State pension under threat as Tory minister warns of £4TRILLION timebomb - 'triple lock simply must go'

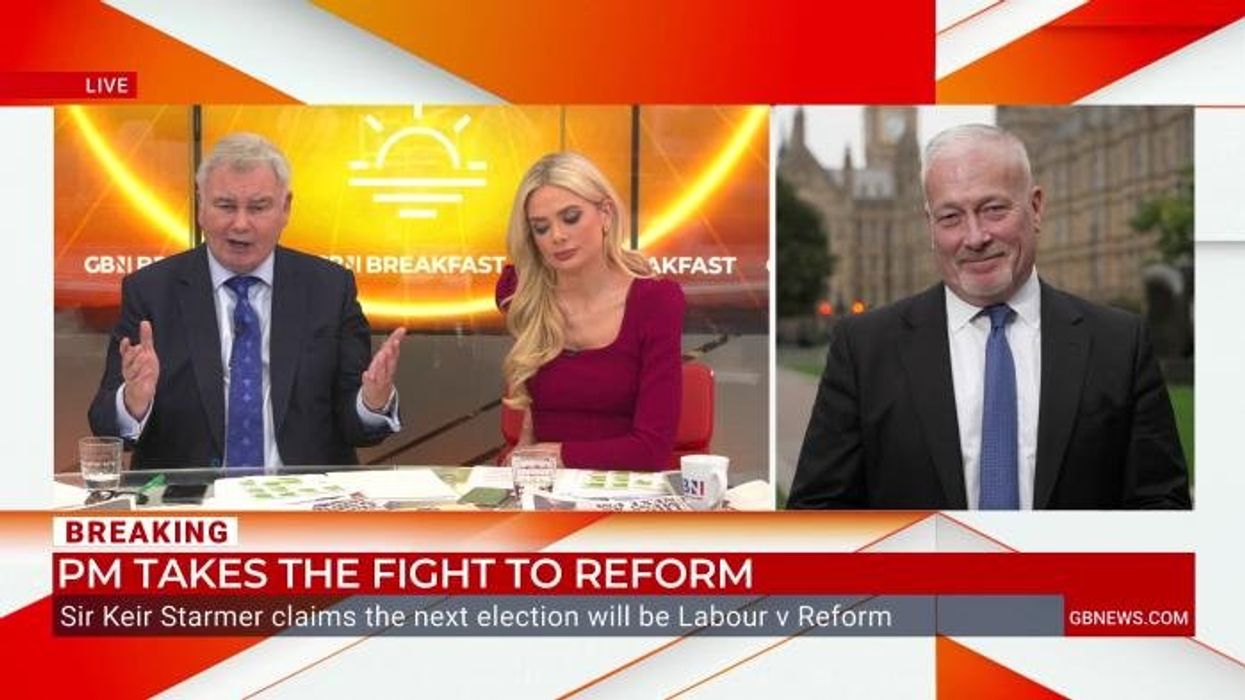

Conservative MP Richard Fuller labels Sir Keir Starmer's attack on his party as 'bizarre' |

GBNEWS

The triple lock increases the state pension by at least 2.5 per cent, or whatever is highest of inflation or wage growth

Don't Miss

Most Read

The state pension is under mounting threat as senior Conservatives and economists warn that the triple lock is no longer sustainable, with some arguing it “simply must go.”

