Savers flock to ISAs amid 'uncertain economic backdrop' as Rachel Reeves preps tax raid

How can I make the most of my ISA? |

GB NEWS

The Chancellor confirmed the tax-free savings allowanced linked to ISAs would be cut from £20,000 to £12,000 during her Budget

Don't Miss

Most Read

Britons are flocking to cash ISAs to protect their savings from the tax man ahead of looming changes to the tax-free allowance, which were confirmed by Chancellor Rachel Reeves in last month's Budget.

On November 26, the Chancellor announced the £20,000 threshold, at which point ISA savers pay tax on interest, will be nearly halved to £12,000 for people under the age of 65.

New research has revealed British households have amassed £207billion in cash ISAs as of the end of September, representing a 14 per cent jump compared with the same period last year.

The figures, published in UK Finance's household finance review for the third quarter of 2025, also reveal that notice savings accounts now contain £295billion which is 10 per cent year-on-year.

Britons are flocking to ISAs despite a looming tax raid from the Chancellor

|GETTY / PA

The banking and finance trade body attributed the surge to savers establishing "precautionary buffers against an uncertain economic backdrop" with the ISA changes set to come into effect from 2027.

Despite falling savings interest rates, which have dropped in line with the Bank of England base rate, households continued to set money aside as a protective measure, the report found.

Eric Leenders, the managing director of personal finance at UK Finance, said: "Savings growth has moderated but remains strong by historic standards, with households continuing to build precautionary buffers against an uncertain economic backdrop ahead of the autumn Budget."

Looking ahead, the trade association expects household savings to keep rising through the remainder of 2025 as more individuals look to take advantage of tax-savings vehicles.

Britons are looking for the best deals | GETTY

Britons are looking for the best deals | GETTYHowever, the organisation cautioned that any further decline in interest rates or slower wage growth could dampen this momentum; with a base rate cut from the Bank of England widely expected this month.

The UK's central bank has raised the cost of borrowing in response to the surge in inflation, which took place in the aftermath of the Covid-19 pandemic and resulted in the cost of living

Based on UK Finance's review, analysts noted that while the pace of saving in Britain has eased somewhat in 2025, it remains robust when measured against historical norms.

As part of Ms Reeves's Budget reforms, the total annual Isa contribution cap will stay at £20,000, which may prompt some savers hitting the new cash limit to direct additional funds into stocks and shares.

Ministers are also introducing measures to stop people circumventing the lower threshold, including levies on interest earned from cash held within stocks and shares Isas and assessments to identify "cash like" holdings.

Following the Budget, Kroo's chief product officer Danny Hynes urged the Labour Government "to reconsider" cutting the tax-free allowance to £12,000 in lieu of alternative reforms.

He shared: "Cash ISAs are a valuable and safe way to earn a return on your money. With a significant portion of the UK public’s finances still remaining 'lazy'– i.e not earning a fair rate of interest - cash ISAs provide a secure way for savers to earn tax-free gains on their hard-earned savings.

"While retail investors will still be able to invest £20,000 into their ISAs, today's announcement that the tax-free cash ISA allowance is to be cut from £20,000 to £12,000, with £8,000 of allowance diverted to stocks & shares products, does not do enough to tackle the lack of financial resilience in the UK.

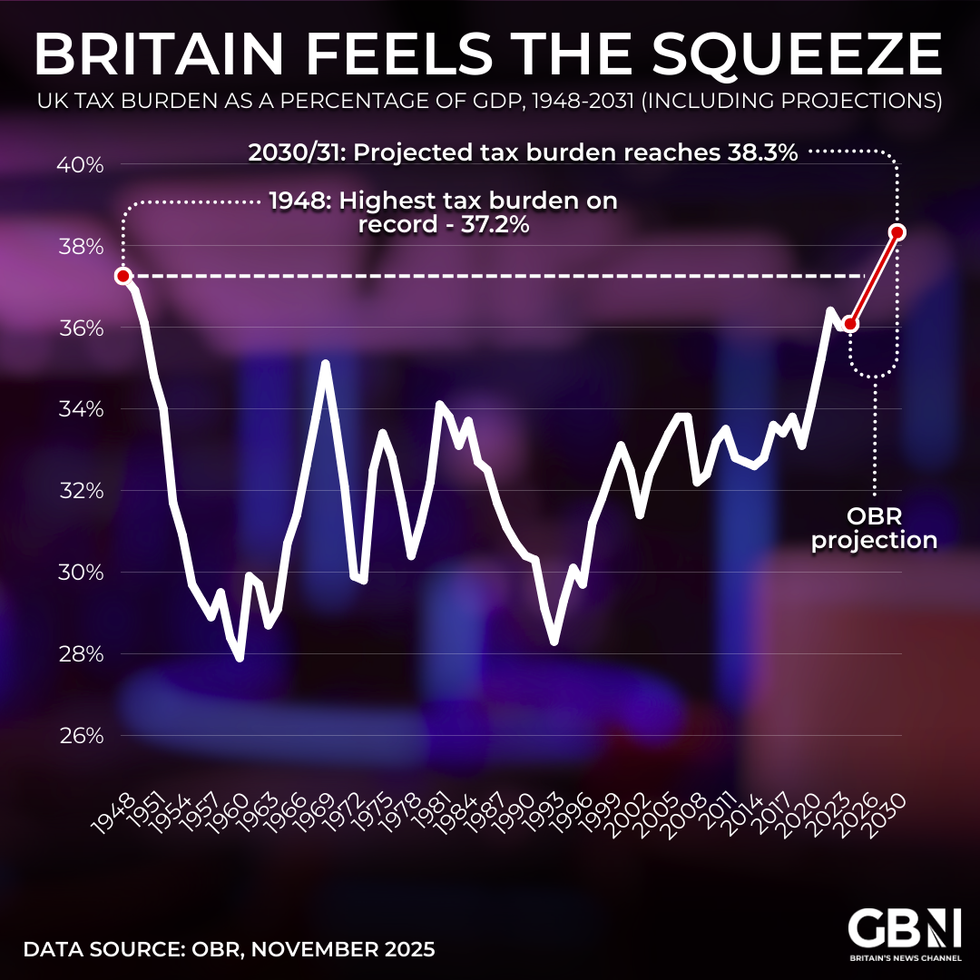

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR"As well as reducing the public’s ability to choose the saving method that works best for them and their finances, this measure also seems to contradict the new increase in the FSCS limit to £120,000, a measure which could be seen as encouraging the public to keep more of its savings in cash.

"We urge this Government to reconsider, and instead provide an additional, separate, £20,000 allowance for stocks and shares ISAs whilst reinstating the £20,000 Cash ISA limit - providing tax relief of up to £40,000 in total annually.

"This will encourage the public to focus on financial resilience, whilst growing their wealth tax-free, in a way that suits them – putting the UK’s ‘lazy money’ to work and fuelling the engine of economic growth."

Defending the ISA reforms during her Budget speech, the Chancellor said: "The UK has some of the lowest levels of retail investment in the G7. And that is not only bad for business, who need that investment to grow. It’s bad for savers too."

More From GB News