Pensioners warned of 'inevitable' tax hike as Rachel Reeves makes 'hard and serious' choice

Retired Britons are among those who could be squeezed hardest on November 26

Don't Miss

Most Read

Latest

Speculation is mounting that Chancellor Rachel Reeves may abandon Labour's election pledge not to raise income tax when she delivers her Budget on November 26.

Ms Reeves is preparing to outline what she will call a Budget of "fairness and opportunity" in a speech from Downing Street on Tuesday.

She is expected to promise to "make the choices necessary to deliver strong foundations for our economy" while focusing on three priorities: reducing national debt, easing cost-of-living pressures and protecting the NHS.

The Resolution Foundation, a think tank with influence around the Cabinet table, has warned that tax increases are "inevitable" on November 26.

TRENDING

Stories

Videos

Your Say

The group's former chief executive Torsten Bell now serves as a Treasury Minister after spending just over a year as an MP.

His ex-think tank has proposed a controversial plan for the Chancellor to introduce a 2p income tax rise while reducing employee national insurance contributions by the same amount.

According to the foundation’s modelling, this "switch" would raise £6billion in extra revenue while shielding most workers from the full impact of the tax rise.

The proposal would specifically target pensioners and landlords who do not pay national insurance.

James Smith, the foundation’s research director, said: "This approach would help deliver a decisive Budget centred around prices, payslips and poverty reduction."

Such a move would mark a clear shift from Labour's manifesto commitment not to raise income tax, VAT or national insurance for working people.

The Resolution Foundation has cautioned that tax rises are 'inevitable' in the forthcoming Budget

|GETTY

In its pre-Budget assessment, the foundation argued that Ms Reeves should attempt to double her fiscal headroom to £20billion, though it acknowledges that £15billion may be more realistic.

Building a larger buffer against economic shocks would, it says, reassure financial markets and potentially reduce borrowing costs.

However, achieving this target while introducing cost-of-living support would require tax rises worth £20-25billion, according to the think tank.

Its proposals include moving green levies from energy bills into general taxation, a shift it says could cut average electricity bills by £160.

Further revenue-raising measures could include freezing personal tax thresholds for two years, which the foundation estimates could generate £7.5billion.

The organisation also calls for "pro-growth" reforms to wealth, motoring and property taxes.

READ MORE ON RACHEL REEVES:

The Prime Minister prepared Labour MPs for difficult decisions on Monday evening

|GETTY

Mr Smith said: "Tax rises of £26billion are likely to be needed," adding that doing so in a targeted way could "boost confidence in the economy and the public finances, while also reducing child poverty and the cost of living."

The Prime Minister prepared Labour MPs for difficult decisions on Monday evening, telling them that "hard and serious" choices were needed to address Britain's economic position.

Sir Keir Starmer said the "long-term impact of Tory austerity, their botched Brexit deal and the pandemic on Britain's productivity is worse than even we feared."

Downing Street has declined to restate Labour's manifesto commitments in full, fuelling speculation about tax measures under consideration.

Asked on Monday whether the Budget would uphold Labour's pledge, the Prime Minister's spokesman said only that the Chancellor would "strike the right balance" between public service funding and growth.

Number 10 said decisions would be "tough but fair" and stated: "We will take the tough but fair choices on tax so everyone, including businesses and the wealthiest, contributes their share to fund our public services."

Economists at the Institute for Fiscal Studies estimate Ms Reeves requires £22billion to maintain the £10billion fiscal buffer she previously set against her debt targets.

They warn this figure could rise if productivity forecasts weaken further.

Some support could come from easing inflation and possible upgrades to growth forecasts, which may provide limited fiscal breathing space.

However, the Chancellor's position has been complicated by a parliamentary rebellion that forced the Government to reverse planned welfare changes worth up to £5billion.