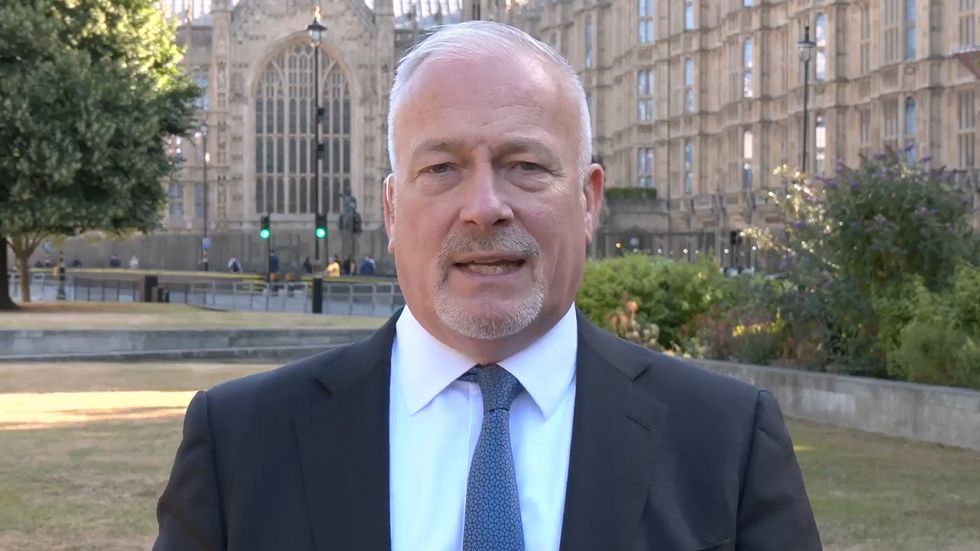

Richard Fuller, the shadow chief secretary to the Treasury, described Britain’s £4trillion state pension liability as a timebomb that was created in an era of faster growth and larger working-age populations.

Mr Fuller said: “The state pension scheme was set up in a period where you could expect that we would have two per cent to three per cent growth and a growing working age population. And that is now a 4 trillion pound liability,” he told a fringe event, warning the Government is “sailing awfully close to the wind on the bond markets.”

He added: "So 2.5 of unfunded debt, 1 trillion of other liability, 1.5 of public sector pensions, *4 trillion pounds of state pension. And so as we think about the issue of fiscal responsibility, what is the conservative route to fiscal sustainability?"

His intervention comes as a growing number of Tory MPs admit the triple lock cannot hold.

TRENDING

Stories

Videos

Your Say

Windsor MP Jack Rankin also told a Centre for Policy Studies event: “The social contract in this country is broken, so people try to get as much out of the system as possible. The triple lock situation is not sustainable long term.”

Mr Rankin admitted the politics are fraught, saying: “We can’t cut pensions because all of our voters are over the age of 70. But if we don’t cut pensions we won’t have any voters under the age of 70.”

The warnings follow an Office for Budget Responsibility forecast that the annual cost of the triple lock will hit £15.5 billion by 2030, up from £138 billion today. The OBR projects that state pension costs could climb to 7.7 per cent of GDP by the 2070s.

Richard Fuller described Britain’s £4trillion state pension liability as a timebomb

| GB NewsAs costs continue to rise former Cabinet minister Tom Tugendhat explained the triple lock is “simply non sustainable over the next 20 or 30 years.” He argued the economy is now “geared towards pensioners” in a way that risks alienating younger voters.

Kemi Badenoch and Mel Stride have previously signalled that the policy is unsustainable, adding to a growing sense among pensioners that their retirement income will not be safe with the Conservatives.

A Labour Party spokesperson said: “The masked has slipped again: the Conservatives want to raid people’s pension pots. Kemi Badenoch’s top team are planning an assault on nearly 13 million of Britain’s pensioners.

“It’s the same old Tories, you simply cannot trust them. Only Labour will protect people’s dignity in retirement, and our commitment to the triple lock will see up to £1,900 a year more in pensioners’ pockets by the end of this Parliament.”

Chancellor Rachel Reeves is confronting mounting fiscal pressures | POOL

Chancellor Rachel Reeves is confronting mounting fiscal pressures | POOL Mr Fuller warned that while voters are “pretty grumpy about taxes”, the bigger danger lies elsewhere.

He said: “What kills ambitions of government isn’t just the burden you place on people for extra taxes... what kills a government’s ambitions are the bond market. And this government is sailing awfully close to the wind on the bond markets.”

Comparing it to business, he added: “Businesses go bankrupt very, very slowly. And what we don’t want is fiscal responsibilities to get to that situation.”

Mr Fuller stressed that, in opposition, Conservatives must “think about those broader aspects of liabilities as part of the overall effort to fiscal responsibility.”

Britons are warned this could become a “multibillion-pound issue” | GETTY

Britons are warned this could become a “multibillion-pound issue” | GETTY“Why should pensioners’ incomes grow at faster rates than those funding the system? This flaw turns the triple lock policy into a disproportional inter-generational transfer, rather than a sound state pension,” he said.

The state pension is becoming one of the most politically charged issues facing the government.

Dr Benjamin Caswell of the National Institute of Economic and Social Research said: “A lasting solution to the UK’s fiscal morass will ultimately require a broad and difficult conversation about the state pension.

“But if the UK public finances are to be put on a stable footing in the near future, the triple lock simply must go.”

He added that since 2011, the state pension has risen by 73 per cent in cash terms, a 21 per centreal-terms increase, compared with just eight per cent for average wages.

More From GB News