Pension crisis looms as Britons urged to 'track down old pots' to boost savings

pensions expert labour window dressing |

GB News

Pension advisers share a six-step challenge to help people track and manage retirement funds

Don't Miss

Most Read

As the end of Pensions Awareness Week is marked, new figures show that three-quarters of working people do not know how much they have saved for retirement.

The findings highlight a widespread lack of awareness despite millions of workers paying into pension schemes every month.

Financial advisers are encouraging people to take part in a six-step challenge designed to help them understand and manage their pensions.

The challenge includes checking how much has been saved, locating old workplace pensions, reviewing investments, estimating retirement needs, comparing these to current savings and updating beneficiary details.

Financial advisers are encouraging people to take part in a six-step challenge designed to help them understand and manage their pensions

| GETTYExperts say these steps can give people a clearer picture of their financial position and help them plan more effectively for later life.

The Government’s free Pension Tracing Service can help individuals track down old workplace schemes.

Users simply enter a former employer’s name to find contact details for pension providers.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Here are the six-steps recommended

1: Find out how much you’ve got in your pension

Advisers urge workers to start by checking their current pension balance.

Matt Pike, from Opal Financial Planning, said: "People often do not bother hunting down small pension pots, but if you had a few thousand in a savings account, you would want access to it, and you never know what it might now be worth."

2: Gain control of any forgotten or old pensions

Many savers have lost track of old workplace pensions. The Government runs a free Pension Tracing Service to help individuals reconnect with schemes from past employers.

Kriss Brining, from PenLife Associates, said: "Tracking down old pensions is not just about the money. It is about seeing the full picture of your retirement. Some of those old schemes might not be working for you anymore or could be poor value."

MEMBERSHIP:

- Panic stations for Keir Starmer as graph shows the devastating impact of snubbing Donald Trump

- Donald Trump's royal embrace just helped topple Labour. Revenge is a dish best served cold - Lee Cohen

- I wish I hadn't read that. Rachel Reeves is about to stiff the middle class and pin it on AI - Kelvin MacKenzie

- Blocking the migrant flight sounds the death knell on democratic sovereignty and Labour's mandate - Rakib Ehsan

- POLL OF THE DAY: Can President Trump help save free speech in Britain? VOTE NOW

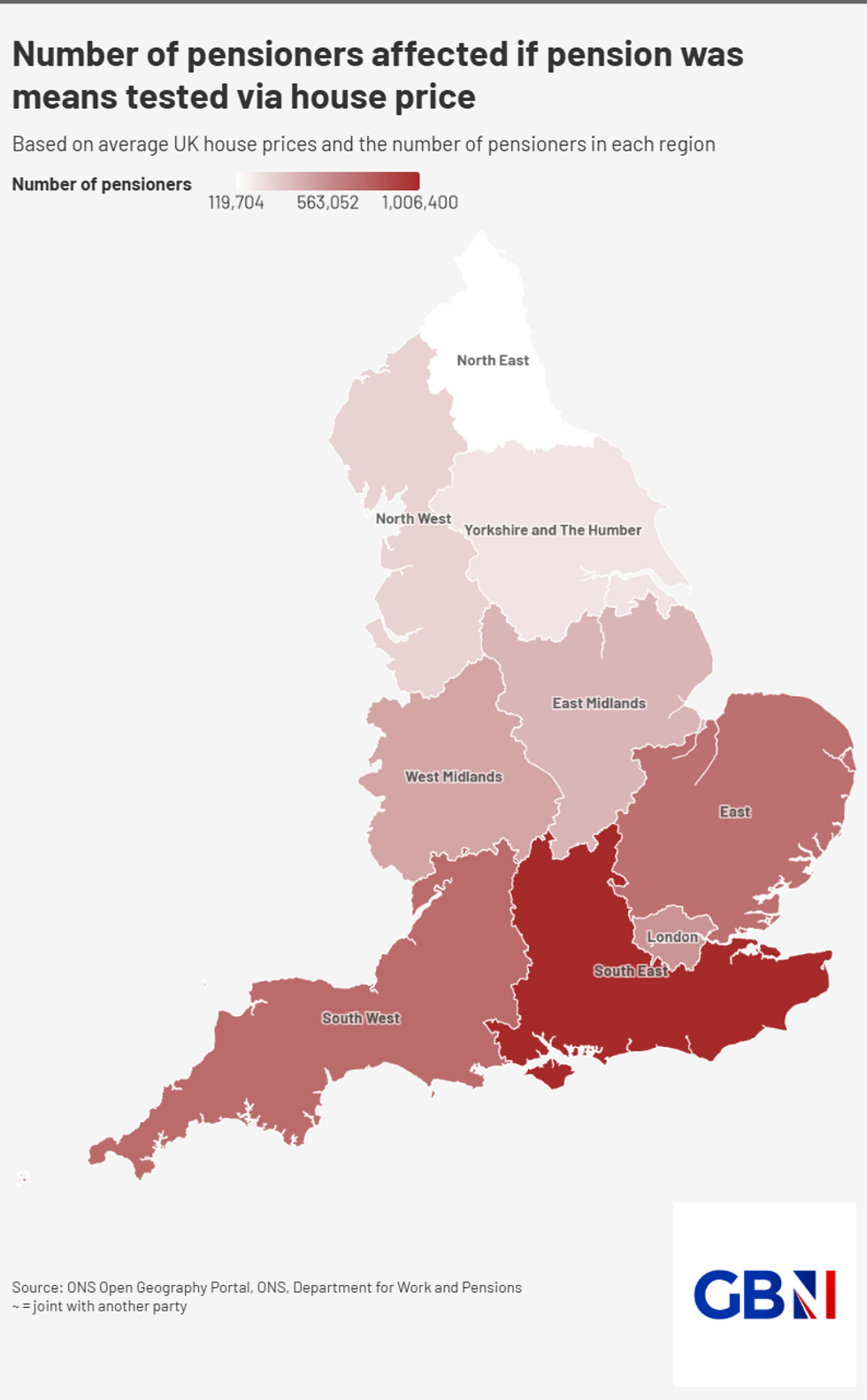

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBN3: Take stock

Understanding how pensions are invested is an important part of retirement planning.

Gerry Davies, from Balance Financial Planning, explained: "Lifestyling automatically reduces investment risk as you get closer to retirement. It sounds sensible, but lower-risk funds often mean lower growth. If you are 65, your pension may need to last another 20 years, and being too cautious could mean your money does not keep up with inflation."

4: Work out how much pension you’re going to need

Advisers recommend thinking about the lifestyle you want in retirement and the income it will require.

James Wadsworth, from PenLife Associates, said: "You need to think about everything from daily expenses to holidays, then put a price tag on it."

Advisers recommend thinking about the lifestyle you want in retirement and the income it will require

|Getty Images

5: Ask yourself, is this going to be enough?

Comparing current savings against likely retirement needs is essential.

Jordan Gillies, from Saltus, said: "A useful starting point is to divide your required annual income by 4 per cent to estimate the pension pot you will need. Online calculators can help, but a financial adviser can create a proper plan showing how your finances might change over time."

6: Get your beneficiary form up to date

Beneficiary forms determine who receives pension savings after death. Advisers warn these must be kept up to date.

Sean Irwin, from Clarity Wealth Management, said: "Updating your beneficiary form is your voice from beyond the grave. It tells pension providers exactly who should get your money."

LATEST DEVELOPMENTS:

More From GB News