State pension 'injustice' as nearly 500,000 Britons to miss out on triple lock payment boost this year

Campaigners are urging the Government to take action over the frozen pensions policy

Don't Miss

Most Read

Nearly 500,000 Britons living abroad are set to miss out on the state pension triple lock this year due to the much-criticised "frozen pensions" policy.

British state pensioners living in the UK will benefit from a 4.8 per cent boost to their state pension payments beginning April 6, secured through the triple lock mechanism.

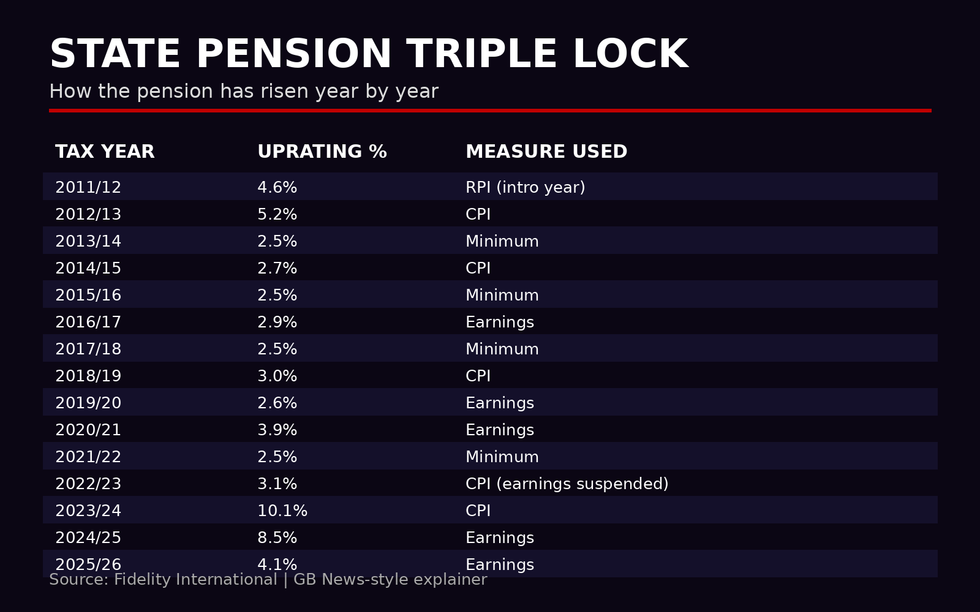

This annual adjustment, determined by the highest figure among average earnings growth, inflation, or 2.5 per cent, will push the full new state pension to £241.30 weekly and the maximum basic state pension to £184.90.

Yet an estimated 453,000 retirees residing overseas will see none of this increase under the status quo.

Nearly 500,000 retirees living abroad face missing out on this year's state pension boost

|GETTY

The End Frozen Pensions campaign has fought persistently for change, with even 100-year-old Second World War veteran Anne Puckridge travelling to Westminster to press for reform.

Analysts note that the existing frozen pension policy creates a stark geographical divide among British retirees abroad.

Those who have settled in Commonwealth countries, particularly Canada and Australia, find their state pension locked at whatever rate applied when they emigrated.

More than 100,000 affected pensioners live in Canada alone, and campaigners had hoped that Mark Carney's appointment as Canadian prime minister last year might prompt fresh negotiations with Westminster.

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL These pensioners, settled in countries lacking reciprocal agreements with Britain, remain excluded from the annual uprating despite having contributed the required National Insurance payments throughout their working lives.

Meanwhile, British retirees who chose to move to the United States or European Union nations face no such penalty, continuing to receive identical pension entitlements to those who remained in the UK.

This disparity means two pensioners with identical contribution records can receive vastly different payments depending solely on which country they retired to.

Nearly half of those affected survive on £65 per week or less, while campaign groups report some are managing on as little as £20 weekly.

