Pensioners could be at risk of wrongful fraud probes under DWP snooping powers: 'Suspects by default!'

Susanna Reid challenges Work and Pensions Secretary Pat McFadden about the government's plans. |

GB NEWS

Age UK is among the charities cautioning pensioners on the risks posed by new DWP powers

Don't Miss

Most Read

Latest

Pensioners in receipt of benefit payments could be the target of wrongful fraud investigations under proposed Department for Work and Pensions (DWP) snooping powers.

Charities have issued stark warnings over measures would grant the department the authority to scrutinise financial accounts of those receiving benefits, potentially ensnaring innocent pensioners in protracted investigation procedures.

Some 16 advocacy groups, amongst them Age UK and Silver Voices, have cautioned that retirees receiving pension credit could become entangled in the anti-fraud initiative, requiring them to navigate complex appeal mechanisms to restore their payments after being mistakenly identified by automated systems.

The legislation in question, the Public Authorities (Fraud, Error and Recovery) Bill, would empower the DWP to compel financial institutions to provide customer data for all benefit recipients.

Charities are warning pensioners about being made 'suspects by default' under DWP snooping powers

|GETTY

These expanded capabilities would permit direct recovery of alleged overpayments from individuals' accounts, bypassing the need for judicial authorisation.

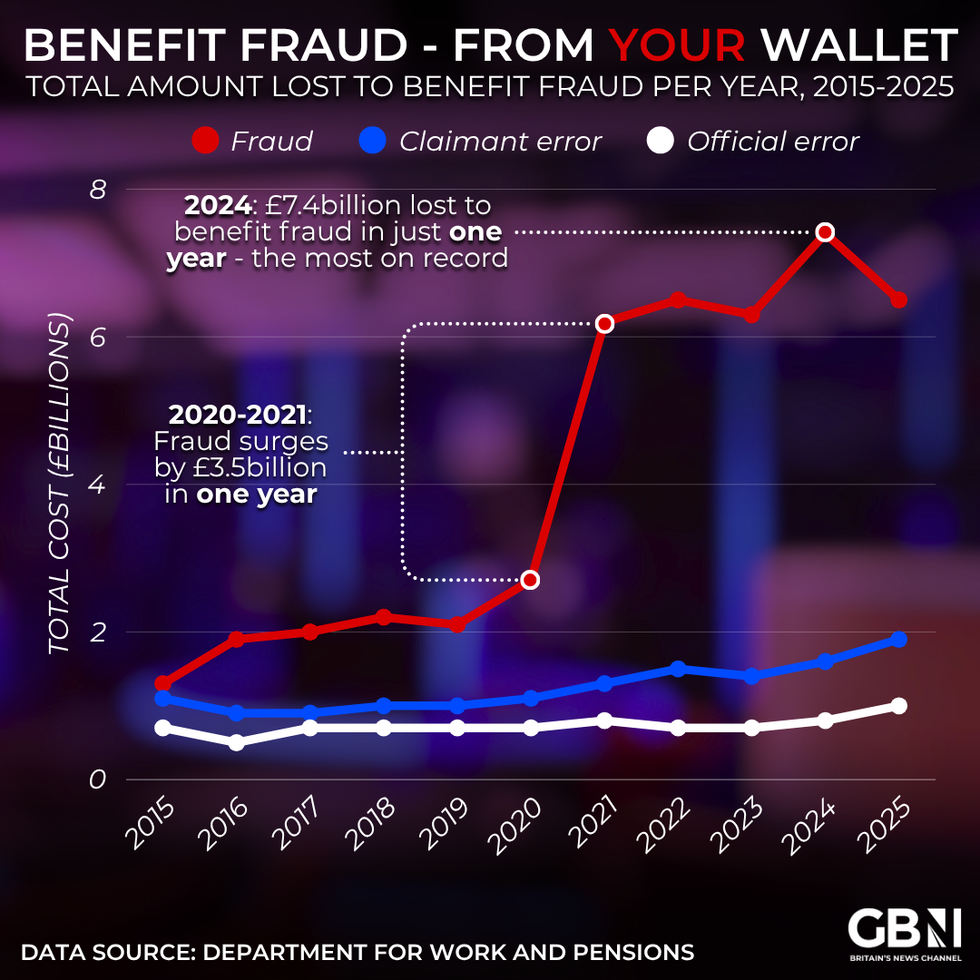

The Government maintains these measures address the £9.4billion lost annually through benefit overpayments and fraudulent claims, representing 3.3 per cent of total welfare expenditure.

Officials have emphasised that bank account access remains restricted and that benefit eligibility determinations will involve human oversight rather than purely automated processes.

Notably, the advocacy groups' correspondence to Work and Pensions Secretary Pat McFadden characterised the proposed powers as "unprecedented level of population-wide mass surveillance".

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWS

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWSTheir letter highlighted risks of "algorithmic errors, wrongful investigations and burdensome appeals" affecting ordinary citizens.

Pensioners have voiced specific anxieties about routine financial activities triggering false alerts.

One Pension Credit recipient explained: "I occasionally need to pay quite large bills at one time thus depleting my savings.

"I am concerned that this movement in my account may trigger the algorithm to flag up a default."

Another individual ceased purchasing lottery tickets, fearing potential winnings might register as undeclared savings, stating: "I genuinely won't know if I do something wrong by mistake and end up losing the roof over my head as a result."

Past experiences with DWP investigations have left some claimants traumatised.

One individual recounted: "I had to get letters from each of the banks to show I was not a fraudster as one of the banks answered the DWP. The mental anguish these mistakes cause is unbearable and nearly sent me under."

Jasleen Chhappar, the legal and policy officer at Big Brother Watch argued that elderly, disabled and impoverished individuals would become "suspects by default" whilst serious criminals evade detection.

LATEST DEVELOPMENTS:

Many pensioners are in receipt of extra support, such as Pension Credit

| PA imagesGovernment statistics reveal merely five per cent of regional fraud investigations resulted in convictions during 2023-24.

A DWP spokesman said: “All powers in the Fraud, Error and Recovery Bill are underpinned by a principle of fairness and proportionality, with numerous safeguards and independent oversight in place.

"In cases of fraud and error, a human will always make any decisions that affect benefit entitlement, and DWP will not have access to benefit claimants’ bank accounts.

"We have a duty to the taxpayer, and this bill is set to save £5.5billion over the next five years, which together with wider reforms will save £9.6billion by 2030, according to Office for Budget Responsibility (OBR) estimates."

More From GB News