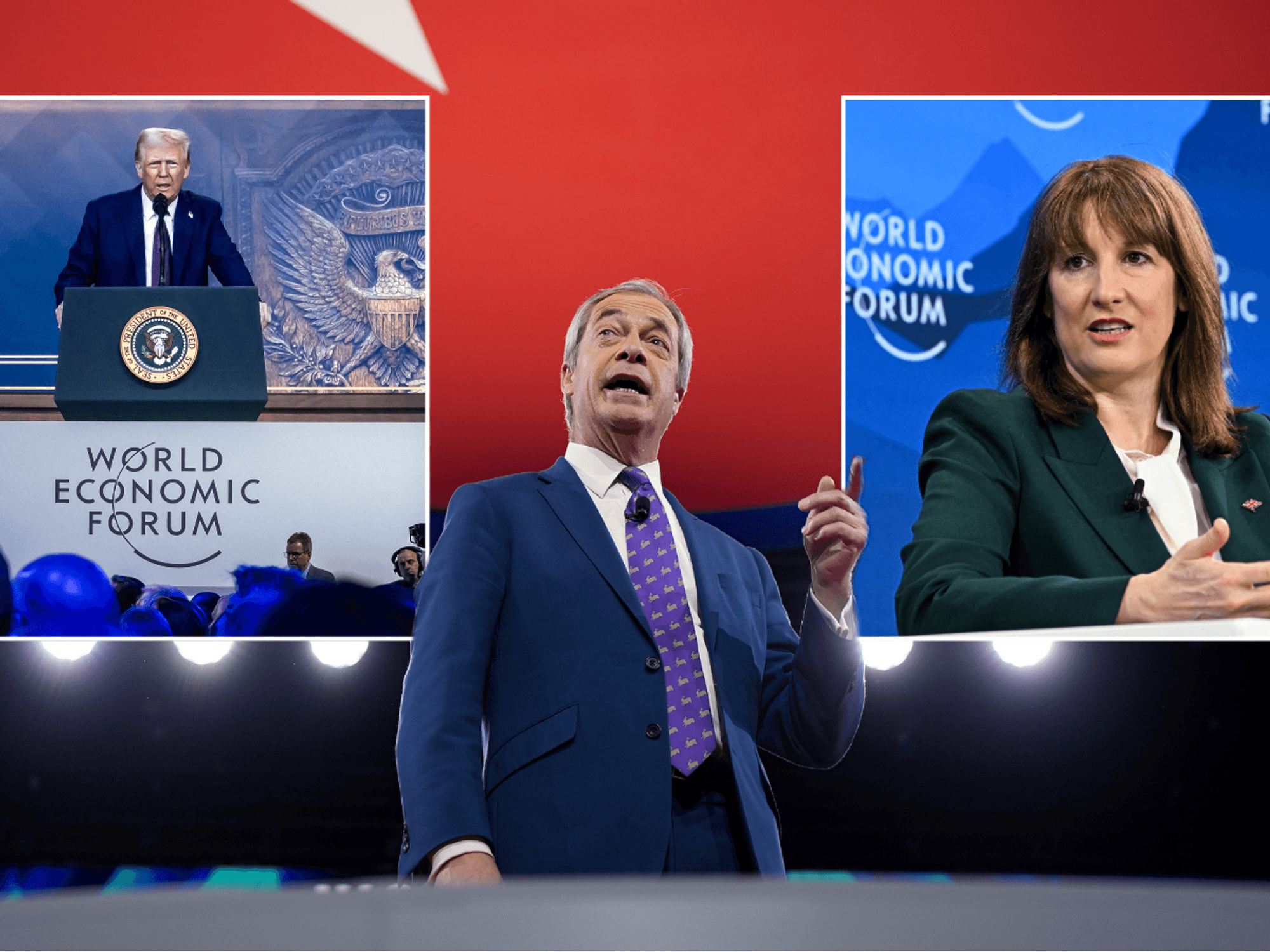

Conservative leader Kemi Badenoch is expected to escalate attacks in a speech on Tuesday

|PA

This combination of pressures has created what Sir Keir called a "difficult economic backdrop" ahead of the autumn statement.

Conservative figures have intensified their criticism of the Chancellor as expectations grow over a potential policy shift.

Shadow chancellor Mel Stride said Sir Keir should dismiss Ms Reeves if she raises taxes, noting she had previously said she would not return for "more taxes" after describing her first Budget as a "once in a Parliament" reset.

"If Rachel Reeves breaks her promises yet again, Keir Starmer must take responsibility and sack her. The country needs a Chancellor with a plan and a backbone," Mr Stride said.

Conservative leader Kemi Badenoch is expected to escalate attacks in a speech on Tuesday, claiming "Britain has stopped working" and accusing Labour of abandoning efforts to reduce the benefits bill.

She will call on the Chancellor to "withdraw the Employment Rights Bill altogether before it becomes Labour's Unemployment Act."

More From GB News