Budget 2025: Pensioners set to be HAMMERED by income tax rise - with Rachel Reeves pushing rates to 65%

It is utterly unthinkable that Labour would put the final nail in the coffin with income tax,' says Alex Armstrong |

GB News

The Chancellor is said to be considering 2p hike for higher earners as the Treasury seeks to plug a £30billion shortfall

Don't Miss

Most Read

Latest

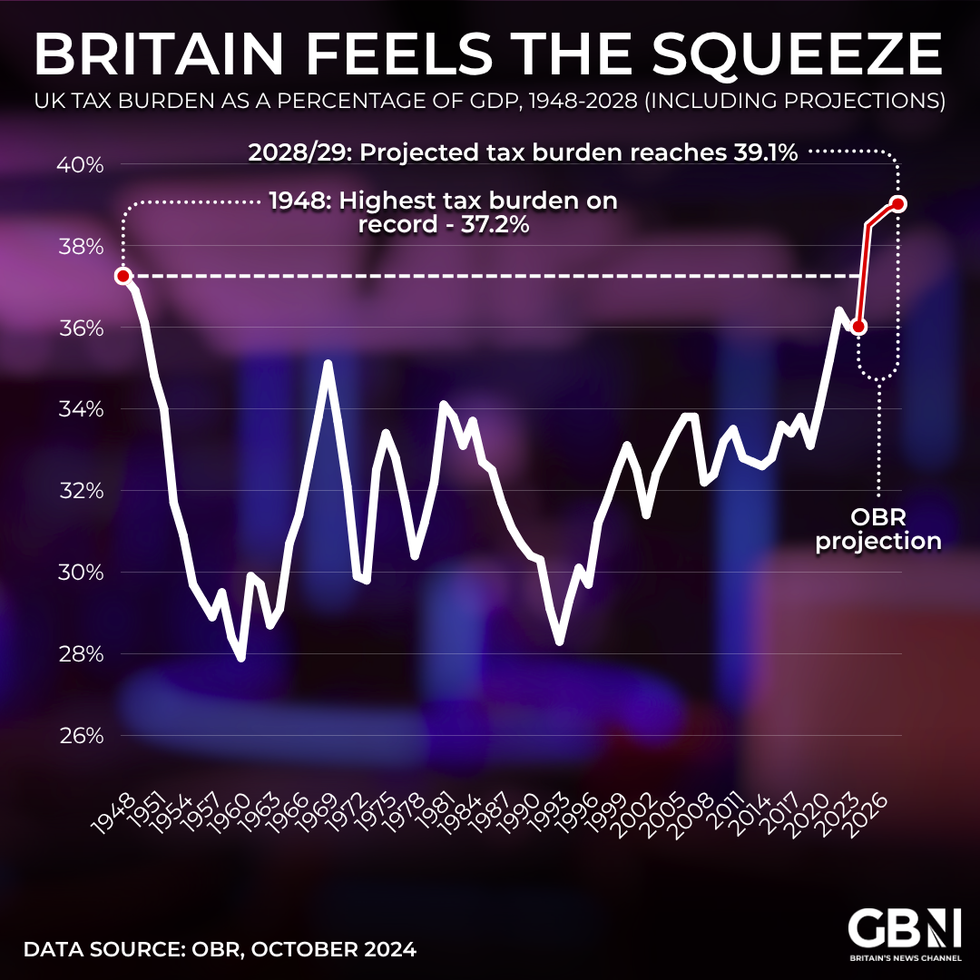

Rachel Reeves is said to be considering a 2p rise in income tax rates — a move that could push the effective tax burden for some higher earners to 65 per cent and break Labour’s election pledge not to raise taxes on working people.

Under the reported plans, workers earning between £100,000 and £125,140 would face an effective 63 per cent income tax rate, alongside two per cent National Insurance contributions.

