Skipton Building Society launches new savings option paying 5.25% so savers can 'prolong lofty rates'

Skipton Building Society has announced a new fixed rate bond

|PA

Skipton Building Society said this offer gives people the chance to “prolong the lofty savings rates” being experienced at the moment

Don't Miss

Most Read

Skipton Building Society has announced the launch of a five-year fixed savings option which pays 5.25 per cent of interest, amid speculation interest rates may be reaching their peak.

The building society says its new 5 Year Fixed Rate Bond gives customers a new option to lock in a “higher” rate for the long term.

They said it could be ideal for savers looking to get their money working hard in the background for years to come.

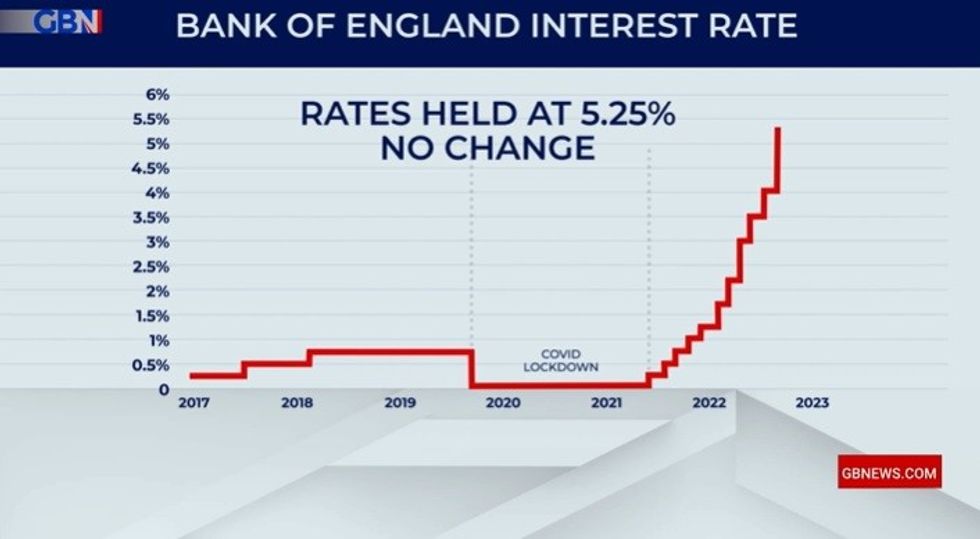

It comes after the Bank of England voted to maintain the base rate at 5.25 per cent, after 14 consecutive hikes over the past two years.

WATCH NOW: Liam Halligan on Bank of England holding interest rates

The 5 Year Bond can be opened with a balance of £500, but opening deposits can be as high as £1million.

It’s important to note that under the Financial Services Compensation Scheme, up to £85,000 is protected per person for each bank, building society or credit union.

Customers can pay in until the payment end date, in this case November 8, but can’t continue to deposit money in the account throughout the term.

It’s not possible to withdraw the money or close the account during the term.

The account can be opened and managed in a number of ways, including in branch, over the phone, online via skipton.co.uk or via the Skipton Building Society app.

The 5.25 per cent interest rate makes the 5 Year Fixed Rate Bond a strong competitor in the best buy comparisons.

Analysis by Moneyfactscompare.co.uk states JN Bank’s Fixed Term Savings Account, which currently pays 5.80 per cent, is the market-leading option right now.

The launch comes shortly before billions of pounds are set to mature from other fixed rate products across the savings market.

Analysis of CACI savings data by Skipton shows more than £15billion is expected to mature from fixed rate products across the market next month.

Maitham Mohsin, Head of Savings at Skipton Building Society, said: “The signs suggest that savings rates might just have reached their peak.

LATEST DEVELOPMENTS:

The Bank of England base rate was held for the first time in nearly two years last month, after 14 consecutive hikes

|GB NEWS

“The Bank of England has halted its run of consecutive Base Rate rises, and some savings providers have already started cutting their savings rates.

"But with the launch of our new 5 year bond, with a high 5.25 per cent rate, we are giving customers the opportunity to lock in this rate for the long term.

"It’s another example of Skipton offering value for the long term.

“We know fixed rate accounts to the tune of £15billion are due to end and mature in November, so for those savers – and any others who can put some of their cash away for a fixed term – our new 5 Year Bond gives means they can prolong the lofty savings rates we’re experiencing right now for the next half-decade.”