State pensioners face £828 tax bill under 'two-tier system' from Rachel Reeves

Dawn Neesom fumes ‘Labour hates old people’ as Rachel Reeves plots to ‘take everything she can’ from pensioners |

GB NEWS

Analysts are sounding the alarm over a potential stealth tax raid on state pensioners

Don't Miss

Most Read

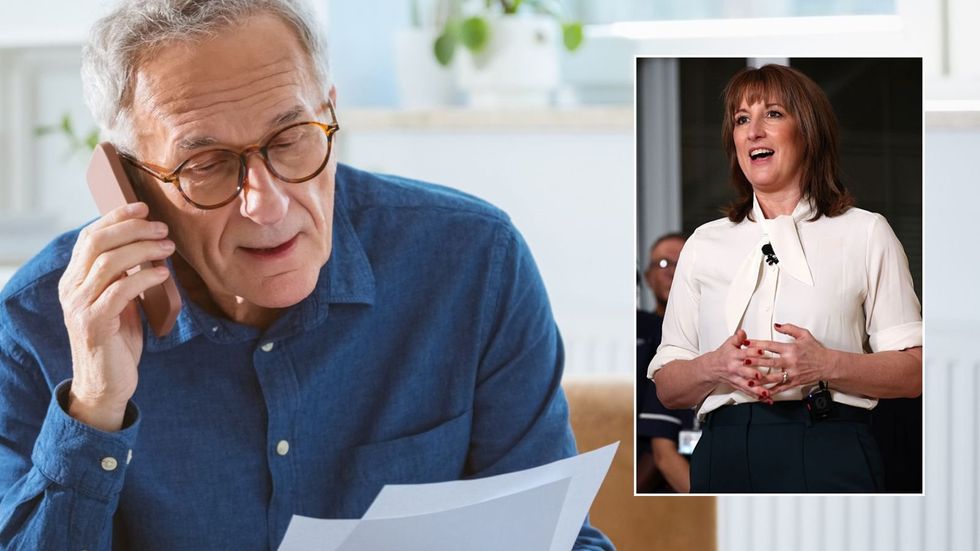

Retirees who opt to delay claiming their state pension by just one year could face an £828 tax bill under Chancellor Rachel Reeves's Budget reforms, according to damning new analysis.

Following her annual fiscal statement, the Chancellor announced older Britons relying solely on state pension income would be exempt from paying income tax throughout this Parliament.

This is despite payments being set to exceed the personal allowance threshold in 2027, which is the amount someone begins to pay tax on earned income and currently set at £12,570.

However, Treasury officials have since confirmed this protection from HM Revenue and Customs (HMRC) applies only to those receiving the basic or new state pension "without any increments".

Analysts warn state pension deferrals could be taxed more under a 'two-tier' system

|GETTY / PA

When asked whether individuals who prefer to defer receiving state pension payments would be excluded from the exemption, a Government spokesman declined to deny it, The Telegraph reports. It should be noted the Treasury is expected to provide further clarification next year.

Under current rules, anyone reaching state pension age of 66 on or after April 2016 receives a one per cent rate increase for every nine weeks they postpone claiming payments.

This translates to approximately 5.8 per cent annually to the state pension, equivalent to an additional £13.35 per week, with many deferring getting paid to bolster their retirement income.

The state pension does not begin automatically when someone turns 66 with retirees needing to actively claiming it. Those who miss the deadline or deliberately wait will have their payments deferred.

Former pensions minister has warned the Chancellor is at risk of creating a 'two-tired' system

| STEVE WEBBTelegraph analysis reveals that a person eligible for the state pension in 2026-27 who delays by twelve months would pay £828 in tax by 2030, while someone claiming immediately would owe nothing. A five-year deferral starting in 2027-28 would result in £3,277 of tax.

Sir Steve Webb, former pensions minister and now partner at pension consultants Land Clark and Peacock (LCP), warned the policy risked establishing a "two-tiered tax system".

He said: "The value of the Chancellor's tax write-off for people who only have the standard state pension will grow each year."

Mr Webb explained that as this benefit increases, more people will seek to qualify, potentially by avoiding pension deferral altogether.

"Over three years, the tax 'amnesty' is likely to be worth around £300, and the risk of losing that money may cause some people to take their pension sooner instead of deferring and taking a higher pension later," he added.

He described the measure as "another perverse side-effect of this ill-thought-through proposal".

Under the triple lock mechanism, state pension payment rates are guaranteed to rise annually by either the highest of inflation, wage growth, or 2.5 per cent.

According to Office for Budget Responsibility (OBR) projections, state pension payments will reach £13,850 by the start of the next decade.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR From April, the full new state pension will climb by 4.8 per cent to £12,548. Even a minimum 2.5pc increase in 2027 would push it to £12,862, breaching the £12,570 personal allowance for the first time.

Analysts have warned the combination of frozen tax thresholds and triple lock will result in older Britons paying tax on their state pensions alone for the first time ever.

During last month's Budget, the Chancellor pledged to keep the triple lock in place throughout the current Parliament and extended the freeze on tax thresholds until 2031.

A Treasury spokesman said: "As the Chancellor has said, over this Parliament those whose only income is the basic or new state pension without any increments will not have to pay income tax.”

More From GB News