Bank of England cuts UK growth outlook to 0.9 per cent with Rachel Reeves under pressure

Growth is central to the Chancellor's economic targets

Don't Miss

Most Read

Rachel Reeves is coming under increasing pressure following the Bank of England's latest verdict on the economic growth, revising their outlook downwards.

The Bank cuts its outlook for 2026 from 1.2 per cent to 0.9 per cent, and for 2027, from 1.6 per cent to 1.5 per cent.

This follows the latest announcement that confirmed the base rate will remain at 3.75 per cent following today's Monetary Policy Committee (MPC) meeting.

As well as this, the projected unemployment rate rose to 5.3 per cent this year, having said in November that it would peak at 5.1 per cent.

TRENDING

Stories

Videos

Your Say

Reacting to the release, Shadow Chancellor Mel Stride said increasing taxes and borrowing to fund welfare has "flatlined growth and pushed up unemployment".

"Whilst the economy weakens, the prime minister and his closest aides are distracted by their own political survival, creating more uncertainty and confusion for British business."

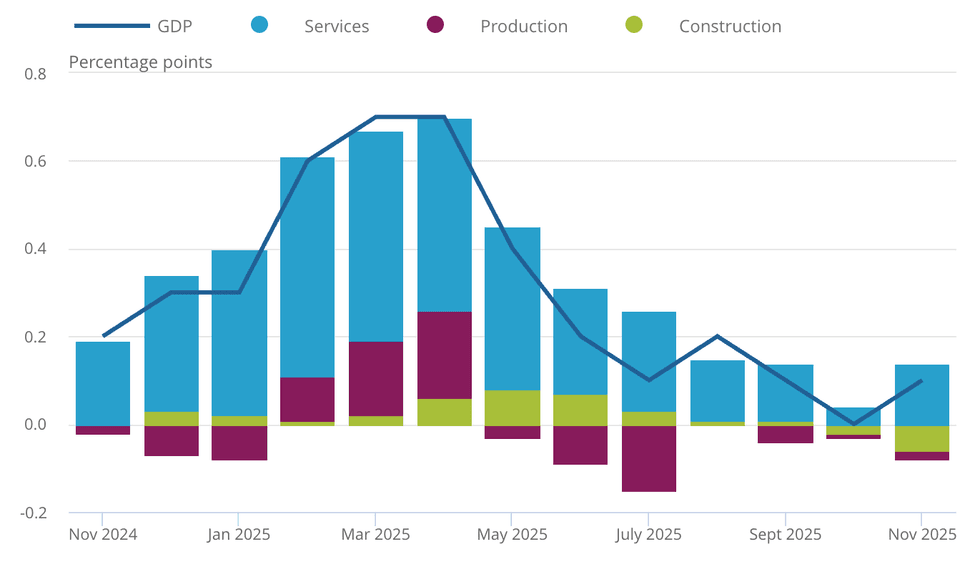

In the latest growth figures from November, GDP grew by 0.1 per cent, after showing no growth since June.

Office for National Statistics (ONS) director of economic statistics Liz McKeown said: “The economy grew slightly in the latest three months, led by growth in the services sector, which performed better in November following a weak October.

The Bank cuts its outlook for this year and 2027

|GETTY

“This was partially offset by a fall in manufacturing, where three monthly growth was still affected by the cyber incident that impacted car production earlier in the autumn.

“However, data from the latest month show that this industry has now largely recovered.

“Construction contracted again, registering its largest three-monthly fall in nearly three years.”

The Government has previously said it is “taking action to bring down bills and inflation”, pointing to measures such as the £150 reduction in energy bills and the freeze on rail fares, which it argues will help “deliver an economy that works for working people.”

“There’s more to do – driving growth, delivering the consolidation to provide stability, keeping inflation low and stable, tackling the cost of living and bringing our borrowing costs down.”

LATEST DEVELOPMENTS

Britain has struggled to sustain economic growth as a number of sectors faltered in 2025 | ONS

Britain has struggled to sustain economic growth as a number of sectors faltered in 2025 | ONSResponding to the latest MPC decision, William Ellis, senior economist at IPPR, said: “The Bank of England missed an opportunity today to cut rates and stop active gilt sales. This decision adds unnecessary strain to the economy, borrowing costs and the taxpayer.

“Higher than expected inflation in December largely reflected statistical noise and temporary factors. With core inflation stable, the bigger picture is still one of easing price pressures, slower wage growth and rising unemployment – yet the Bank of England’s stance is restricting growth.

“The Bank also note that measures introduced by the government in the recent Budget will help to reduce inflation and hit the 2 per cent target a year earlier than originally expected. This should encourage the Bank to act more boldly and more quickly.”

