Rachel Reeves refuses to rule out extending income tax threshold freeze as 7m Brits dragged into paying more to HMRC

Chancellor Rachel Reeves refuses to rule out extending freeze on income tax thresholds |

GBNEWS

Income tax thresholds are currently frozen until 2028, but mounting pressure on public finances could see the freeze extended further

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves has declined to rule out extending the freeze on income tax thresholds beyond 2028, as the Government grapples with an estimated £2.5 billion cost from welfare reform concessions.

During Treasury questions in the House of Commons, Reeves was directly asked whether she could guarantee the freeze would end as scheduled.

Rather than providing a clear answer to the prospect of extending the reforms, the Chancellor deflected by highlighting that the Conservative Party had originally implemented the threshold freeze.

She stated: "I am not taking any lessons from the party opposite who have opposed everything that is needed to invest in our public services which is how we are in the mess we are in, because of the damage that they caused."

The freeze has dramatically expanded the number of higher-rate taxpayers

|Parliament TV

Her refusal to explicitly rule out an extension has fuelled speculation about the Government's future fiscal plans.

The Government's U-turn on benefit cuts will cost taxpayers around £2.5 billion by 2030, the Work and Pensions Secretary has told MPs as she laid out concessions to Labour rebels.

By freezing the tax threshold, the Treasury can raise money without having to explicitly raise taxes.

The freeze has dramatically expanded the number of higher-rate taxpayers, with HMRC figures revealing that 7.08 million people are projected to fall into this bracket in the 2025-26 tax year.

This represents a sharp increase from 5.10 million in 2022-23 and 4.43 million in 2021-22. The total number of income tax payers is expected to reach 39.10 million in 2025-26, up from 34.50 million in 2022-23.

Additionally, those paying the additional rate of tax are projected to more than double to 1.23 million, compared with approximately 570,000 in 2022-23.

The phenomenon of fiscal drag, where frozen thresholds combine with wage increases to push earners into higher tax brackets, has resulted in taxpayers contributing an additional £89 billion in income tax compared to 2021-22.

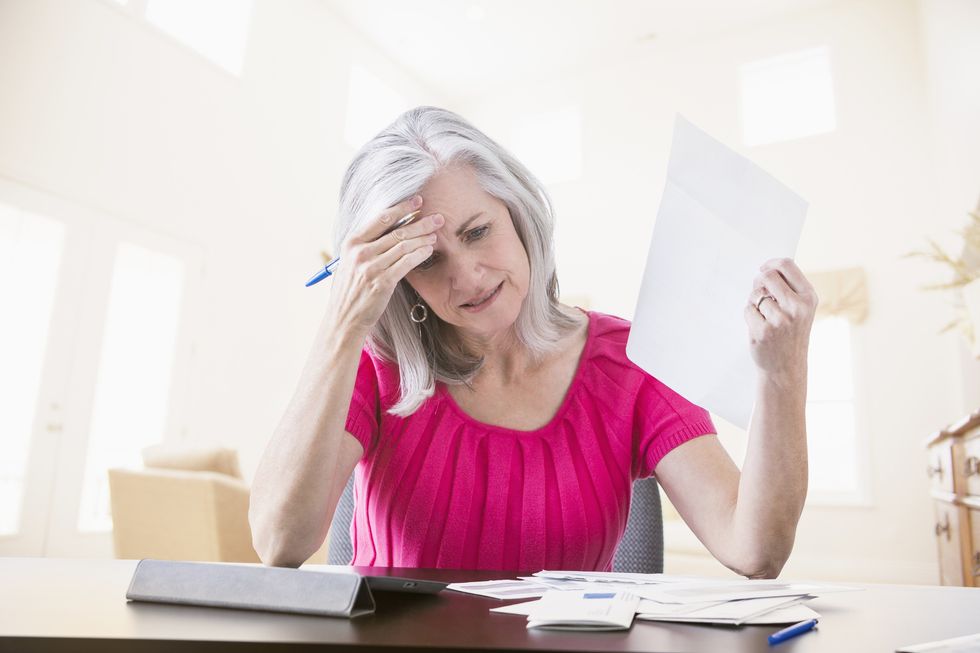

Financial experts have expressed serious concerns about the ongoing impact of this stealth tax on both workers and pensioners.

Sarah Coles, head of personal finance at Hargreaves Lansdown, warned: "It has had a devastating impact on the tax we pay on our earnings, but that's not the end of it, because it also takes a huge chunk out of our savings and investments.

Fiscal drag is dragging Britons into higher tax brackets | GETTY

Fiscal drag is dragging Britons into higher tax brackets | GETTY "It reveals just how much damage is being done to our finances by this horrible stealth tax and there's plenty more to come."

She added: "Income tax thresholds are set to stay until 2028, but as the debate around the Government finances intensifies, the risk that the freeze remains for even longer can't be ruled out."

Laura Suter, director of personal finance at AJ Bell, noted that higher-rate taxpayers now account for almost a fifth of all taxpayers at 18.1 per cent, demonstrating that the higher rate "once reserved for those on healthy salaries, is now pretty commonplace."

She highlighted that pensioners face particular challenges: "It's not just working age people who have faced this rising tax tide, pensioners are being hit too.

"The frozen tax bands combined with chunky increases in the state pension mean that more pensioners are becoming taxpayers."

A Treasury spokesperson defended the Government's position, stating: "This Government inherited the previous Government's policy of frozen tax thresholds."

The Chancellor's refusal to explicitly rule out an extension has fuelled speculation about the Government's future fiscal plans

| GETTYThe spokesperson emphasised that the Chancellor had announced at both the budget and spring statement that the freeze would not be extended beyond its current end date.

They added: "We are also protecting payslips for working people by keeping our promise to not raise the basic, higher or additional rates of income tax, employee national insurance or VAT."

The Treasury maintained this approach represents "the plan for change protecting people's incomes and putting money into people's pockets," whilst acknowledging the threshold freeze policy was inherited from the previous administration.

Despite these assurances, the Chancellor's refusal to explicitly rule out an extension has fuelled speculation about the Government's future fiscal plans.

More From GB News