Seven steps to stop your credit score blocking your path to a mortgage

What practical steps can people take if they’re struggling with higher repayments? |

GB News

Specialists say inaccurate reports and new credit can cause lenders to change or withdraw offers

Don't Miss

Most Read

Latest

Homebuyers are being warned that mortgage offers can still fall through even after approval, as lenders increasingly recheck credit files before completion.

New findings from HSBC show that nearly a third of adults have never checked their credit score, while more than a quarter do not understand how the system works.

Carl Watchorn, head of customer propositions at HSBC UK, said this lack of awareness "means many are missing out on significant savings without even realising it".

Finance expert Funmi Olufunwa said that borrowers should not focus solely on the numerical score itself.

TRENDING

Stories

Videos

Your Say

"What matters far more is that the file is accurate. It's the lender who decides whether you're a good bet, not Experian or Equifax."

Here are seven practical steps to protect your mortgage offer.

1. Check all credit files

Lenders can use different agencies, meaning information may vary between files.

Ying Tan, CEO of broker Habito, said: "Most lenders will only use one. We've seen missing data – such as a payday loan not showing up – cause a product change after submission."

Borrowers can obtain free statutory reports from Experian, Equifax and TransUnion.

Nearly a third of adults have never checked their credit score while more than a quarter do not understand how the system works

|GETTY

2. Correct mistakes and provide context

If inaccuracies appear, both the lender and credit agency should be contacted promptly.

The correction process can take several weeks, making early action important.

Borrowers can also add a short explanation to disputed entries, which lenders must review as part of their assessment.

LATEST DEVELOPMENTS:

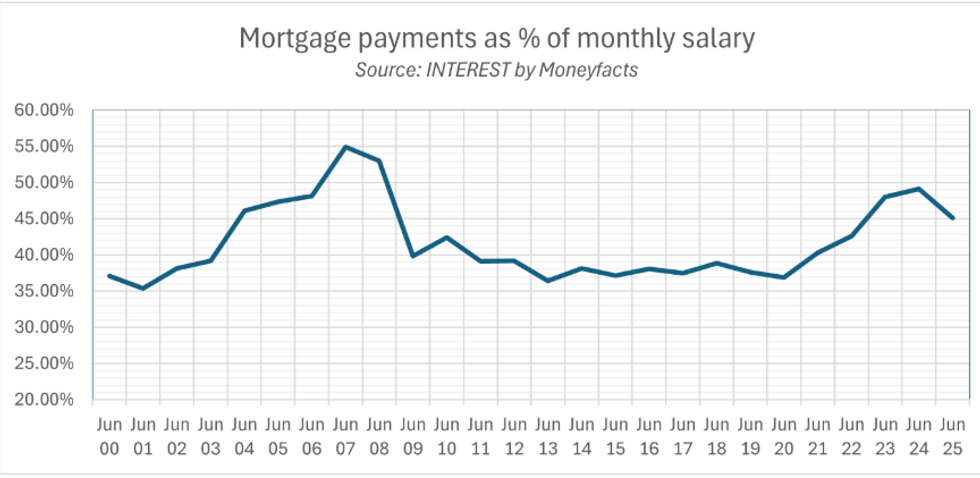

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS3. Act quickly on CCJs

If the debt is paid within one month, borrowers may apply to have the County Court Judgments (CCJ) taken off their record entirely.

Ms Olufunwa said: "People often don't realise this window exists. If you don't check your file, you may not even know the CCJ is there – and you miss the chance to fix it."

4. Avoid fresh borrowing

Even interest-free arrangements or buy-now-pay-later products can affect affordability assessments.

Nicholas Mendes, from broker John Charcol, said: "It isn't unusual for lenders to re-run checks before completion.

"If you've taken on new credit, your balances have risen or your payment behaviour has changed, the lender might revise terms – or even withdraw the offer."

5. Keep payments clean

Mr Tan said: "We often see issues with utility or mobile bills, especially when people make manual transfers. Even small admin errors can push borrowers onto pricier specialist deals."

Experts suggest that direct debits for minimum payments across all accounts can help demonstrate consistent financial management.

6. Build a clear track record

Advisers say that those who have never borrowed before may find themselves disadvantaged by having too little credit history.

A small and well-managed credit card can help build a profile over time.

Being registered to vote also assists lenders in verifying identity and stability.

Borrowers are urged to review past financial links, which may remain on their credit file long after relationships or shared accounts have ended.

Ms Olufunwa said: "I know someone who was still linked to their ex-husband seven years after divorce. That can absolutely affect your mortgage chances."

Mr Mendes said: "Transparency gives you options. If something shifts, your broker can advise whether to delay, switch lender or adjust the loan before the underwriter finds out."

House prices have increased by 2,385 per cent in 50 years | GETTY

House prices have increased by 2,385 per cent in 50 years | GETTYDavid Hollingworth, from L&C Mortgages, said that while mortgage offers are generally binding once issued, significant changes such as job loss or large increases in debt can trigger further checks.

He said: "That's not common, but it can happen."

7. Inform your broker about changes

Mr Mendes said: "Avoid new credit, pay everything on time and don't rock the boat before completion.

"Once you've got the keys, you can revisit the rest."

Our Standards: The GB News Editorial Charter

More From GB News