State pension proposal REJECTED as DWP has 'no plans' to slash retirement age to 60

State pension age rise ‘almost inevitable’: Ann Widdecombe issues warning as Denmark raises the bar |

GB NEWS

Currently, the state pension age is 66

Don't Miss

Most Read

A proposal to slash the state pension age from 66 to 60 years old has been rejected by the Department for Work and Pensions (DWP) despite thousands of Britons signing a petition to do so.

More than 16,000 people have signed an official petition titled "Give State Pension to all at 60 and increase it to equal 48hrs of Living Wage" as concerns over Britons' retirement prospects grow.

In response to the petition, a DWP spokesperson said: "The Government has no plans to make the State Pension available from the age of 60 or for it to equal 48 hours a week at the National Living Wage.

"Our commitment to the Triple Lock through this Parliament will benefit over 12 million pensioners.

The DWP has rejected calls to reduce the state pension age

|GETTY

"From the end of this Parliament, spending on the state pension as a result of our commitment to protect the triple lock is forecast to be around £31billion more a year, compared with 2024/25."

The DWP's statement also includes cites additional benefits for state pensioners, including Pension Credit which offers means-tested support to older households on low incomes.

Pension Credit is widely known as a "gateway benefit" as it gives people access to extra support, including council tax assistance, energy bill concessions and a free TV licence for over 75s..

In the official petitions website, the Government is obligated to respond to any petition that receives more more than 10,000 signatures.

