State pension age rise to 70 'necessary' due to 'unpredictable' triple lock, Labour told

Currently, the state pension is 66 but this will rise to 67 from next year

Don't Miss

Most Read

Raising the state pension age to 70 is a "necessary" proposal to tackling Britain's retirement crisis as the triple lock becomes increasingly "unsustainable", a leading think has suggested.

The Intergenerational Foundation has put forward its recommendations as part of the Labour Government's third state pension age review, which is considering whether the rules surrounding when people can access payments are "appropriate".

As part of its report, the organisation cited that "inequalities between generations have grown" while Government spending has increasingly skewed towards older Britons.

According to the think tank, per-person Government expenditure on pensioners has risen by 55 per cent in real terms, compared to just 20 per cent for children in recent years.

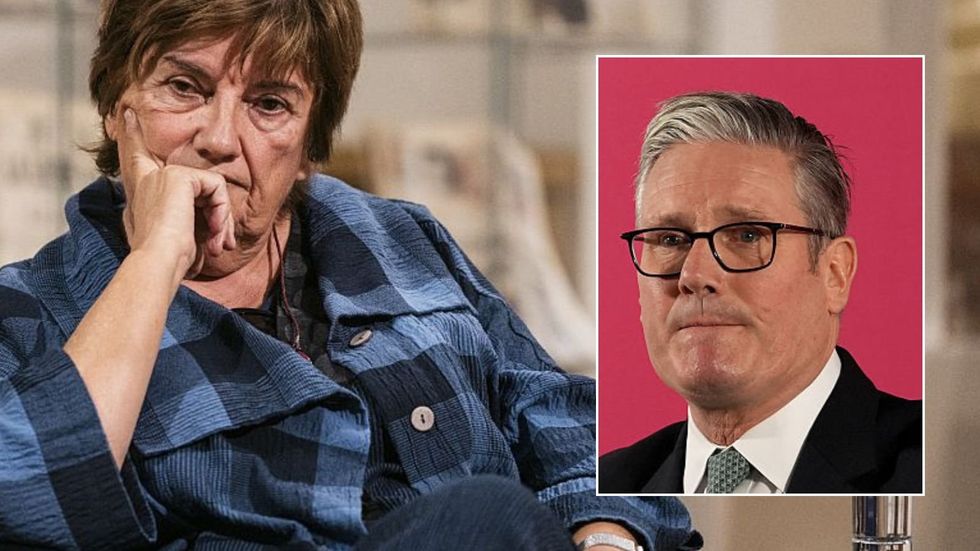

Labour have been told an increase in the state pension age to 70 may be 'necessary'

|GETTY

Notably, the Intergenerational Foundation highlighted the growing cost of the state pension triple lock as being "not only unsustainable but also unpredictable" in its current form.

Thanks to the triple lock mechanism, state pension payment rate are increased annually based on either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

Earlier this year, a report from the Office for Budget Responsibility (OBR) found that policy will cost the Government £15.5billion a year by 2029-30 which is nearly three times what was originally forecast when it was introduced.

To address this growing cost and the retirement benefit's long-term sustainability, the think tank cited automatic adjustment mechanisms as a way of providing a rules-based framework for making state pension age chances based on life expectancy.

The Chancellor has confirmed the triple lock will remain in place throughout this Parliament

| PAThe report shared: "One option could be to increase the state pension age to 70 by 2035. Based on the 2022 Office for National Statistics (ONS) cohort life expectancy projections, this would reduce the average period of retirement to around 16 years for men and 19 years for women.

"By contrast, under the currently legislated timetable, the average retirement period would be around 19 years for men and 22 years for women. While such reforms would undoubtedly be politically difficult, they may be a necessary part of a broader package of measures to prevent a future debt crisis."

As well as this, the Intergenerational Foundation called for the existing pensions system in the UK to overhauled to mirror the Netherlands’ two-thirds model for retirement.

They added: "This would provide clarity, deliver fiscal savings, and help prevent retirement periods from continuing to expand at the expense of younger taxpayers. But the two-thirds model also recognises that some of the additional years of life expectancy will likely be spent in poor health.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR "As such, it accounts for the fact that healthy life expectancy tends to rise more slowly than overall life expectancy, ensuring that future reforms remain fair as well as fiscally sustainable.

Despite this call for drastic reform, the think tank reminded the current Labour Government and future administrations to "recognise inequalities within generations" when considering changes.

"Life expectancy and healthy life expectancy vary dramatically by class, region, and occupation. Attempting to set multiple state pension based on these factors would be overly complex.," the report shared.

"However, these inequalities can be addressed through stronger bridging benefits for those unable to work until state pension age, early access for those with very long contribution histories, and better support for people with disabilities or long-term health conditions."

LATEST DEVELOPMENTS

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR As part of the Budget, Chancellor Rachel Reeves reaffirmed Labour's commitment to the triple lock despite growing concerns over its long-term viability and expense on the taxpayer.

Currently, the state pension age for both men and women in the UK is 66 years old but this will begin to rise to 67 sometime between 2026 and 2028 for individuals depending on their birthday.

Another increase to 68 is currently legislated to be implemented for between 2044 and 2046 but a review may bring this forward to the late 2030s. It should be noted that no earlier changes has been confirmed or legislated.

The Labour Government's ongoing state pension age review is expected to conclude in May 2026, at which point ministers must publish a response to the independent findings.