Rachel Reeves set to slap drivers with 'double tax' in Budget ahead of major pay-per-mile decision

Drivers could be charged 3p per mile on top of paying Vehicle Excise Duty

Don't Miss

Most Read

Latest

Motorists could be slapped with additional charges even when driving abroad under new plans to introduce pay-per-mile car taxes in the Budget later this month.

Chancellor Rachel Reeves is expected to launch new pay-per-mile car taxes in the Autumn Budget to raise money for the Government as it scrambles to fill a £50billion financial black hole.

Labour could oversee the rollout of road pricing measures from 2028 following a planned consultation, with electric vehicle owners facing a cost of 3p per mile.

Experts have consistently called on the Government to introduce new car tax measures to account for the plummeting revenue from fuel duty as more people switch to EVs.

TRENDING

Stories

Videos

Your Say

Fuel duty raises around £25billion a year as petrol and diesel drivers head to filling stations less often, given the popularity of new electric cars.

In addition to paying Vehicle Excise Duty (VED), electric car owners would face an additional tariff when travelling longer distances, The Telegraph reported.

Motorists heading to Europe on holiday could find themselves slapped with huge costs, especially when travelling through France.

Drivers would be charged the 3p per mile charge, which would cost £45.90 when travelling from Calais to Nice and back.

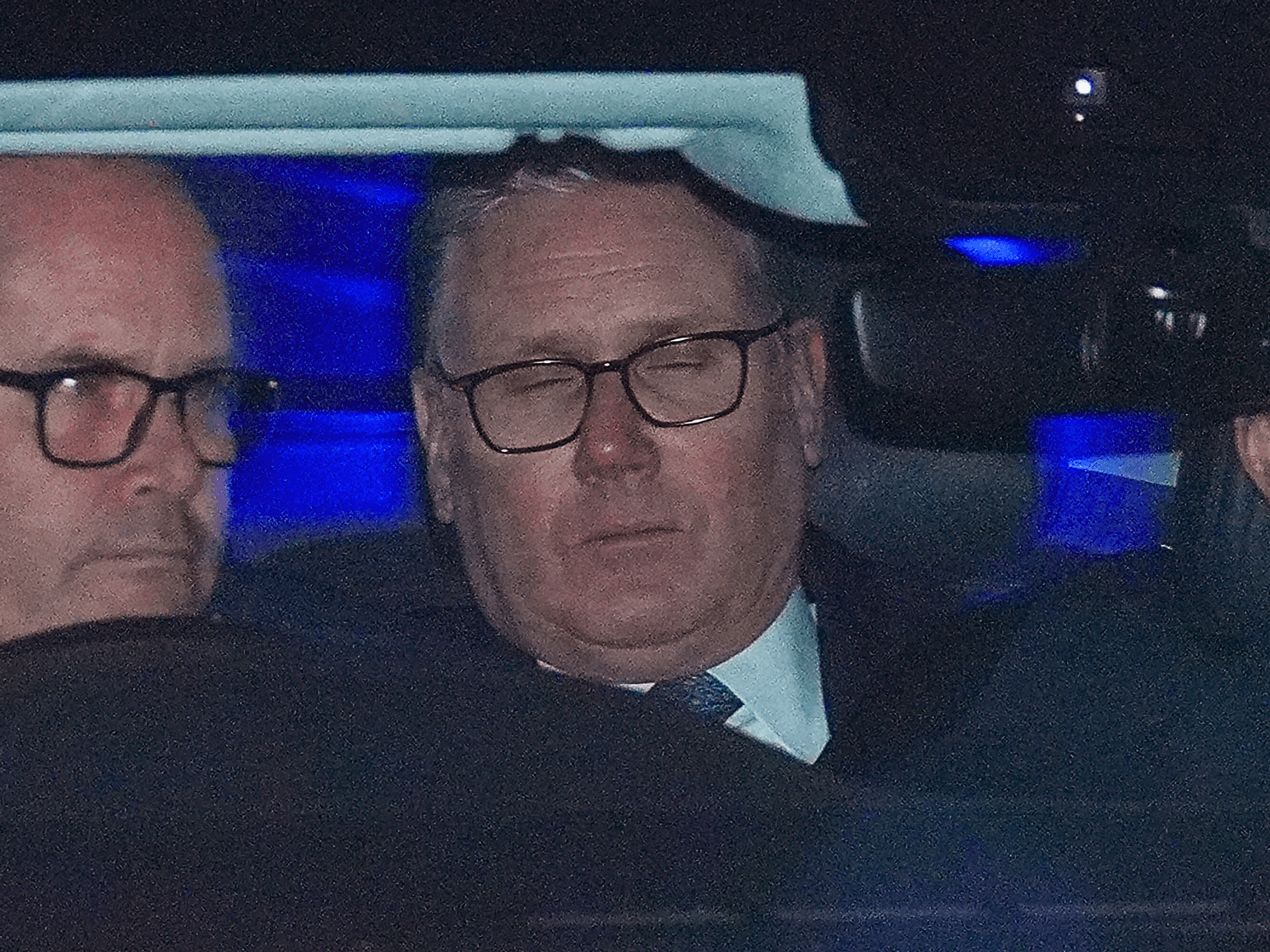

Chancellor Rachel Reeves is expected to introduce pay-per-mile car taxes later this month

|GETTY/PA

They would also be exposed to unpopular "peage" tolls found on motorways and major routes across the country.

Commenting on the potential road pricing plans, Edmund King, president of the AA, noted that drivers would be "paying tax twice" to the French and UK Governments.

He highlighted that this would only impact electric vehicle owners, with the expert not seeing "any practical way around it".

Mr King continued, saying: "It would be pretty bureaucratic to have to check your mileage at Dover and have it stamped on some kind of certificate to say you're leaving the country for two weeks.

LATEST DEVELOPMENTS

- Major brands recall 1.75 million cars as drivers urged to 'park away from structures' over serious fire risks

- Revolutionary electric car charging breakthrough could see EVs power homes for two days - 'Remarkable!'

- Rachel Reeves set to hammer millions of drivers with pay-per-mile car taxes in Budget despite backlash - 'Farcical!'

"There are already concerns about the extra checks at the borders, so I think it would be a nightmare."

The proposal to introduce pay-per-mile car taxes has been slammed by industry experts, who warn that it could impact the uptake of new electric vehicles, since drivers want to avoid paying more tax.

Shadow Transport Secretary Richard Holden told GB News that Labour was irresponsible to be hitting drivers with additional charges, breaking a key manifesto pledge.

Similarly, the Leader of the Conservatives in the London Assembly, Susan Hall, warned that the Government could eventually expand the scheme to impact all drivers.

Chancellor Rachel Reeves will unveil the Autumn Budget on November 26 | PA

Chancellor Rachel Reeves will unveil the Autumn Budget on November 26 | PASpeaking to GB News, a Treasury spokesperson said that the Chancellor considers any potential tax changes to fiscal events, with the next event, the Autumn Budget, taking place on November 26.

A Government spokesperson added: "Fuel duty covers petrol and diesel, but there's no equivalent for electric vehicles.

"We want a fairer system for all drivers whilst backing the transition to electric vehicles, which is why we have invested £4billion in support, including grants to cut upfront costs by up to £3,750 per eligible vehicle.

"Just as it is right to seek a tax system that fairly funds roads, infrastructure and public services, we will look at further support measures to make owning electric vehicles more convenient and more affordable."