State pension alert: Nine million Britons to pay 'nonsensical' tax on retirement income in 2025

State pension age rise ‘almost inevitable’: Ann Widdecombe issues warning as Denmark raises the bar |

GB NEWS

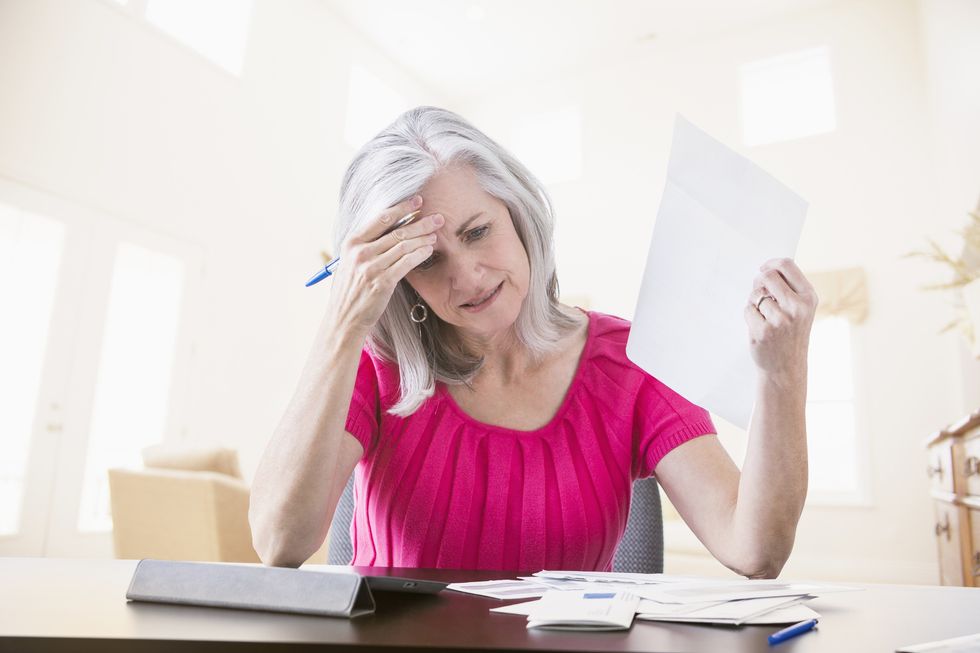

Analysts are sounding the alarm over the impact of fiscal drag on pension incomes

Don't Miss

Most Read

Latest

Nearly nine million Britons of state pension will pay income tax on their retirement income this year, according to the latest figures from the Government.

Data from the Department for Work and Pensions (DWP) reveals that 8.51 million pensioners paid income tax to HM Revenue and Customs (HMRC) in the 2024/25 financial year.

With 13 million people now at state pension age across the country, the proportion facing tax bills continues to grow due to the impact of fiscal drag and the triple lock.

Fiscal drag occurs when tax thresholds are frozen during a period of time when incomes or inflation are on the rise, resulting in taxpayers being pulled into higher brackets.

Older Britons are at risk of paying more to the tax man

| GETTYThe Personal Allowance remains frozen at £12,570 until the start of the 2027/28 tax year, meaning more pensioners will be pushed into paying tax on their retirement income as their state pension increases under the triple lock.

Under this payment rate increase metric, state pensions rise annually by the either average wage growth, inflation or 2.5 per cent; whichever is highest.

With the Government pledging to honour the triple lock during this parliamentary term, everyone receiving the full New State Pension could be pushed over the Personal Allowance tax threshold within two years.

Steve Webb, a partner at pensions firm LCP, warned that the state pension will surpass the this particular allowance from as soon as April 2027.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Older Britons are worried about the future of the state pension triple lock | PA

Older Britons are worried about the future of the state pension triple lock | PAAs it stands, the full new state pension currently is offering claimants £11,973 annually, just £597 below the Personal Allowance tax threshold.

However, Labour Government forecasts predict 2.5 per cent increases over the next four financial years, pushing the full New State Pension to £12,578.80 by the 2027/28 financial year. This would exceed the Personal Allowance by just £8.80 annually.

Webb added: "This could mean hundreds of thousands of pensioners are taxed on just £8 per year, with a tax bill of £1.60."

The state pension rose by 4.1 per cent in April, however future projections suggest more modest increases ahead.

The pensions expert warned of a "nonsensical situation" developing, which could have a detrimental impact on retirement incomes.

LATEST DEVELOPMENTS:

Fiscal drag is dragging Britons into higher tax brackets | GETTY

Fiscal drag is dragging Britons into higher tax brackets | GETTY He stated: "A combination of an increasing state pension and frozen tax thresholds means we will soon be in the nonsensical situation where the new state pension will be just a few pounds above the income tax threshold."

He added: "Long gone are the days when retirement meant no longer having to deal with the tax office."

Labour has pledged to maintain frozen tax thresholds until 2028, while the triple lock formula provides a minimum 2.5 per cent increase floor.

If this promise is kept, state pension payment rates will rise to at least £236 in April 2026 and £241.90 in April 2027.

More From GB News