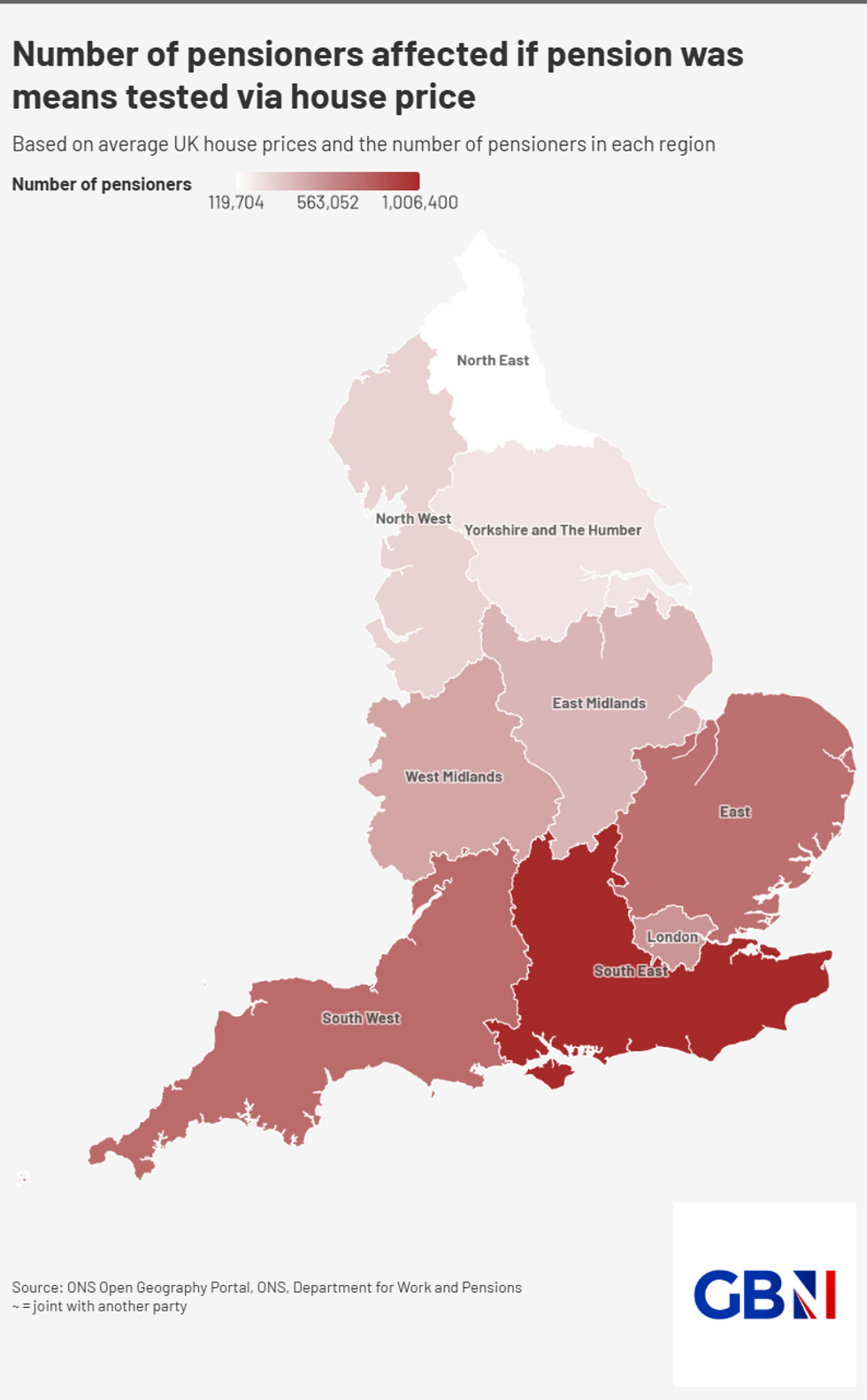

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNAfter 100,000 signatures, any petition that reaches this threshold will be considered for debate among MPs in Parliament.

Petition creator Denver Johnson said: "We want the Government to make the state pension available from the age of 60 and increase this to equal 48hrs a week at the National Living Wage.

"Hence from April 2025 a Universal State Pension should be £586.08 per week or about £30,476.16 per year as a right to all including expatriates, age 60 and above.

"We think that Government policy seems intent on the State Pension being a benefit not paid to all, while ever increasing the age of entitlement.

"We want reforms to the state pension, so that it is available to all including expatriates, from age 60, and linked to the National Living Wage, for security."

Catherine Foot, director of the Standard Life Centre for the Future of Retirement

Ms Foot said: "In our ageing society the affordability of the state pension is a constant point of discussion and the government has kicked off a review of state pension age.

"While more people are living to 90 and beyond, this growth in the number of very old people only provides a very partial picture. Life expectancy varies dramatically across the country and the uneven nature of increases needs to be taken into account as part of this process.

LATEST DEVELOPMENTS:

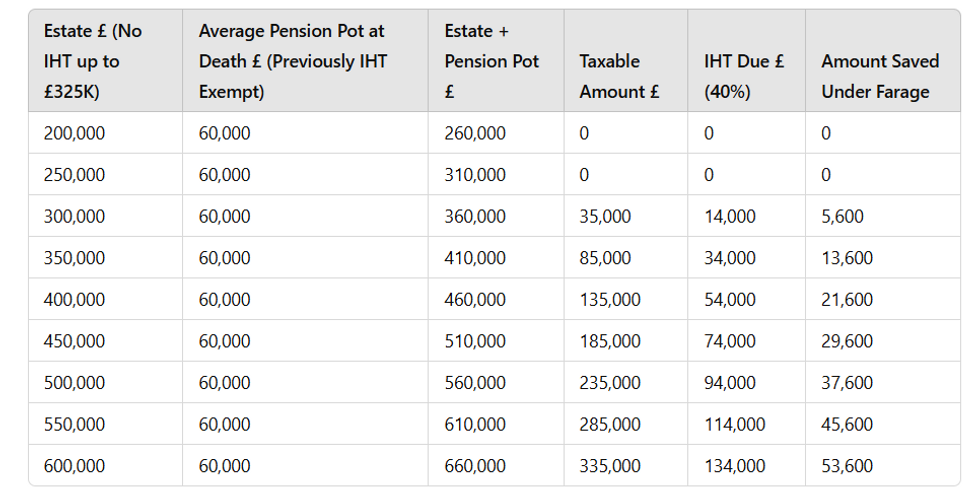

How much could you save? Pension pot | GBN

How much could you save? Pension pot | GBN"For individuals, longer lives provide the opportunity to rethink the traditional life phases of education, work and retirement and take a more flexible approach.

"People’s ability to do so however rests on having sufficient savings in place to enjoy what could be a lengthy retirement.

"The new Pensions Commission provides an opportunity to address the situation whereby 17 million people are currently under-saving and set out a roadmap towards a gradual increase in savings rates.

"Similarly, many people are leaving the workforce early, often due a lack of flexible working opportunities and there’s a real opportunity both for employers and employees to extend their working lives with the right incentives in place.”

More From GB News