‘I was delighted state pension was rising… then I got a letter from HMRC’

Fiscal drag, when tax allowances are frozen while incomes increase, is starting to impact pensioners

Don't Miss

Most Read

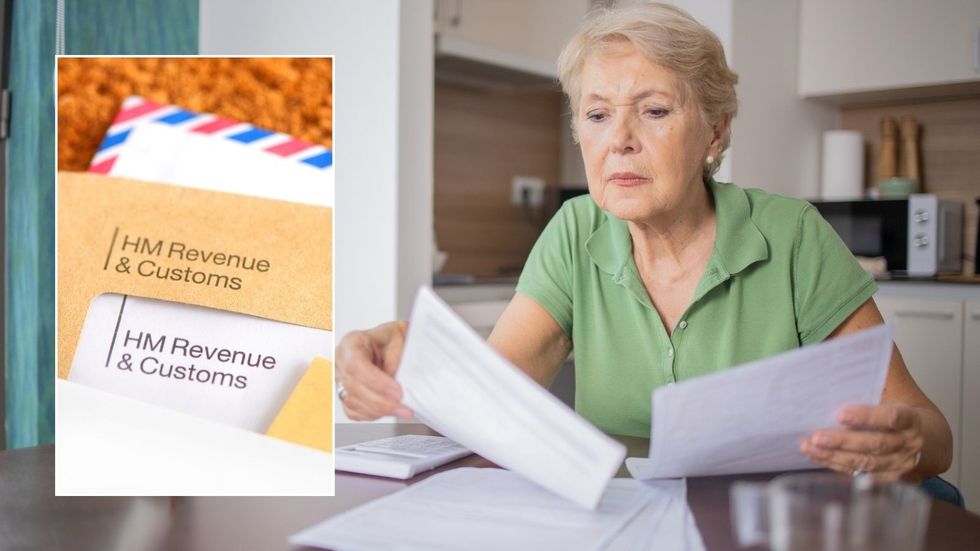

A pensioner who will now be taxed on her state pension found out about the “stealth tax” via a letter from HM Revenue and Customs (HMRC).

GB News reader Susan Bruce, 76, from Portsmouth, has received her state pension since she was 60 but this will be the first year that she will have to pay tax on pension income.

This is due to Chancellor Jeremy Hunt's decision to freeze tax thresholds until April 2028 which is dragging many older Britons into the tax net.

State pension payments will be awarded a 8.5 per cent rate hike this month thanks to the Government’s decision to maintain the triple lock.

This is a pledge to raise pensions by the highest out of either the rate of inflation, average earnings or 2.5 per cent.

The full new state pension will exceed £11,000 a year for the first time which is below the personal allowance’s £12,750 threshold.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Fiscal drag is pulling pensioners above the personal allowance threshold

|GETTY

However, individuals with other retirement income coming in are more likely to be pulled into the 20 per cent basic rate tax bracket for the first time despite being retired.

Ms Bruce and her husband Peter, 80, unfortunately are among the many who are impacted by this stealth tax.

The dire financial situation is compounded by the fact that Mr Bruce suffers from dementia with his wife receiving little help in way of social care from the current Government.

She explained: “I’ve received my pension since I was 60 and my husband’s been receiving his since he was 65. We heard about the triple lock and we really pleased.

“A tax code drops through our letterbox. I thought, ‘Why would we receive a tax code?’ I showed it to our daughter and she said it’s because our personal allowance doesn’t cover the money we received from the state pension.

“I was speaking to my friend who is 90 and he said he’s received a tax code. His is exactly the same. Because they [the Government] are not putting up the personal allowance, they are giving it to us with one hand and taking it away with the other.”

Ms Bruce fears the situation will be only get “worse and worse” due to the Government freezing tax allowances at their current level for the next four years.

Mr Bruce receives £207 a week from his state pension but this will be first time he will have to pay tax on this benefit.

Despite the Government hailing its record in regard to supporting pensioners, between the triple lock and cost of living payments, Ms Bruce believes older Britons are being “deceived”.

She claimed: “They’ve put up the capital gains tax to a higher level for their own benefit.

LATEST DEVELOPMENTS:

Retirees are paying tax for the first time due to Jeremy Hunt's allowance freeze

| GETTY“Jeremy Hunt is saying he’s doing so much for us old-age pensioners but all he’s doing is taking money from us through tax.”

The couple are urging the Government to raise the personal allowance threshold in line with inflation to stop fiscal drag from decimating peoples’ retirement savings further.

Ms Bruce explained: “They decided to freeze it and Jeremy Hunt decides to keep the triple lock but that’s not doing pensioners any good.”

GB News has contacted the Treasury for comment.