Pension system overhaul 'game changer' for retirement savings, Rachel Reeves declares

GB NEWS

Labour's Pension Schemes Bill gives the green light to the previously proposed "megafund" initiative for

Don't Miss

Most Read

Latest

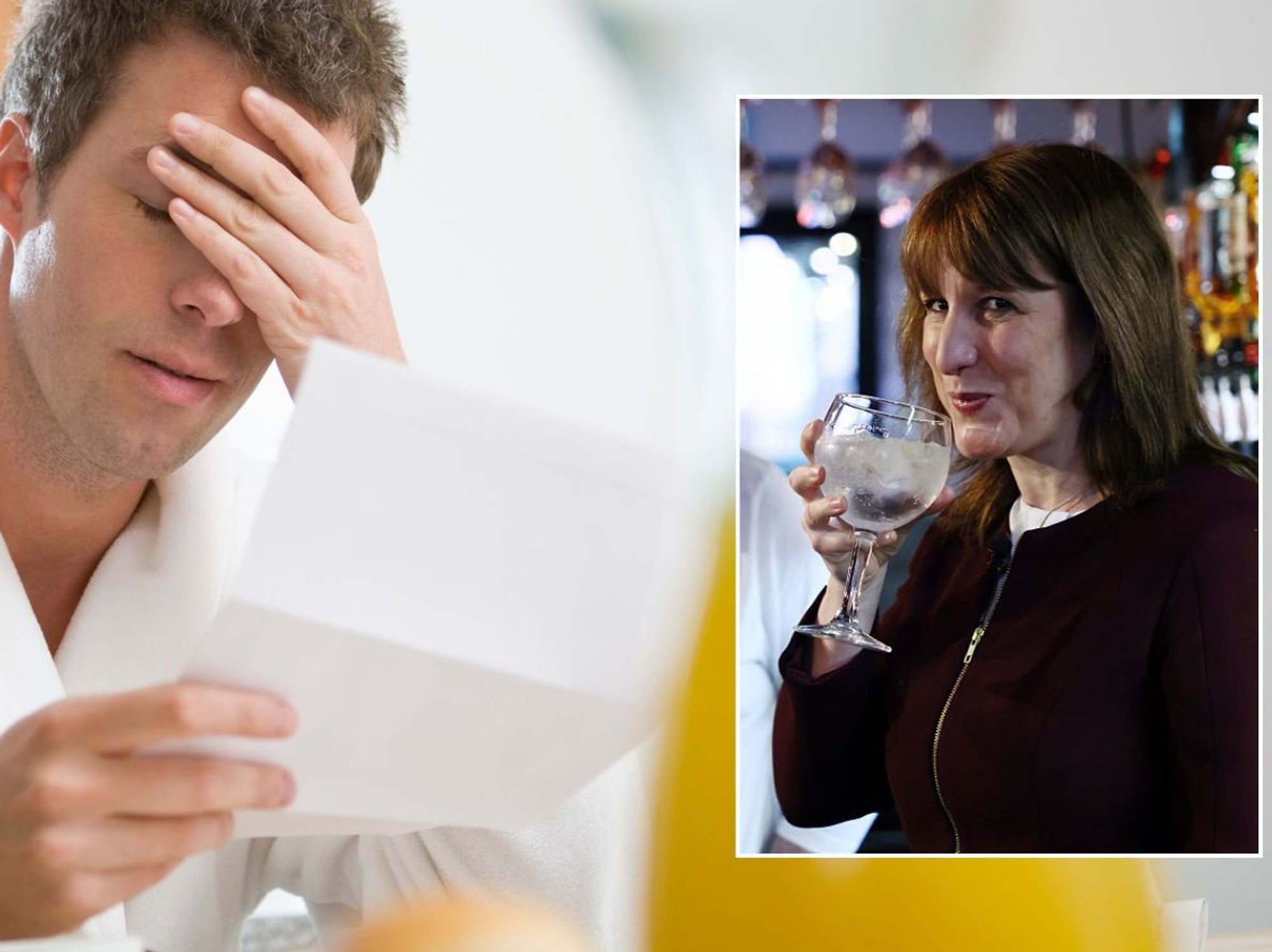

Chancellor Rachel Reeves is implementing "game changing" reform to pensions with new legislation that will create massive investment funds and the consolidation of scattered retirement savings.

The Pension Schemes Bill establishes new requirements for multi-employer defined contribution schemes to form "megafunds" worth at least £25billion. These substantial pools of capital will leverage economies of scale to access a broader range of investment opportunities.

The legislation also addresses the proliferation of small pension pots that many workers accumulate throughout their careers. Under the new rules, micro pension pots valued at £1,000 or less will be automatically consolidated into single schemes.

This sweeping reform represents the Government's strategy to channel pension savings into productive investments whilst simplifying the retirement savings system for millions of workers.

Work and Pensions Secretary Liz Kendall said: “The Bill is about securing better value for savers’ pensions and driving long-term investment in British businesses to boost economic growth in our country.”

Chancellor Rachel Reeves described the legislation as “a game changer”.

The Chancellor has hailed the "game changer" reform to the pension system

|GETTY

The Bill introduces several key provisions to modernise Britain's pension infrastructure. Workers approaching retirement will benefit from new requirements for schemes to provide clear default options for converting their savings into retirement income.

Defined benefit pension schemes will gain increased flexibility to release surplus funds, with the Government identifying a collective surplus worth £160billion.

These funds can be deployed to support employers' investment plans whilst benefiting scheme members.

The automatic consolidation of micro pots aims to solve a longstanding problem where workers lose track of small pensions accumulated across multiple employers. This measure will help ensure retirement savings remain accessible and manageable.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are worried about their pension savings | GETTY

Britons are worried about their pension savings | GETTY The megafund structure will enable pension schemes to diversify their portfolios and access investment opportunities previously available only to larger institutional investors.

Leading pension providers have welcomed the reforms as a positive step towards improving outcomes for savers.

Andy Briggs, CEO of Phoenix Group, said: "The Bill sets a clear direction for the future of pensions with the emphasis on building scale and ensuring savers receive value for money."

Ian Cornelius, CEO of Nest, said: "We believe that large, well-governed schemes can drive great outcomes for their members by using their scale and expertise to diversify where money is invested, and gain access to attractive investment opportunities not available to smaller investors at low cost."

The Pensions Regulator's chief executive Nausicaa Delfas endorsed the focus on value for money and preventing small pot formation, stating these measures would help create "a system fit for the future."

However, critics have raised concerns that the legislation overlooks a fundamental issue facing British pensioners.

LATEST DEVELOPMENTS:

Former pensions minster Steve Webb has called the Bill into question

| PASir Steve Webb, a former Liberal Democrat pensions minister who is now a partner at LCP, said: "Whilst there are many worthy measures in the Bill, the biggest omission is action to get more money flowing into pensions."

He continued: "This issue is unfortunately on the back burner. Measures such as consolidating tiny pension pots are helpful tidying up measures, but do nothing to tackle the fundamental problem that millions of us simply do not have enough money set aside for our retirement."

The Association of British Insurers echoed these concerns, with director of policy Yvonne Braun stating: "We also urgently need to tackle the level of pension contributions which are too low to create an adequate retirement income for many."