Rachel Reeves tax raid triggers wage slump as Bank of England warns pay rises will fall short of what they would've been

'I pay your wages!' Michelle Dewberry fumes as MPs 'refuse' to answer question on salaries |

GBNEWS

While wage growth is 'strong' there are signs of caution among employers

Don't Miss

Most Read

Latest

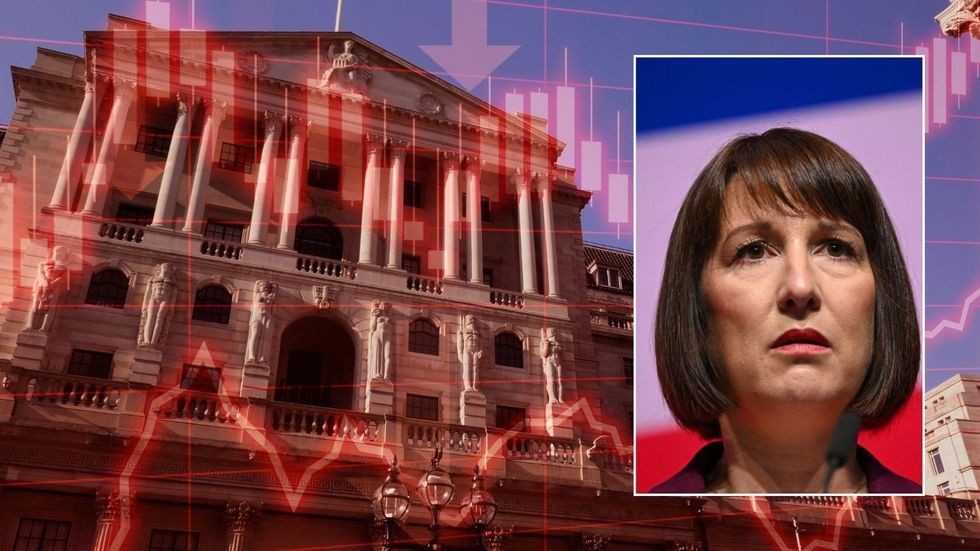

Rachel Reeves' £25bn raid on employers' National Insurance Contributions is putting the brakes on wage growth across the UK, new research has shown.

Just as workers were beginning to see their pay packets recover from the cost of living crisis, the Chancellor's tax increase is causing employers to tighten their purse strings.

Wage growth is now slowing sharply, with company surveys clearly pointing to the Chancellor's policies as the culprit. After accounting for inflation, regular pay increased by just 2.8 per cent, showing earnings are still rising in real terms but at a slower pace.

The figures highlight growing concerns over the health of the UK labour market and the strength of the wider economic recovery.

The National Insurance hike, which came into force last month, is hammering businesses nationwide. While bosses nominally pay the tax, the cost is increasingly being shared with workers through lower wages, as well as with customers through higher prices.

The tax raid increases the rate of NICs from 13.8 per cent to 15 per cent. It also reduces the earnings threshold at which the tax kicks in from £9,100 per year to just £5,000. This change means employers of low-paid and part-time workers are particularly hard hit.

The timing couldn't be worse for many businesses still recovering from recent economic challenges. Many employers are now faced with difficult decisions about how to absorb these additional costs.

All employers are looking to try to mitigate higher costs somehow.

| GETTYThe impact is already being felt across various sectors as companies reassess their budgets and staffing plans. The Bank of England's Monetary Policy Report on Thursday revealed the direct impact of these changes on wages.

The Bank said: "In response to NICs changes some firms say they are likely to offer pay settlements of one to two percentage points less than otherwise. All employers are looking to try to mitigate higher costs somehow."

Sir Dave Ramsden, a deputy governor of the Bank, noted a shift in how businesses are absorbing the tax. He said: "What our agents are telling us is that, actually, it will be pushing down on wages relative to what they would have been."

The Bank also highlighted that "firms have cited April's increase in employer NICs as a reason for weakness in employment growth".

Small businesses are feeling the squeeze most acutely, according to experts

| GETTYSmall businesses are feeling the squeeze most acutely, according to experts. The National Institute of Economic and Social Research has highlighted the disproportionate impact on smaller firms.

Arnab Bhattacharjee at the Institute said: "A large part of the heat, whether you look at NICs or the national minimum wage, falls on small and medium-sized enterprises."

He added that small businesses are already "tightening their belts" in anticipation of labour market reforms expected over the summer.

This pre-emptive belt-tightening suggests the full impact of the NICs increase may not yet be fully visible in economic data. Many SMEs operate on tighter margins, making them particularly vulnerable to increased employment costs.

While the NICs raid may help cool the jobs market, it's still adding to inflation pressures.

The Bank of England now expects inflation to accelerate from 2.6 per cent to peak at 3.5 per cent in the third quarter. Without the National Insurance increase, price rises would peak at around 3.3 per cent.

This keeps inflation firmly above the Bank's two per cent target, potentially delaying interest rate cuts. The Bank is particularly cautious following the recent cost of living crisis.

Officials fear households are now "more sensitive to inflationary pressures" after experiencing very high inflation in 2022. This sensitivity could lead workers to demand higher pay, creating a self-fulfilling inflationary spiral.

Ironically, Donald Trump's trade policies may provide some relief for UK workers facing underwhelming pay rises. Global oil and gas prices have plunged as traders fear an economic slump, potentially reducing energy bills.

The Bank of England estimates Chinese export prices could fall by around 10 per cent

| GETTYThis should help limit inflation's peak to around 3.5 per cent rather than the previously forecast 3.75 per cent.

Meanwhile, Chinese goods diverted from the US market due to Trump's 145 per cent tariff could flood the UK with discounted products.

The Bank of England estimates Chinese export prices could fall by around 10 per cent.

This combination of factors means inflation might return to the two per cent target by early 2027 instead of year-end.

Lower mortgage payments from resulting interest rate cuts could help offset stagnant wages.