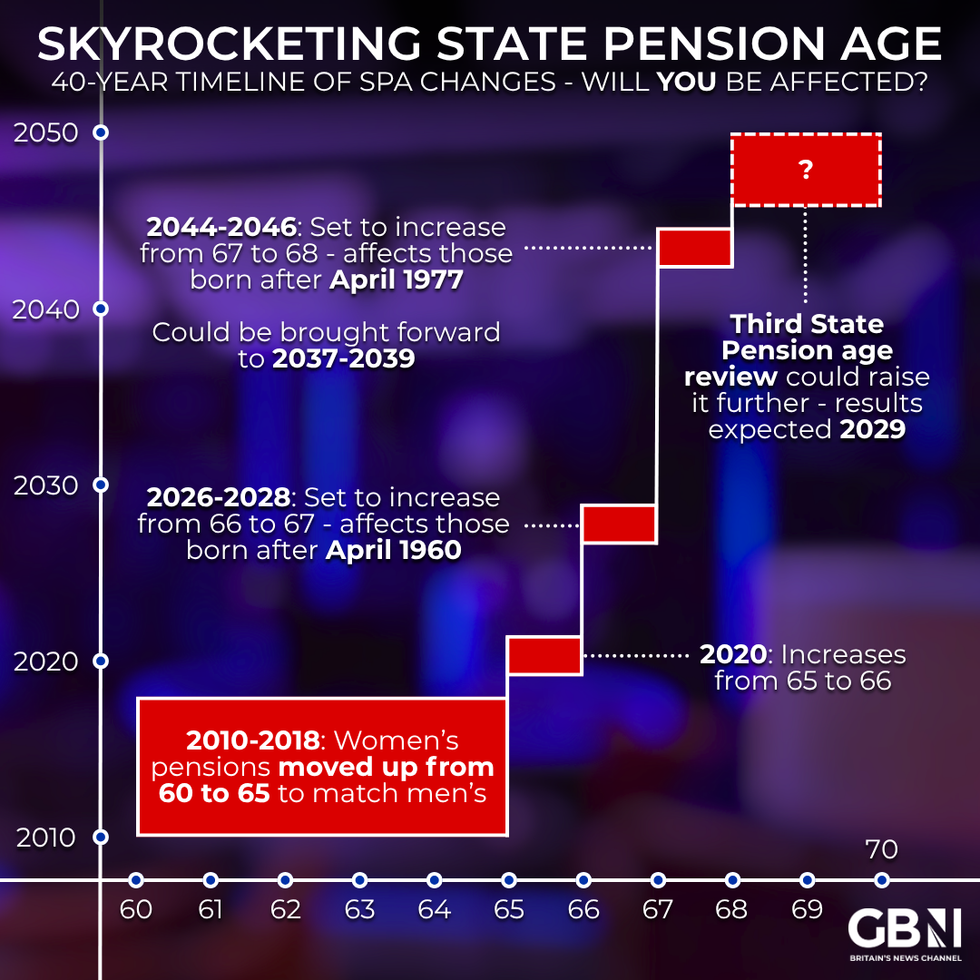

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsMr Lewis asked the Chancellor whether an 85-year old man with dementia would be required to fill out a Self-Assessment tax return if their annual payments crosses the personal allowance.

In response, Ms Reeves said: "If you just have a state pension, you don't have any other pension, we are not going to make you fill a tax return. I make that commitment for this Parliament.

"2027 looks like the time that it [full, new state pension] will cross over. We are working on a solution, as we speak, to ensure that we're not going after tiny amounts of money."

When pressed by the host of the Martin Lewis Money Show Live on whether retirees will need to pay tax on state pensions alone, she added: "In this Parliament, they won't have to pay the tax.

