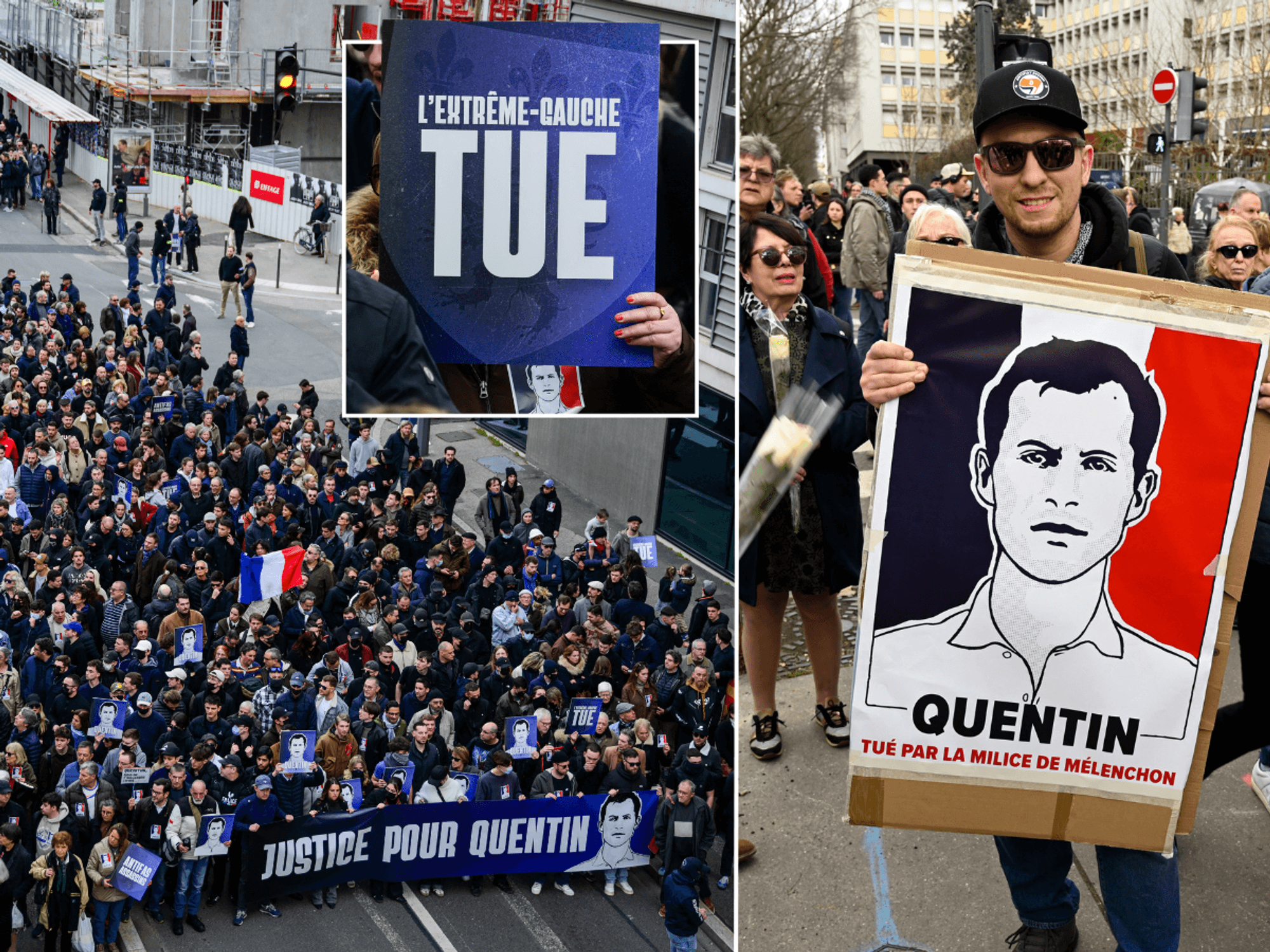

What happens to your pension when you die? Pension warning as your pot could sit 'unclaimed' after death

Pension savers are being urged to nominate who they want their pension pot to go to

|GETTY

People spend much of their working life contributing to their pension for retirement, but not many will think about what happens to a pension after death

Don't Miss

Most Read

Saving into a pension brings a number of tax advantages, but failing to name the beneficiary of this pot could mean it goes sitting "unclaimed" after death.

GB News spoke to pension experts on what happens to a pension after death and how to ensure the pot goes to loved ones.

Becky O’Connor, Director of Public Affairs at PensionBee, told GB News: “Pensions usually sit outside of your estate meaning that in most cases they won’t count towards your inheritance tax threshold when you pass away.

“For this reason, pensions can be a great way of leaving money to loved ones.”

