State pension future in doubt as Kemi Badenoch endorses means testing 'debate' amid triple lock concerns

Christopher Hope interviews Kemi Badenoch

|GB NEWS

The triple lock's cost has raised questions about the long-term viability of the state pension

Don't Miss

Most Read

Kemi Badenoch has sidestepped questions over the state pension's future, asserting the Tories and policymakers should "have a debate" over means testing payments amid concerns over the triple lock's affordability.

While speaking to GB News' Christopher Hope at this year's Conservative Party Conference, Ms Badenoch cited that means testing "is not policy" at the moment but opened the door

The beleaguered leader is under pressure as the Tories see multiple defections from councillors to Nigel Farage's Reform during the centre right party's annual get together.

When asked about means testing, Ms Badenoch said: "If I could just make this point, the first place to start has to be in the workplace. If people get off benefits and into work, it's a double whammy.

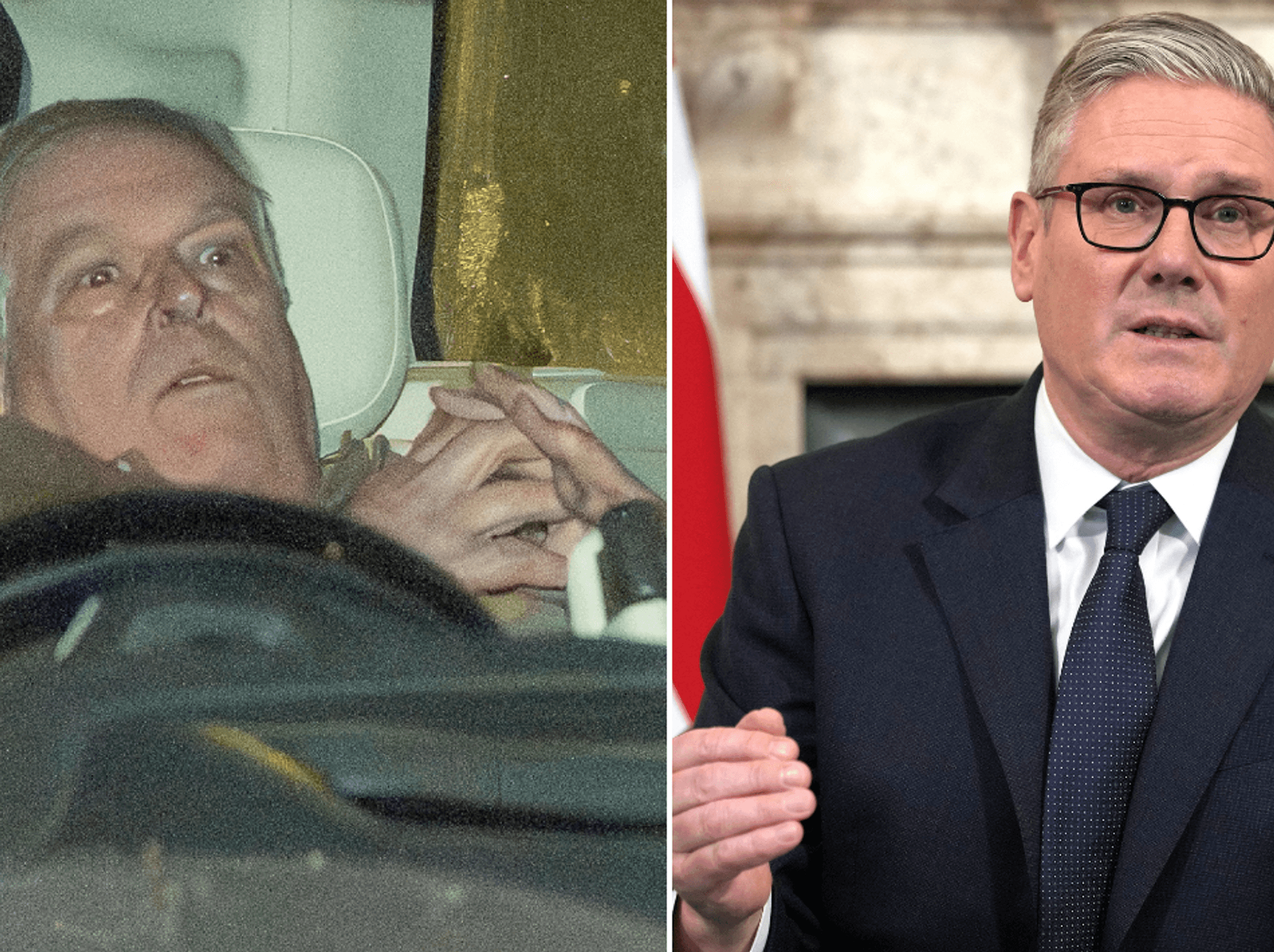

GB News has asked Kemi Badenoch to share her opinions on the state pension

|PA / GETTY

"They pay more in taxes. We're not paying their benefits. We will grow the economy. If we grow the economy, then we don't have to worry about whether or not we can afford the triple lock. We can afford it. That's our policy."

The Tory leader was specifically asked about comments made by Richard Fuller, the Shadow Chief Secretary to the Treasury, who suggested Britain should emulate Australia's state pension system.

In Australia, how much someone gets in retirement from the state pension is dependent on their savings and assets with Mr Fuller noting the UK has £4trillion in state pension liabilities, despite the size of the British economy coming to around £2.5trillion.

Despite ruling out means testing in the interim period, Ms Badenoch signaled this policy pledge could be reversed depending on circumstances and changing opinion within the Tory party.

Kemi Badenoch has sidestepped questions about the state pension's long-term future

| ParliamentThe Tory leader added: "We are having a conference and I said, I want us to have debates. Let people have the debate. But that is not policy. We are not Labour or Reform where everybody is scared to say anything that the leader hasn't given permission to say. Have the debates and then we'll decide who's right or wrong."

