State pension payments to be 'penalised' under 'rushed' Rachel Reeves tax policy as HMRC raid looms

Dawn Neesom fumes ‘Labour hates old people’ as Rachel Reeves plots to ‘take everything she can’ from pensioners |

GB NEWS

Will you need to pay tax on your state pension payments alone?

Don't Miss

Most Read

Retirees risk being "penalised" under "rushed and incoherent" plans from Chancellor Rachel Reeves after last week's Budget amid growing concerns state pension payments alone.

The full new, state pension is in course to surpass the personal allowance threshold in 2027 for the first time due to the impact of fiscal drag and frozen HM Revenue and Customs (HMRC) thresholds.

The Labour Government has pledged to keep the triple lock in place until at least the end of this Parliament. Under this metric, state pension payment rates rise every year by either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

From April 2026, the full new state pension will jump 4.8 per cent to £12,547 annually. If the retirement benefit were to increase by the 2.5 per cent minimum in 2027, payments will be at least £12,862.

The Chancellor is being accused of having a 'rushed and incoherent' policy when it comes to state pensions being taxed

|GETTY / PA

On top of this, the Chancellor confirmed the current freeze on personal tax thresholds will be extended an additional three years until 2031; exacerbating the impact of fiscal drag.

This is the term used to describe when tax thresholds are kept at the same level while incomes or inflation rise, resulting in more Britons being pulled into higher HMRC brackets.

Ahead of Ms Reeves's fiscal statement, this development triggered widespread anxiety among retirees who fear they could face taxation solely on their state pension income.

However, the Chancellor suggested that those who are reliant solely on the state pension alone will not need to pay tax on payments or have to fill out a Self-Assessment form.

Experts are warning over the impact of fiscal drag | GETTY

Experts are warning over the impact of fiscal drag | GETTY During an interview with financial journalist Martin Lewis, Ms Reeves shared: "If you just have a state pension, you don't have any other pension, we are not going to make you fill a tax return. I make that commitment for this Parliament.

"2027 looks like the time that it [full, new state pension] will cross over. We are working on a solution, as we speak, to ensure that we're not going after tiny amounts of money."

When asked specifically if older Britons will need to start paying tax on their state pension alone, the Chancellor added: "In this Parliament, they won't have to pay the tax.

According to Maike Currie, PensionBee's VP of Personal Finance, "It's no wonder pensioners have been worried they'd pay tax on nothing more than their state pension income.

"While the Chancellor has confirmed that until the end of Parliament in 2029 those with only the state pension won’t be taxed, saying that the government is working on a solution, there is very little detail on how this will work in practice, with many unanswered questions.

"Would someone with just £1 of private pension income, face tax when their neighbour on the same income from the state pension pays nothing? What about pensioners on the old system, or those with SERPS income, many of whom already pay tax via Simple Assessment?"

"There’s also the thorny issue of fairness, where a worker earning £12,500 pays tax and National Insurance, while a pensioner on the same amount pays neither?

"The Government’s intentions may be good, but the execution looks rushed and incoherent. As ever the devil is in the detail of how this is implemented.

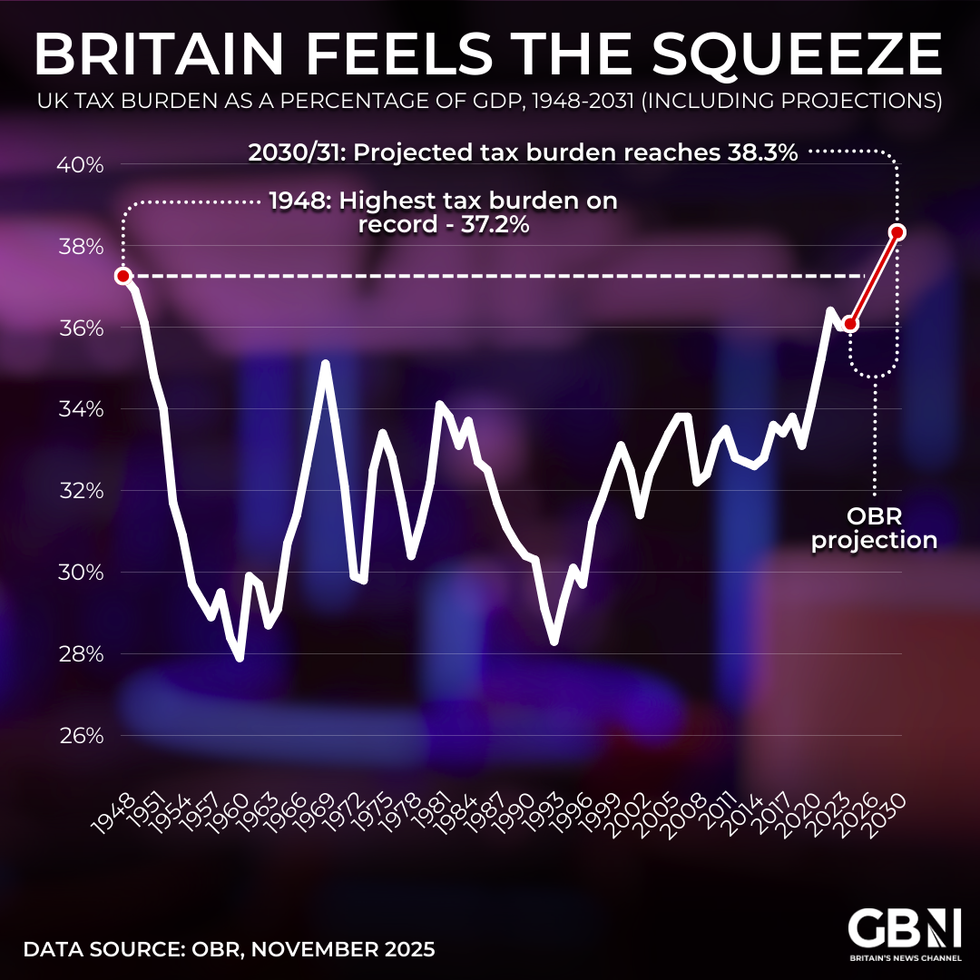

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR"Unless the policy is clear on these cliff edges and contradictions, this policy risks deepening the generational divide and creating a tax system with more complexity that rewards some pensioners while penalising others who’ve done the right thing and saved.

"Without a clear, fair and fully costed plan - including how HMRC will handle Simple Assessments for millions of pensions, the Government risks replacing one problem - small tax bills for pensioners - with another: a messy, unfair system full of exemptions, anomalies and hard-to-justify gaps.”

Simple Assessment is used by HMRC to collect tax from individuals with straightforward income, including state pension payments or interest on savings, when PAYE cannot deduct tax automatically. The tax authority issues a notice, known as a PA302, highlighting how much tax is owed, which must be paid by a set deadline, usually after the tax year ends.

Retirees on the full state pension who cross the personal allowance would get receive a Simple Assessment, but under the proposed exemption, those whose only income is the state pension are expected not to be issued these notices,

More From GB News