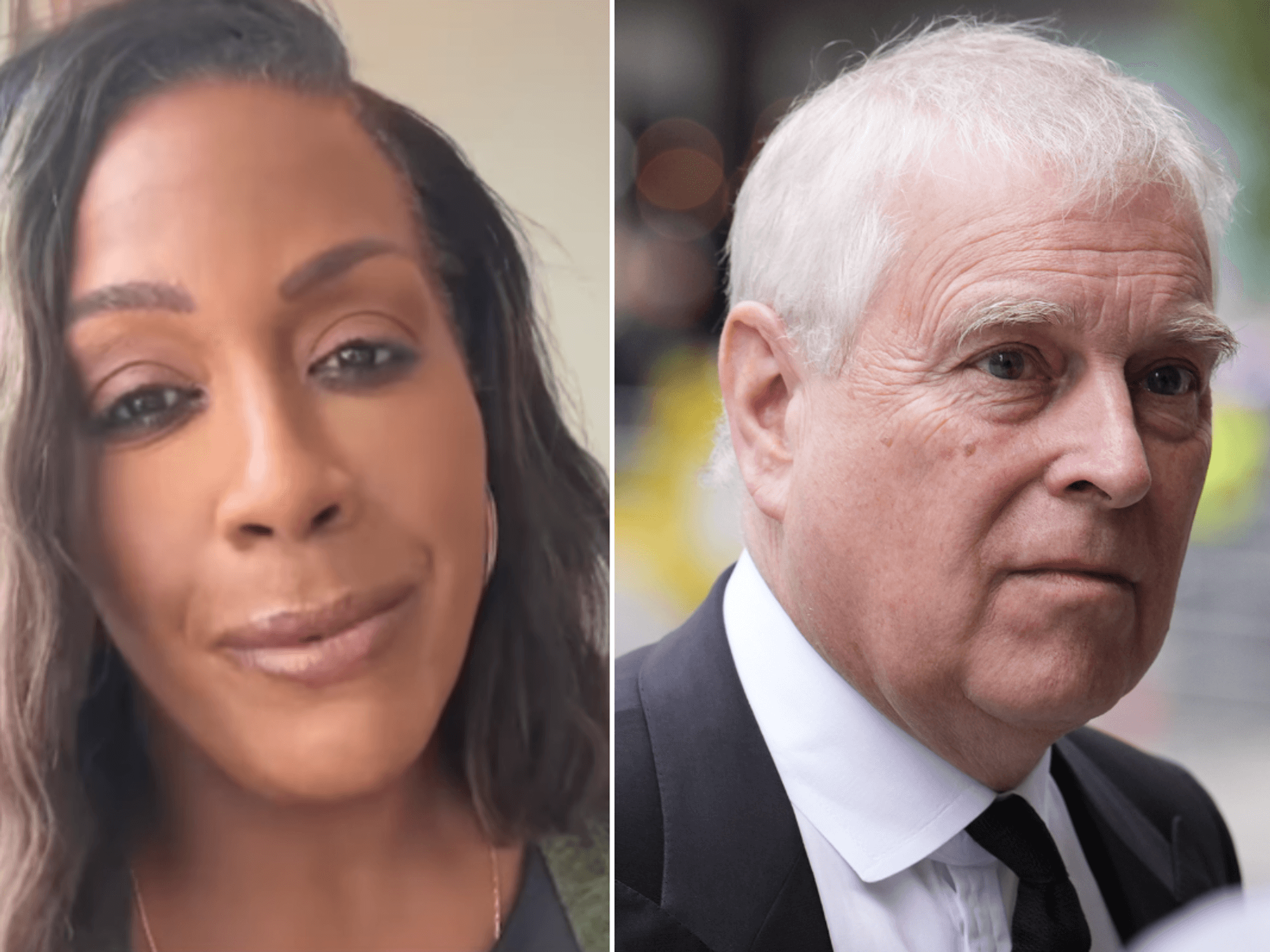

Nominating beneficiaries for a pension can help ensure loved ones inherit the money, the pensions expert said

|PA

However, because pensions fall outside of an estate, they generally can't be put into a will, something which PensionBee said "a lot of people don't know".

Pension savers should check with their pension provider to see what the rules are and what options the beneficiary has.

After death, the person who is dealing with the affairs should contact the pension provider to find out the next steps.

Ms O’Connor said nominating beneficiaries of one’s pension savings now could be worthwhile.

She said: “Nominating beneficiaries for your pension can help ensure your loved ones inherit your money and your wishes are carried out.

“A beneficiary can be anyone: a friend, a partner, a relative, even a charity. You can nominate a beneficiary easily by contacting your provider and asking to fill out an ‘expression of wish’ or a ‘nomination of beneficiaries’ form, or something similar.”

Speaking on The Pension Confident Podcast, Jaypee Soule, Head of Second Line Compliance at PensionBee, said: “It's important to make your pension provider aware of what you'd like to do with your pension if you pass on."

She added: "The decision on who your pension goes to is at the absolute discretion of the pension provider.

"If it can't go into your will then it's important you go add your beneficiaries to your account, make sure we know who you want your pension to go to."

The pension expert explained pensions can be left to as many people as a person likes.

In the event that a person didn't express who they'd like to inherit their pension and they die, the pot could remain "unclaimed", she warned.

Ms Soule said: "I think the majority of people don't think about it."

However, if a person hasn't nominated who they want their pension to go to, that's not to say it cannot be claimed.

Ms Soule explained if a person hasn't confirmed their wishes, "it doesn't mean that's it and it's gone" as providers will "wait to hear from a family member" and then try and figure out who the deceased would have wanted their pension to go to.

She urged people to let family members know they have a pension and add beneficiaries' names.

LATEST DEVELOPMENTS:

Pension savers are being urged to let their family members know they have a pension

|PA

How a pension is paid to beneficiaries after death will depend on the type of pension a person has and age will also play a part.

Ms O'Connor explained the different conditions depending on the age when a person passes away and the type of pension:

Defined Contribution pensions

“If you pass away before age 75 and haven't touched your pension, your beneficiaries have two years to claim your entire pot tax-free.

“If you're over 75, your beneficiaries will have to pay income tax at their usual rate.”

Drawdown pensions

“If you pass away before age 75, but have already started accessing your pension via drawdown, it’s possible for your beneficiaries to access the pot as a tax-free lump sum.

“Or they can opt to receive drawdown payments tax-free.”

Defined Benefit pensions and annuities

“If you have a Defined Benefit pension (also known as a ‘final salary’ pension) or an annuity, you may find it more difficult to pass on.

“However, if you pass away before age 75 and haven’t already retired, your beneficiaries will usually receive your pension as a tax-free lump sum.”