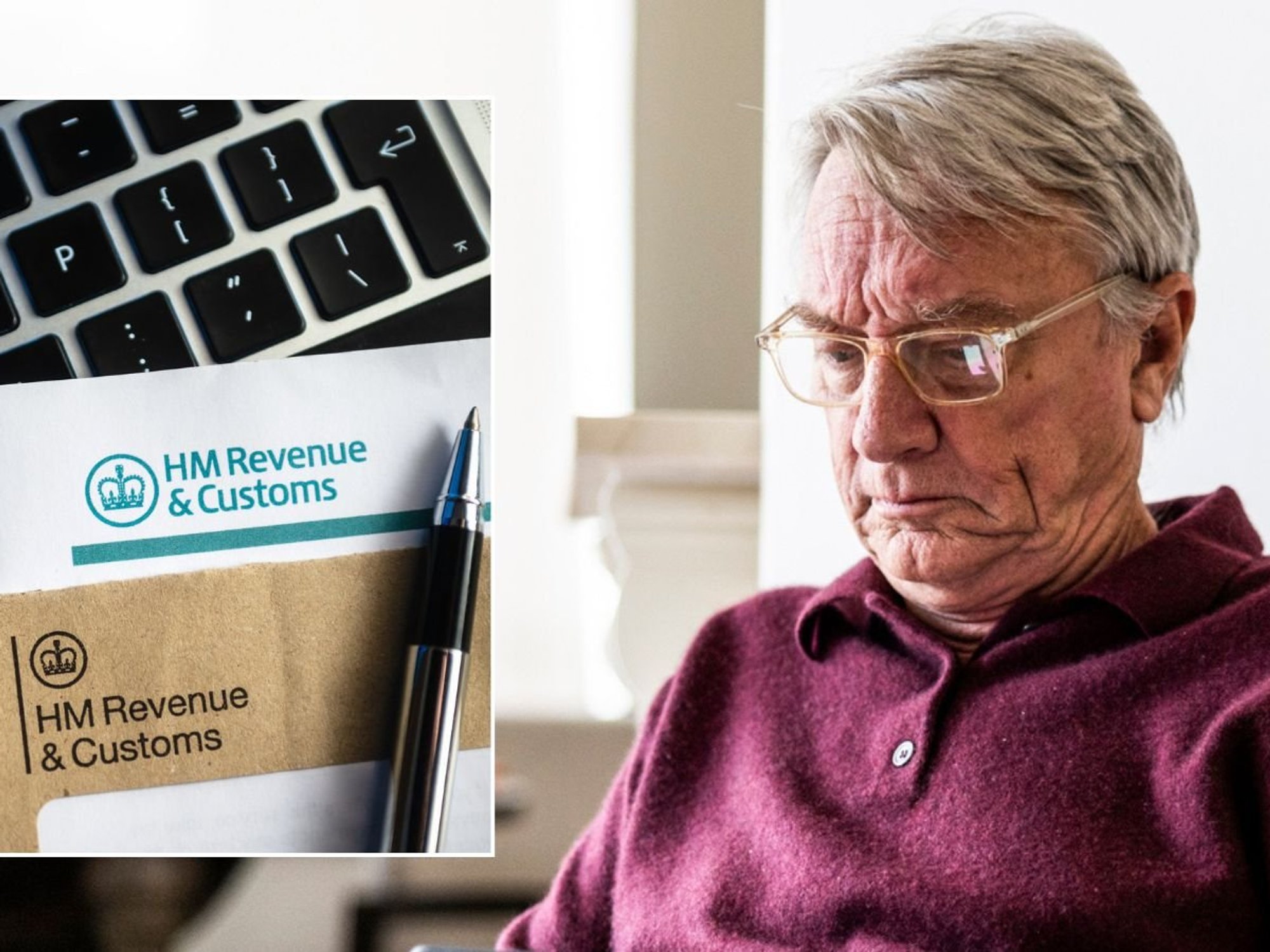

Pensioners would face a huge hit if rumours of a 2p income tax rate rise become reality, especially if it is offset by a National Insurance cut.

This is because pensioners do not pay National Insurance after state pension age – but they do pay income tax.

Someone with a retirement income of £35,000 a year would pay £400 a year more tax.

The proposal would mark a major departure from Labour’s manifesto, which promised: "Labour will not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher, or additional rates of income tax, or VAT."

At the same time, the Chancellor is weighing up a 2p National Insurance cut, though this may apply only to those earning below £50,270.

TRENDING

Stories

Videos

Your Say

Official data shows nearly 700,000 Britons fall within the affected income bracket — double the number from six years ago.

These workers already face what analysts describe as a “tax trap”, created by the 40 per cent higher rate combined with the gradual withdrawal of personal allowances.

For every £2 earned above £100,000, individuals lose £1 of their £12,570 tax-free allowance.

By £125,140, that allowance disappears entirely.

This mechanism results in a 60 per cent effective tax rate for income within that band, which would rise to 63 per cent under the proposed changes, before National Insurance is added.

Chancellor Rachel Reeves may raise income tax by two pence, pushing some earners to a 65 per cent tax burden and breaching Labour’s pledge not to tax working people

|GETTY

If Ms Reeves increases the basic income tax rate from its current 10 per cent, she would be the first Chancellor to do so since Denis Healey in 1975.

The move is intended to address a projected fiscal gap of up to £30billion, linked to weak productivity and delays to welfare reforms.

Analysis by wealth management firm Quilter found that a higher-rate taxpayer on £100,000 receiving a £10,000 pay rise would pay £6,500 in tax and National Insurance under the proposed system — compared with £6,200 currently.

That represents an extra £300 loss for workers already paying some of the highest rates in Europe.

LATEST DEVELOPMENTS

Tax Burden as a percentage of GDP

|GETTY

Separate calculations published by The Telegraph show that someone earning £125,140 would lose £1,749 a year under the potential increase.

Retirees earning more than £125,140 would face additional tax bills of at least £2,500.

The Chancellor is also expected to extend the freeze on income tax thresholds until between 2029 and 2030.

The measure, known as a stealth tax, allows inflation to push workers into higher bands without a formal rate rise, increasing the burden on middle and higher earners.

Shaun Moore, tax and financial planning expert at Quilter, warned the changes would make “a perverse part of our tax system even worse.”

He said the £100,000 threshold, which has remained unchanged for more than a decade, needs urgent reform.

"The tax burden on this already penalised cohort of workers becomes even greater at a time when tax thresholds are frozen and more is being asked of them," he said.

Mr Moore added that many on £100,000 “will not necessarily feel rich, but such a move will see the Government consider them to be.”

Pensioners look set to be hit hardest by the Budget

| GETTYHe also noted that the financial strain is compounded by reductions in childcare benefits that begin at this income level, adding further pressure on middle-income professionals.

The Treasury declined to comment when contacted by GB News.

More From GB News