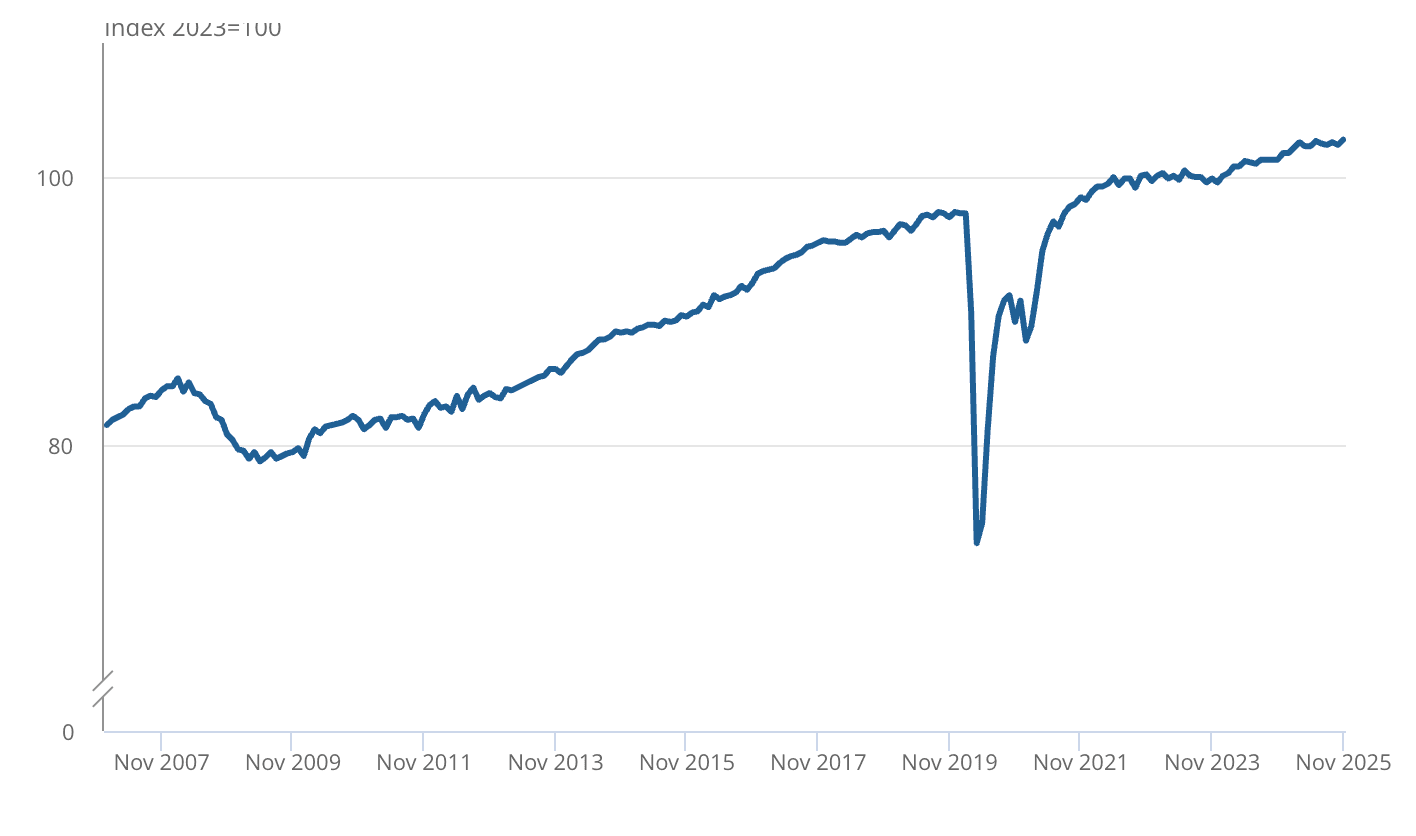

GDP had grown 1.4 per cent compared with November 2024 | ONS

GDP had grown 1.4 per cent compared with November 2024 | ONSA central theme of the Chancellor’s agenda has been the drive to secure sustained economic growth, boost investment, and support job creation.

Last year, she set out that ambition in stark terms, saying: “For too long, we have accepted low expectations, accepted stagnation, and accepted the risk of decline. We can do so much better. Low growth is not our destiny. But growth will not come without a fight.

“That’s what our Plan for Change is about. That is what drives me as Chancellor. And it is what I’m determined to deliver.”

On the latest announcement, the Bank's Governor Andrew Bailey said: "My main message today is one of good news."

Disinflation is on track, he asserted, and looks to be ahead of the schedule they had expected in November.

He adds they need to make sure inflation falls back to its two per cent target "and stays there".

More From GB News