Britons warned of 'hidden horror' in pensions that could leave families with unexpected tax bill

Victoria Atkins MP says the Tories will reverse Labour's inheritance tax changes when they are 'back in Government'. |

GBNEWS

New research has found that fewer than half of UK adults are aware of upcoming pension rule changes set to take effect in 2027

Don't Miss

Most Read

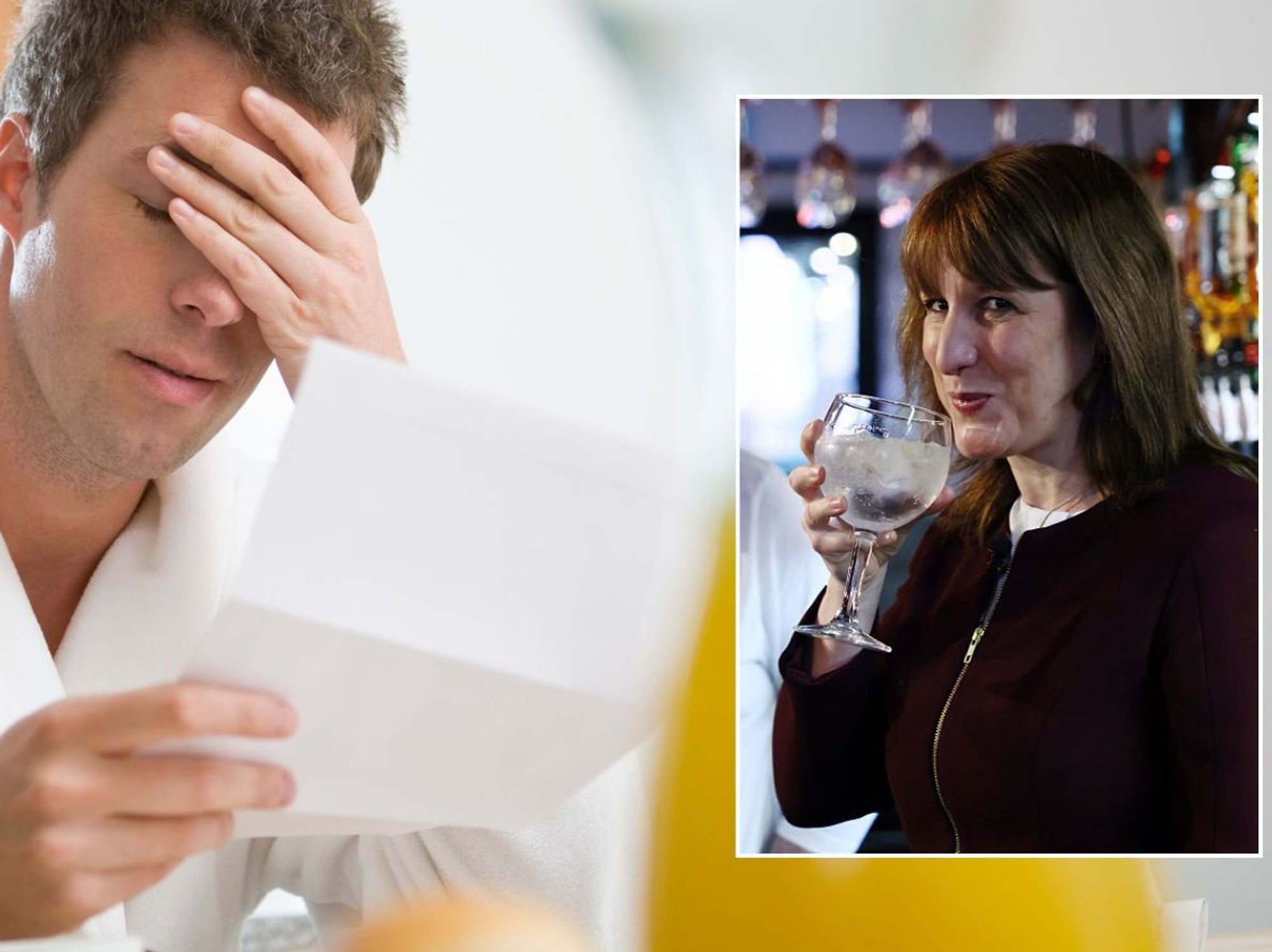

There's a hidden threat buried in the UK’s pension system, and most people don’t even know it’s there.

New research shows a major change that is on the way could leave families facing unexpected financial pressure.

There is a "hidden horror" in our pensions that could have a big impact on our families, according to Helen Morrissey, head of retirement analysis at Hargreaves Lansdown. Less than half of us are aware of this looming issue.

She said: "There’s a hidden horror in our pensions that could have a big impact on our families – but less than half of us are aware of it"

The horror refers to upcoming changes that will make pensions subject to inheritance tax from 2027.

This tax is currently only paid by around four per cent of families, but the inclusion of pensions will open it up to many more households, potentially leaving them facing a nasty surprise bill they hadn't anticipated or planned for.

Only 48 per cent of people are aware that the Government plans to make pensions subject to inheritance tax from 2027, according to a survey of 1,200 people undertaken by Opinium on behalf of Hargreaves Lansdown in April 2025.

When asked about the upcoming changes, seven per cent incorrectly said this was false, whilst a further 45 per cent admitted they didn't know.

The survey revealed significant gaps in awareness between different groups. Men showed higher awareness at 54 per cent compared to women at 42 per cent.

The disparity becomes even more pronounced when examining income levels, with stark differences emerging between tax brackets.

Britons warned of 'hidden horror' in pensions that could leave families with unexpected tax bill

| GETTYAdditional rate taxpayers demonstrate significantly higher awareness at 86 per cent, compared to 58 per cent of higher rate taxpayers and just 45 per cent of basic rate taxpayers.

This group is far more likely to have a looming liability, so it's encouraging that awareness is so high amongst them.

Additional rate taxpayers are likely to have other assets and pensions that could push them into inheritance tax-paying territory.

LATEST DEVELOPMENTS:

With the addition of pensions to the mix from 2027, this could tip them over into paying inheritance tax that they wouldn't have paid previously

| GETTYHowever, the lower awareness amongst basic and higher rate taxpayers creates a concerning situation where families may face unexpected bills they haven't prepared for when the changes take effect in 2027.

The huge property price increases seen in recent years could push many more families closer to the brink of inheritance tax liability.

With the addition of pensions to the mix from 2027, this could tip them over into paying inheritance tax that they wouldn't have paid previously.

This combination of rising property values and the inclusion of pension assets creates a perfect storm for middle-income families who may find themselves unexpectedly liable for inheritance tax.

Many households could discover their total estate value has crossed the threshold purely due to these two factors working together.

However, there are strategies available to mitigate an inheritance tax bill, though understanding the rules is vital.

Inheritance tax is only payable on estates worth more than £325,000, with an additional residential nil rate band of £175,000 that applies when passing on your home to children or grandchildren.

Married couples or those in civil partnerships can pass assets of any value to their partner without inheritance tax liability.

There are strategies available to mitigate an inheritance tax bill, though understanding the rules is vital

| GETTYThey can also inherit any unused portion of their spouse's nil rate bands, potentially allowing families to pass on as much as £1million to loved ones free of inheritance tax.

Morrissey concluded: "It's important to be aware of these looming changes, but not let worry push you into making action that you later come to regret.

"With this in mind, it’s really important that you don’t give so much away that you potentially leave yourself short of cash later on in life, when you still might need it.

"Any gifting plan should give yourself room to manoeuvre, should you find yourself needing care later in life, for instance. You don’t want to be in a position where you need to ask loved ones to return money at a later date."

More From GB News