State pensioners face 'new challenge' as thousands to be 'dragged' into paying tax on payments

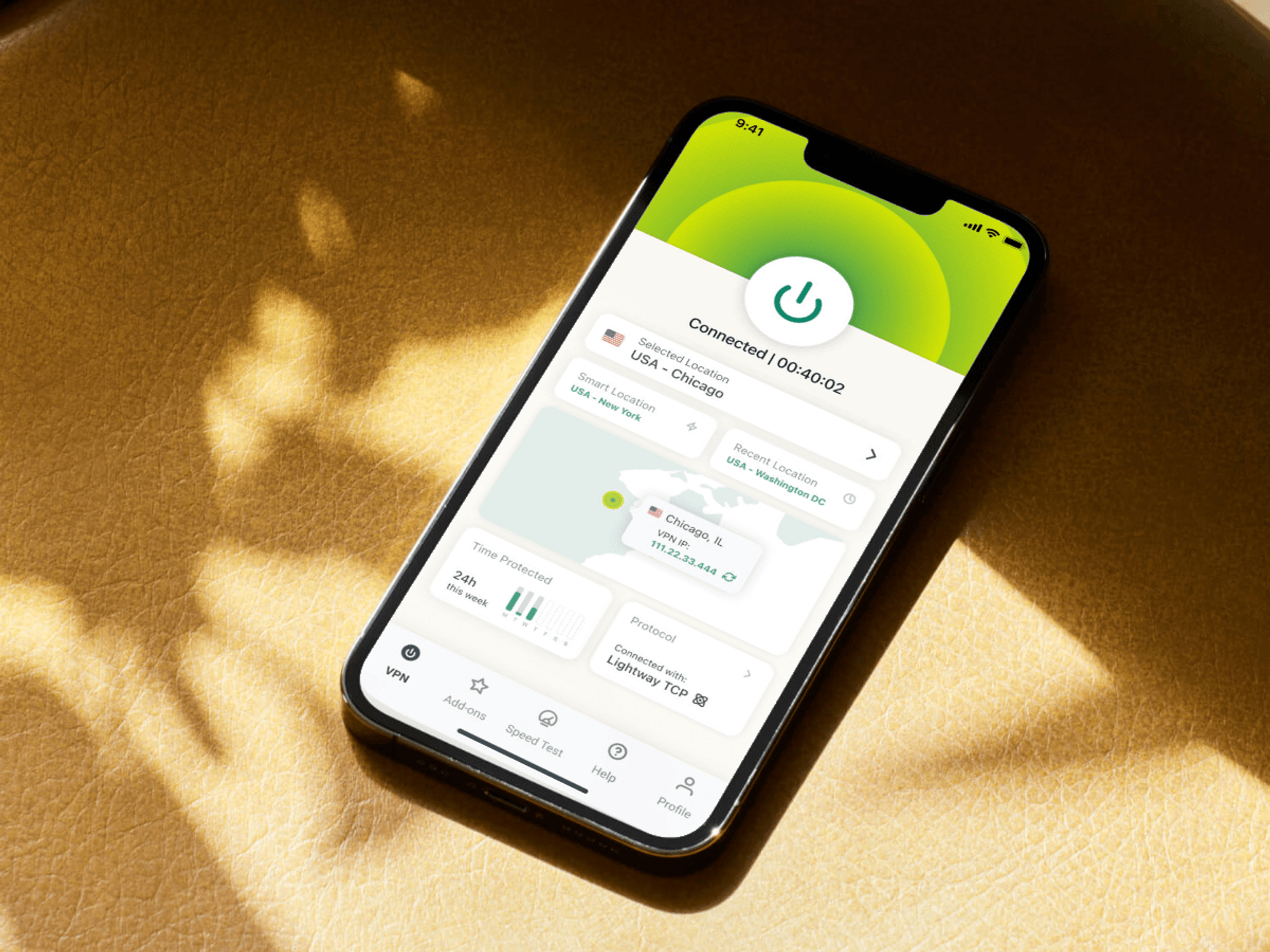

Analysts are sounding the alarm over the impact of fiscal drag on state pension payments

Don't Miss

Most Read

Latest

State pensioners face "new challenges" in the years to come as thousands are at risk of being taxed on their retirement payments alone, new research has found.

New HM Revenue and Customs (HMRC) figures reveal that 37.7 million people paid income tax in 2024/25, marking a significant increase of six million taxpayers compared to 31.5 million in 2019/20.

The number of income taxpayers also rose by 1.4 million from the previous year. The surge is attributed to frozen income tax thresholds creating fiscal drag.

This phenomenon pulls more people into taxation as wages and incomes rise, or inflation, whilst tax bands remain static.

State pensioners are at risk of paying more tax to HMRC

|GETTY

Additionally, there has been a notable increase in National Insurance contributors, with 28.5 million people paying class one National Insurance in 2024/25, up from 26.6 million in 2022/23.

The frozen thresholds mean a rising number of people are paying tax and paying more tax on a greater proportion of their income.

Clare Stinton, the head of workplace saving analysis at Hargreaves Lansdown, described the phenomenon as "fiscal drag in action - a stealth tax that quietly increases the tax burden across the board".

Since 2021/22, the personal allowance has remained frozen at £12,570. If it had kept pace with inflation, it would be around £15,518 today.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Some pensioners are able to avoid the tax man | GETTY

Some pensioners are able to avoid the tax man | GETTY "Instead, millions on modest incomes have been dragged into paying tax for the first time," Stinton said. "The cost-of-living crisis hasn't gone away, and now lower earners must factor tax into their long list of essentials

"With the freeze set to remain until 2028, the impact is only expected to deepen further. Pensioners face particular challenges from the frozen thresholds.

Thanks to the triple lock, the State Pension has jumped about 24% in three years, rising from £185.15 in 2022/23 to £230.35 per week in 2025/26.

Under this payment rate increase metric, retirement benefits rise annually by either the rate of average wages, inflation or 2.5 per cent.

"While that boost is welcome, it brings a new challenge: if the State Pension continues to rise at a similar pace, more retirees could soon find themselves crossing the personal allowance threshold and paying tax on their State Pension alone," Stinton warned.

The combination of rising state pension payments and static tax thresholds means pensioners who previously paid no income tax are increasingly likely to be pulled into the tax system purely through their state pension income.

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves has confirmed tax allowances will remain frozen for the next couple of years | Parliament TV

Chancellor Rachel Reeves has confirmed tax allowances will remain frozen for the next couple of years | Parliament TV"This isn't just about more people paying tax, it's also that people will be paying more tax on a larger portion of their income," Stinton added.

Stinton emphasised the importance of proactive tax planning in response to these changes. "Paying into your pension can help keep total taxable income below income tax thresholds, while at the same time boosting your retirement savings. A double win," she said.

For those saving for retirement, long-term planning becomes crucial. "If you're aiming for a retirement income that may exceed future tax thresholds, consider using ISAs alongside a pension," Stinton advised.

She highlighted that income taken from an ISA is tax-free, which "can be used alongside a pension to give you much needed flexibility in managing your tax bill."