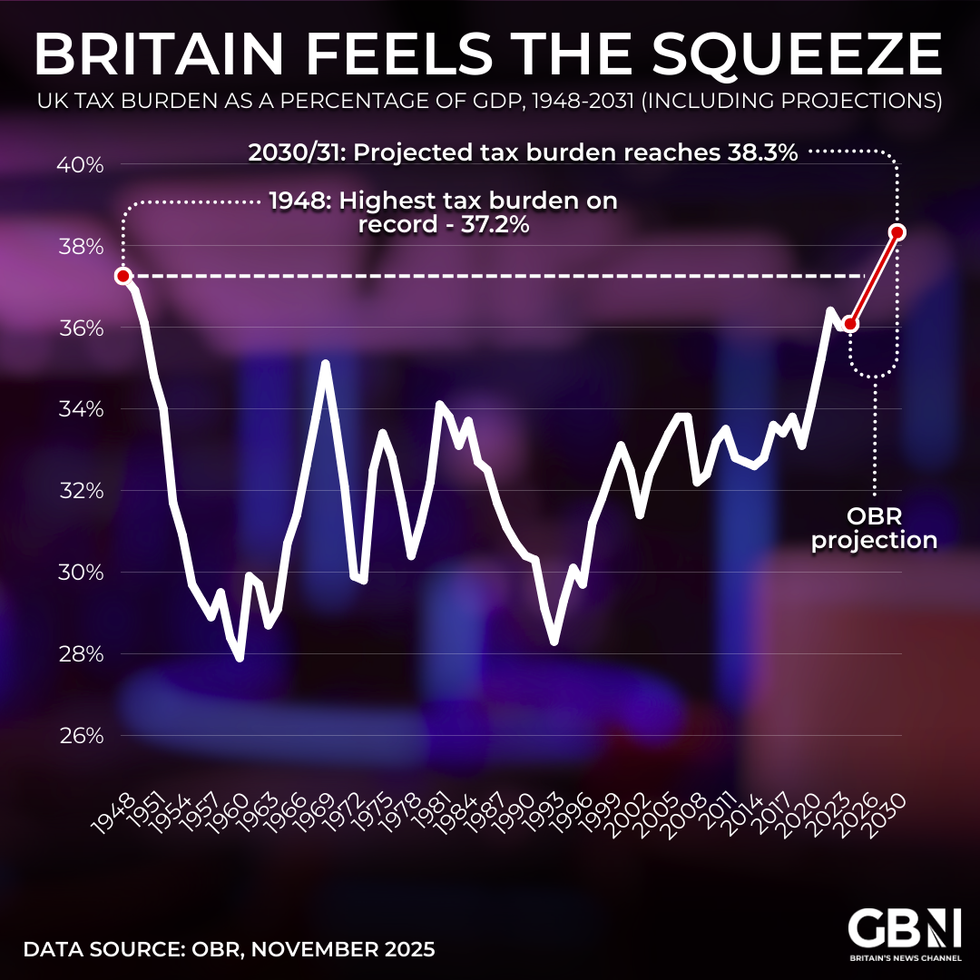

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR"Further out, I'm not able to make any commitments on that but we're just looking for a simple workaround at the moment."

Following the Budget, Aegon's pensions director Steven Cameron shared: "State pensioners will be relieved to hear this week that the state pension triple lock is being honoured in full, leading to a 4.8 per cent increase which is above inflation.

"However, the sting in the tail is that by 2027/28, the full new state pension will exceed the personal allowance which has today been frozen until 2031, leading to even those relying solely on the full new state pension for retirement income facing a tax liability.

"This liability will grow in future years and if the triple lock led to the same increases from now till 2031, it could grow to over £500. The Chancellor has offered some assurances by saying pensioners won’t have the admin burden of completing simple assessment tax returns.

LATEST DEVELOPMENTS

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR "However, importantly, this is not the same as waiving the tax. The Government is to look into alternative approaches to dealing with the tax charges. It’s important that this made as easy and stress-free as possible for pensioners.

"While state pensioners may not face tax bills through the letterbox, many of those solely reliant on the state pension will in future pay tax on some of this – a case of the Government giving with one hand and taking with the other."

Sarah Hills, LV's wealth proposition Director, said: "It’s vital that people understand the implications of freezing the personal tax-free allowance and income tax bands until 2031.

"These measures will significantly affect pensioners and working-age individuals alike. Freezing tax thresholds will push more people into higher tax brackets and may lead to unwelcome consequences."

More From GB News