Pension savers urged to avoid major pitfalls as retirement plans could 'backfire' - what you need to know

Nigel Farage explodes at 'direct attack on thrift' as Rachel Reeves mulls tax on pensioners |

GB News

Experts warn against tax-free cash errors and contribution limits

Don't Miss

Most Read

Pension savers withdrew funds at unprecedented levels during the 2024/25 financial year, with total withdrawals jumping 36 per cent compared to the previous period.

The rush to access retirement savings has exposed many to significant financial risks.

Financial planning experts have identified three critical mistakes that could prove costly for those accessing pensions without professional guidance.

These include withdrawing tax-free cash without adequate planning, breaching pension recycling rules, and triggering restrictions that cap future pension contributions at £10,000 per year.

TRENDING

Stories

Videos

Your Say

Philip Lewis, Head of Financial Planning Advice at Evelyn Partners, says: "Gradual annual increases in the overall amounts taken from pensions are to be expected as the population ages and more defined contribution pension holders reach retirement, but other factors are definitely at play with the recent growth in withdrawals."

1. Withdrawing the 25 per cent tax-free pension commencement lump sum without careful planning

Mr Lewis warns that moving funds from a tax-sheltered pension into taxable accounts can create unexpected liabilities.

"Taking tax-free cash too early or without careful consideration might end up coming back to bite you tax-wise and could also undermine retirement plans," he explains.

Financial planning experts have identified three critical mistakes that could prove costly for those accessing pensions without professional guidance

| GETTY"Simply taking a large amount of money out of a tax-protected environment and moving it into a taxable one can backfire even if the pension withdrawal itself is tax-free."

Revenue authorities have tightened regulations, making these withdrawals irreversible. Previously, some providers permitted savers to cancel their tax-free cash requests, but new guidance prevents this option.

2. Pension recycling rules prevent savers from claiming tax relief twice on the same funds

Those who withdraw their tax-free cash and then reinvest it into a pension could face scrutiny from HMRC.

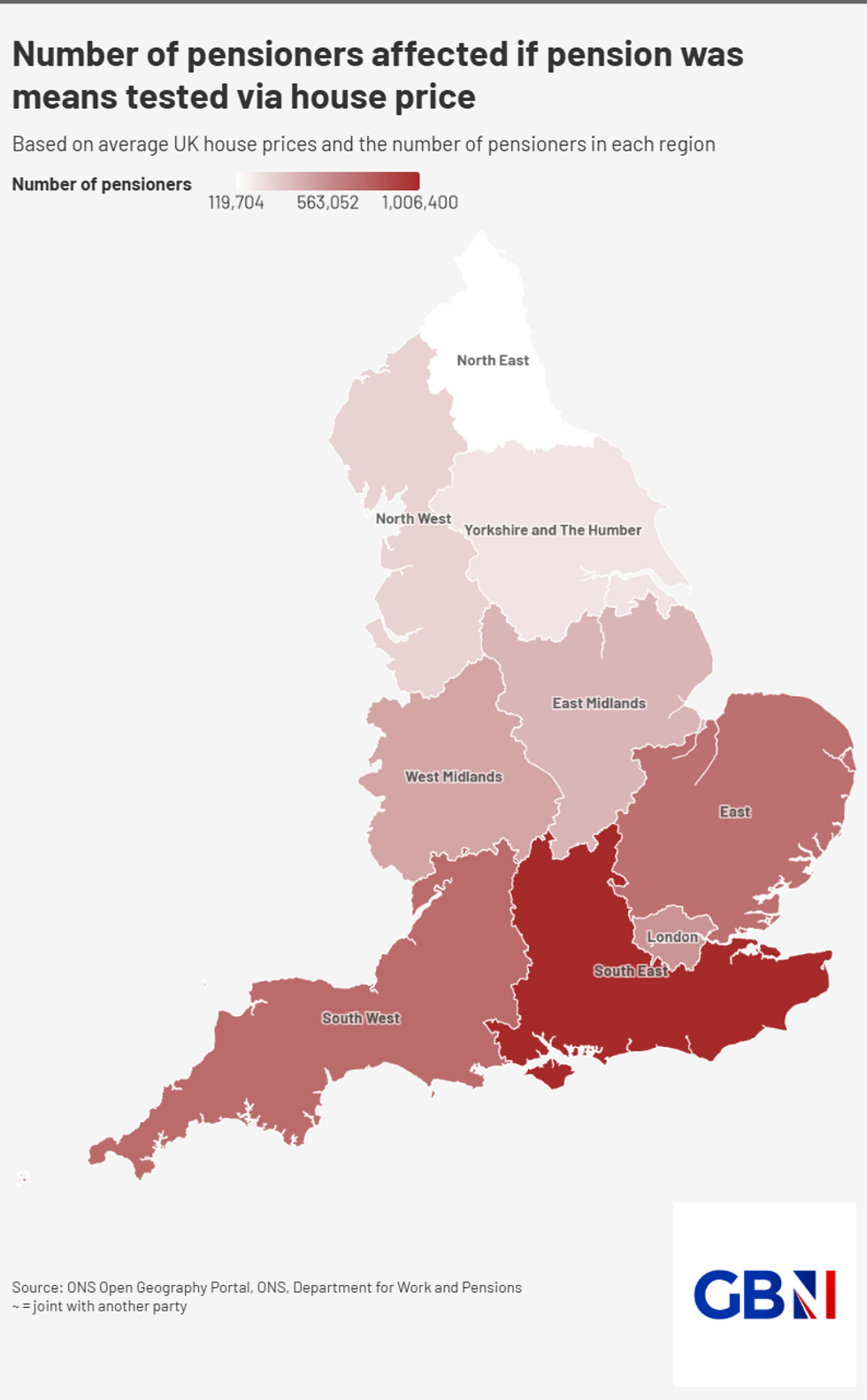

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBN"The good news is that just taking the PCLS does not reduce the amount a saver can pay into their pension each year with tax relief, as the 'money purchase annual allowance' (MPAA) is not triggered," Mr Lewis notes.

However, he cautions that "HMRC will be watching out for large or increased pension contributions by those who have just taken their TFC."

Savers can still contribute up to £60,000 annually after withdrawing their tax-free portion, provided they meet earnings requirements and avoid triggering recycling rules.

3. The money purchase annual allowance severely limits future pension-building capacity

Accessing pension funds flexibly can activate this £10,000 yearly contribution limit, well below the standard £60,000 allowance.

"How you access your pension is crucial," Mr Lewis emphasises.

"If you access your pension flexibly or take taxable amounts then you risk triggering the MPAA which will limit future contributions to £10,000 a year and could hamper your ability to rebuild your pension pot."

The MPAA is triggered by flexi-access drawdown arrangements, uncrystallised funds pension lump sums, flexible annuities, or full encashments.

LATEST DEVELOPMENTS:

Despite these complex rules, only around 31 per cent of first-time pension-accessing individuals obtain professional advice

| GETTYLeaving funds invested after taking tax-free cash or buying a lifetime annuity avoids the restriction.

Despite these complex rules, only around 31 per cent of first-time pension-accessing individuals obtain professional advice.

Recent data shows that over half of first-time withdrawals in 2024/25 triggered the MPAA, highlighting widespread unawareness of long-term consequences.

Rising living costs, inheritance tax changes from April 2027, and lingering concerns over potential tax-free cash reforms continue to drive hasty pension access decisions.

Without proper guidance, these withdrawals could compromise retirement security for thousands of savers.

More From GB News