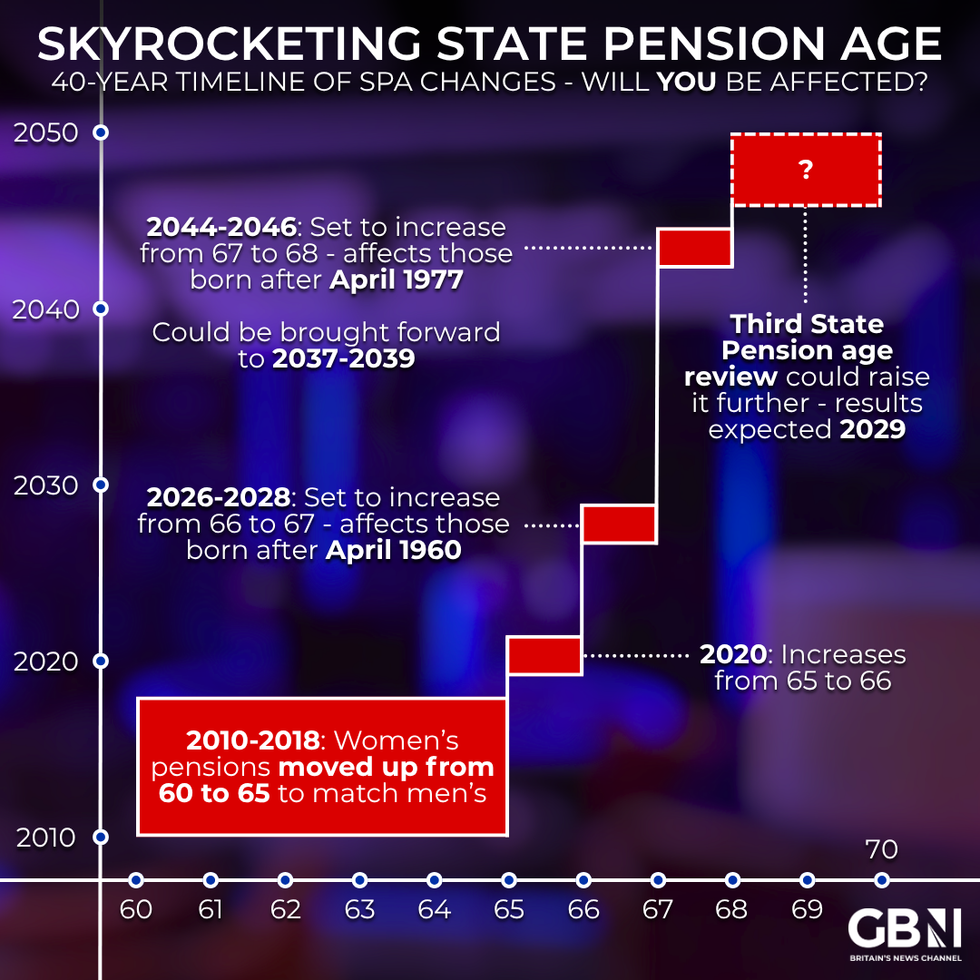

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsAdding to the injustice, an estimated 86 per cent of expat pensioners claim they were never told their state pension would be frozen upon leaving Britain.

Many had paid National Insurance contributions throughout their careers with no understanding that their retirement income would be permanently capped at the rate when they departed.

The End Frozen Pensions campaign has gathered thousands of signatures on an online petition and made repeated appeals to Government ministers, yet the policy remains unchanged despite the documented hardship it causes.

John Duguid, who leads the End Frozen Pensions Campaign, has sharply criticised Chancellor Rachel Reeves's approach to the issue.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR "The Chancellor found the words, and the money, to help protect pensioners from inflation at home, while offering nothing to the hundreds of thousands of British pensioners overseas whose incomes are being eroded year after year," he declared.

"Once again, we are left out of sight, out of mind, and out of pocket. And the fact that most of the affected countries are members of the Commonwealth adds insult to injury.

"The Government appears content to grow a chasm between its pensioners residing at home and abroad."

Mr Duguid described the situation as a scandal, noting that Government figures show rectifying the injustice would cost just £63million in the first year.

More From GB News