Pension reform in Budget could 'lead to a reduction in take home pay for millions', Rachel Reeves warned

GB NEWS

The Society of Pension Professionals is urging the Chancellor and MPs to exercise caution over potential changes to salary sacrifice rules

Don't Miss

Most Read

Pension system reform in the upcoming Budget, related to salary sacrifice, could "lead to a reduction in take home pay for millions", Chancellor Rachel Reeves warned.

Every MP in Parliament has been contacted by pension industry professionals to highlight risks associated with altering current salary sacrifice schemes for retirement contributions.

The Society of Pension Professionals distributed a briefing document entitled "A sacrifice too far?" which outlines concerns about possible government reforms to these arrangements.

This intervention from the organisation's comes as speculation mounts that ministers might target salary sacrifice mechanisms to generate savings in the forthcoming Budget on November 26.

Pension reform could 'lead to a reduction in take home pay for millions', Rachel Reeves warned

| GETTYTheir analysis indicates that Government research conducted by HM Revenue and Customs (HMRC) has fuelled expectations of potential changes to these established pension contribution methods.

These pension contribution schemes affect substantial portions of the workforce across both private and public sectors.

Approximately 33 per cent of employees in private companies currently benefit from salary sacrifice provisions, while nearly one in ten public sector workers also participate in such schemes.

The widespread adoption means that any Government modifications would create financial consequences for millions of British workers, according to industry experts.

Chancellor Rachel Reeves will unveil the Autumn Budget on November 26 | PA

Chancellor Rachel Reeves will unveil the Autumn Budget on November 26 | PAEmployees using these arrangements could face annual costs running into hundreds of pounds if the schemes were abolished or significantly restricted.

The Society of Pension Professionals emphasises that alterations to the current system would generate considerable disruption for a vast number of workers who rely on these mechanisms for their retirement planning.

Treasury figures indicate the salary sacrifice system represents a £4billion annual investment, comprising £1.2billion in employee benefits and £2.9billion for employers.

Despite this expense, the arrangement enjoys broad support as an effective mechanism for encouraging retirement savings.

Research undertaken by HMRC revealed strong employer backing for the current framework.

Companies expressed concerns that modifications would create administrative complexity, diminish worker benefits and reduce incentives for pension participation.

The study examined three possible reform scenarios, with employers warning that each option would significantly damage staff morale.

Business leaders stressed that any restrictions would undermine the positive role these schemes play in promoting workplace pension engagement.

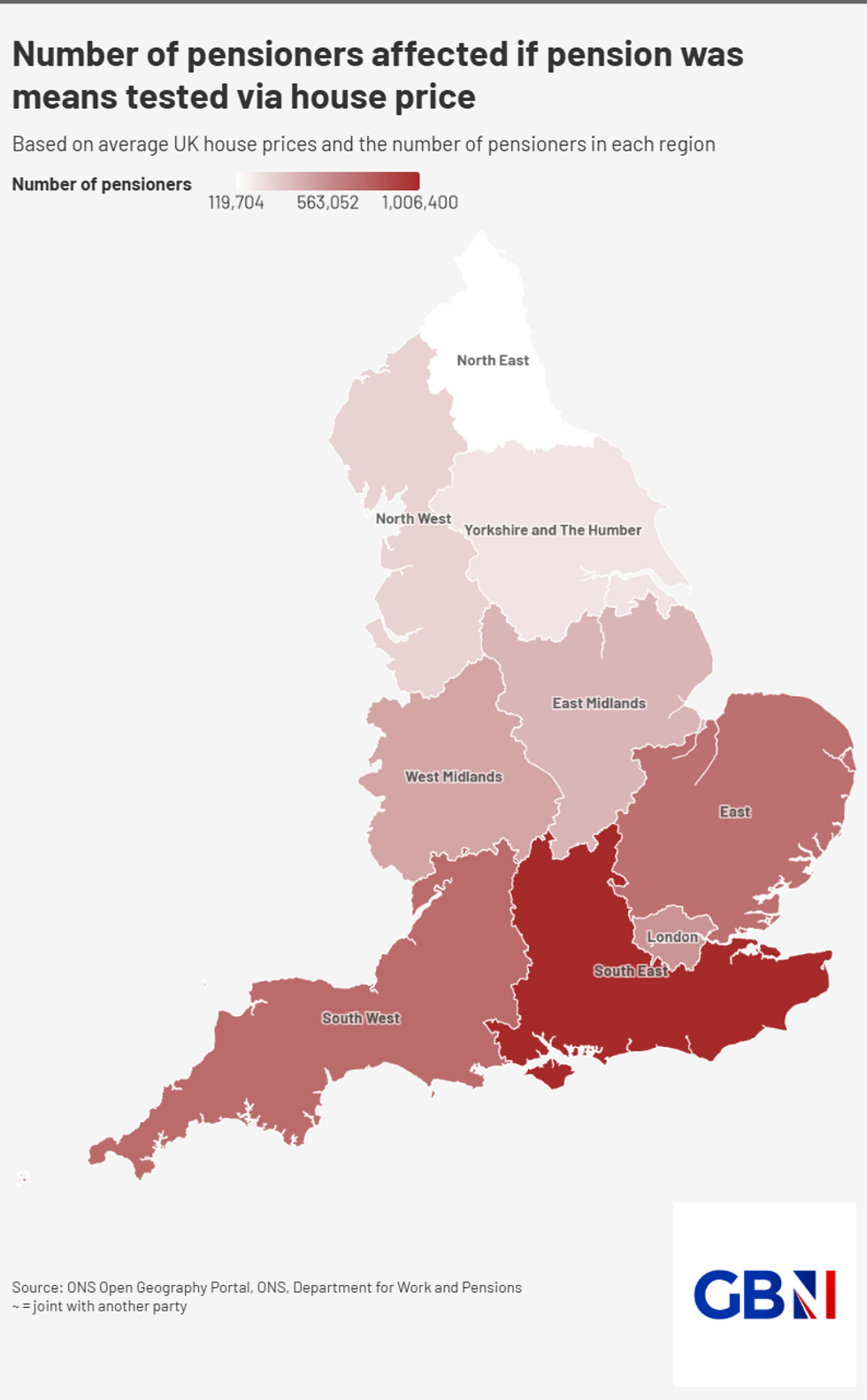

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNSteve Hitchiner, who chairs the Society of Pension Professionals' Tax Group, warned that "changing salary sacrifice arrangements would lead to a reduction in take home pay for millions of employees who are saving into a workplace pension, with the greatest impact for those earning less than £50,284 a year."

He added that reforms would "also represent another sizeable cost to employers, despite the Chancellor's public commitment against this, and would undermine the critical role that employers play in supporting and promoting good quality pension saving vehicles".

The Chancellor is widely expected to break Labour's manifesto promise and raise income tax during her fiscals statement later this month.

Pensioners are expected to be targeted in this HMRC raid as it is rumoured the Treasury is considering raising the levy while cutting National Insurance for working-age people; resulting in asset rich demographics paying more.