Reform UK slammed over pension system proposal as 'retired workers could be worse off'

WATCH: Richard Tice addresses a Reform UK press conference on pensions |

GB NEWS

The deputy leader accused Local Government Pension Scheme (LGPS) managers of 'rip-offs, decadence and complacency' and demanded sweeping changes to how the funds are run during a scathing news conference yesterday.

Don't Miss

Most Read

Reform UK is under fire from unions and the wider pension industry over a new proosal to overhaul the Local Government Pension Scheme (LGPS), which some claim could leave "retired workers worse off".

Yesterday, the party's deputy leader Richard Tice claimed Britain’s largest public sector pension scheme is being “badly mismanaged” and insisted Reform officials would deliver far better value for money.

However, his claims have sparked a strong reaction from within the pensions industry, with officials defending the LGPS as one of the most successful pension schemes in the world and warning against politically driven interference.

Speaking at a press conference, the Reform UK deputy leader said local councils were overpaying hundreds of millions of pounds in fees and accused the scheme of underperforming by almost £1billion over the past year.

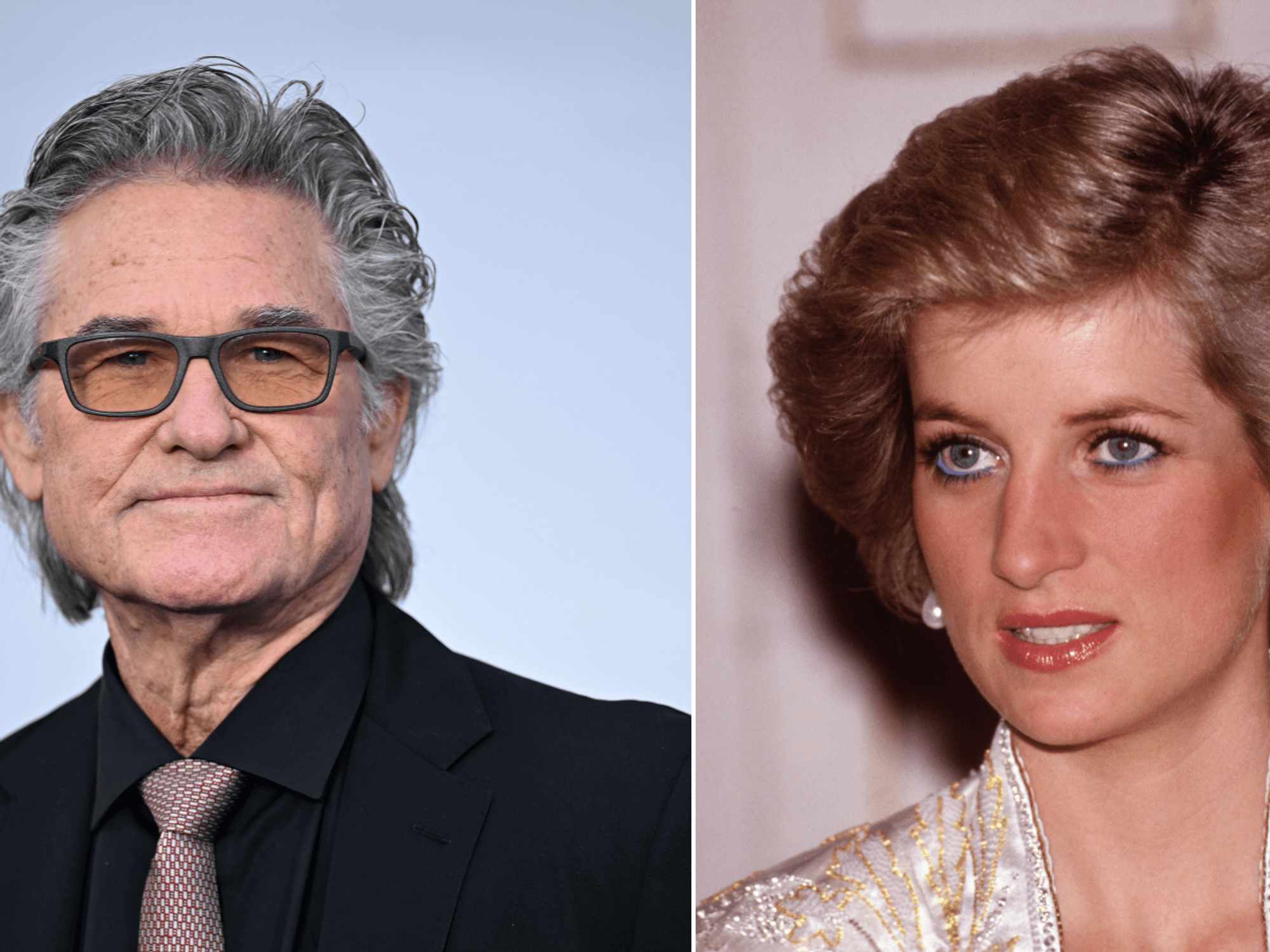

The deputy leader slammed pension scheme waste

|GETTY

He estimated the combination of excess fees and weak investment performance could amount to as much as £11billion annually.

"This is simply financially incompetent at best, gross negligence at worst,” Mr Tice said. “Because people don’t understand it, no one has dug into it.”

He also attacked the scale of illiquid investments in the LGPS, calling for councils to cap exposure at ten per cent, and pledged that Reform UK would launch its own branded pool manager.

However, industry bodies have rejected Reform’s analysis. Pensions UK policy director Zoe Alexander pointed to strong recent results, with the LGPS delivering an aggregate return of 8.9 per cent in 2024 and average funding levels of 108 per cent.

She said the next valuation is expected to show even further improvement, with savings already helping to reduce employer contributions.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

“The policy of consolidation, pursued by both the last and current Government, has led to considerable savings, estimated at over £1billion,” Alexander added. “These savings are expected to accelerate as pooling reforms proceed rapidly.”

She stressed the LGPS is a leading responsible investor with the highest proportion of domestic assets in the UK pensions sector.

“Any policy proposing changes to one of the largest pension funds in the world should be supported by evidence and detailed plans. The duty of LGPS is to look after members’ interests,” she said.

