Economy warning as UK risks £600BILLION stock market exodus to Wall Street

Labour's history of economic woes and recessions |

GBNEWS

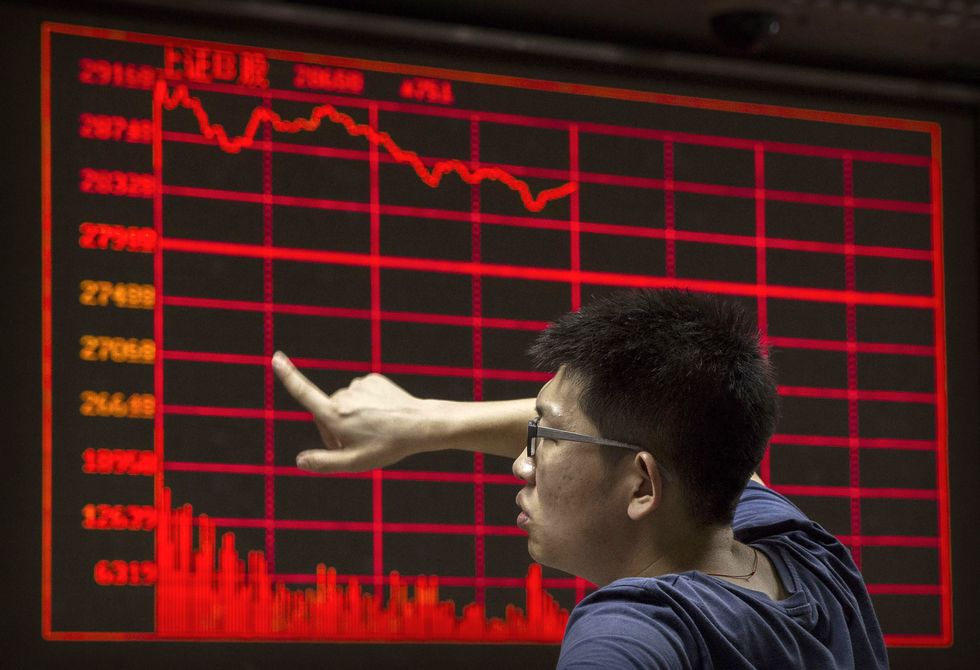

Such a shift would deal a heavy blow to London’s reputation as a world-leading financial hub

Don't Miss

Most Read

Some of Britain’s biggest companies worth a combined £600 billion could quit the London Stock Exchange and move to Wall Street, sparking fresh fears for the City’s future.

Concerns grew after pharmaceutical giant AstraZeneca revealed plans to take out a direct listing on the New York Stock Exchange.

As many as ten other major firms with large American operations and investor bases could follow suit, investment platform AJ Bell has warned.

Experts say such a shift would deal a heavy blow to London’s reputation as a world-leading financial hub and risk triggering a wider exodus of blue-chip companies.

The firms under scrutiny include energy giants Shell and BP, mining company Rio Tinto, and pharmaceutical manufacturer AstraZeneca, alongside catering group Compass, credit agency Experian, and distribution specialist Bunzl.

Medical device maker Smith & Nephew, pest control firm Rentokil, and precious metals miner Fresnillo complete the roster of companies that analysts believe could find New York's capital markets more appealing.

These ten corporations collectively represent £620billion in market value, according to AJ Bell's calculations.

The broker's assessment focused on firms with extensive American operations or significant US investor representation, factors that make a transatlantic move increasingly attractive.

Each company maintains substantial business interests in America, creating natural alignment with US markets and potentially stronger valuations on Wall Street compared to their current London listings.

Dan Coatsworth from AJ Bell cautioned that "an onslaught of UK-listed companies upping sticks for the US would be terrible for the reputation of the London market."

Economy warning as UK risks £600BILLION stock market exodus for Wall Street

| ReutersHe highlighted how momentum could build amongst firms, stating: "The more companies that move, the more the topic will be discussed in the boardroom by other companies that have a US presence."

Each company that leaves London risks setting off a domino effect, making others more likely to follow.

AJ Bell has cautioned that firms with strong ties to the US could soon justify moving their main stock market listings across the Atlantic.

LATEST DEVELOPMENTS:

Each company that leaves London risks setting off a domino effect, making others more likely to follow.

| GETTYIf this trend gathers pace, it could do serious damage to London’s role as a global financial hub, turning a handful of departures into a full-blown exodus.

Several high-profile names have already made the jump to New York, including CRH, Flutter, Indivior and Ferguson.

Equipment rental business Ashtead and financial technology firm Wise are currently transitioning their listings to the United States.

not all major corporations are following this trend, with mining giants Glencore and Anglo American explicitly rejecting any plans to relocate to New York

| PAHowever, not all major corporations are following this trend, with mining giants Glencore and Anglo American explicitly rejecting any plans to relocate to New York.

These two companies represent a combined market value of £73 billion, though analysts fear their position could shift if the exodus accelerates.

The pattern of departures has established a precedent that makes future moves more likely, as successful transitions by early movers demonstrate the viability of abandoning London for America's deeper capital markets.

More From GB News