State pension payments have been pointed out as an area of potentially essential Government reform due to growing anxiety over the triple lock's cost on the taxpayer.

According to figures from the Office for Budget Responsibility (OBR), the retirement benefit's triple lock is costing the state £10billion more than initially projected since its creation in 2010.

Under the triple lock, state pension payment rates increase annually in line with either the rate of inflation, average wages or 2.5 per cent; whichever is the highest that year.

When asked about the triple lock, Ms Badenoch said: "People have paid. They've paid their contribution. And I don't think that that's where we should start when it comes to cutting the spending."

However, when pressed on whether this manifesto promise will be kept going into the next General Election, she added: "The election is not tomorrow. I am talking about policies for today."

On Monday, Mr Fuller told conference attendees why he believes reform to the state pension system is necessary to ensure payments remain economically viable for future generations.

He shared: "30 years ago, Australia looked at demographic changes and they decided to move towards a scheme that is more akin to putting money aside for your savings… essentially the state pension is means-tested.

Latest Development

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR "This is a more secure, more guaranteed state pension for people. The difficulty is the transition costs… so [there is] more work to do on that." He did note that his opinion was not Conservative Party policy.

As it stands, the state pension is expected to go up by 4.7 per cent next April in line with annual earnings growth for May to July 2025. If this hike is implemented, it would bring the full, new amount to £241.05 per week.

Steven Cameron, the pensions director at Aegon, shared: "Inflation has been increasing, albeit gradually, over the past few months, most recently standing at 3.8 per cent. In August, the Bank of England predicted inflation would peak in September at four per cent.

"Therefore, inflation would have to rise sharply to exceed the earnings figure. “When earnings growth exceeds inflation, pensioners receive an increase based on earnings which is good news for them as it improves their purchasing power. If inflation exceeds earnings growth, this determines the triple lock increase, and purchasing power is protected, albeit not improved."

More From GB News