Unions have also raised concerns. Unison general secretary Christina McAnea warned that “forcing council staff onto inferior pensions would leave retired workers worse off and add to the already severe recruitment crisis in local Government”.

“Employees’ pensions aren’t the reason so many councils are on a financial precipice. That’s down to years of budget cuts from Conservative Governments,” she said. “The sums involved appear to have been plucked out of the air by Reform UK.”

Tice has fumed over Britain's state pension scheme

|GETTY

The pensions offensive is just one strand of Reform’s cost-cutting agenda. Mr Tice and his colleagues say they will drive £50billion in annual savings by forcing government departments to trim five per cent of their budgets.

They insist the squeeze would not hit frontline services but would instead cut waste and secure better deals in procurement. Reform also plans to halve the foreign aid budget - slashing it from £12.8billion to around £6billion - and to end what it calls a hidden “subsidy” to commercial banks.

At present, the Bank of England pays interest on quantitative easing reserves. Reform argues that scrapping those payouts would save the taxpayer £35billion a year.

The proposal has drawn backing from senior economists, the New Economics Foundation, and two former Deputy Governors of the Bank of England.

Beyond pensions and public spending, Reform has promised a Royal Commission into Britain’s struggling social care system. The party wants a single, unified funding stream to replace today’s patchwork split between the NHS and local councils.

Tax breaks and VAT relief would be offered to providers, while what it brands “excessive waste” would be stripped out.

Reform has also vowed to clamp down on care home giants that use offshore structures and shareholder loans to minimise UK tax liabilities, insisting they must pay a fair share while still providing quality care.

Mr Tice’s attack on the LGPS underscores Reform UK’s determination to present itself as the only party willing to take on entrenched public sector inefficiency.

With billions of pounds at stake in pensions, aid, banking policy, and social care, the party is betting that taxpayers are ready for what it calls “common-sense savings” and for a shake-up of Britain’s vast public sector machine.

LATEST DEVELOPMENTS:

Zia Yusuf has called out waste expenditure by Kent County Council

| GETTYThis comes after Reform UK’s head of DOGE Zia Yusuf has also hit out at the over-spending he’s seen in local councils.

"Trip to safari parks, trips to the circus, trips to the cinema, Domino's Pizza, McDonald's, TV licences.

He says that the British public “are sick and tired of being treated like second-class citizens in their own country."

GB News has contacted Reform UK for comment.

More From GB News