Pension crisis looms as millions 'losing out on valuable' £9,000 in retirement savings - are you impacted?

New research on retirement savings has founding Britons are losing track of workplace and private pension pots

Don't Miss

Most Read

Britain is on the verge of a pension crisis as millions of adults are at risk of losing more than £9,000 in retirement income due to not keeping track of their savings, new research has found.

Analysis from Standard Life has uncovered that approximately a quarter of British adults have no idea which company manages their pension savings, whilst a significant majority have made no attempt to locate missing retirement funds.

The study found that 26 per cent of UK adults cannot identify their pension provider. Additionally, 66 per cent have never attempted to locate missing pension funds, despite these forgotten savings averaging £9,470 per pot.

Nearly a quarter of adults fail to understand that switching employers typically results in accumulating several separate pension accounts, while under a third have successfully maintained records of retirement savings from former workplaces.

Standard Life's research is shining light on Britain's looming pension crisis

|GETTY

The research reveals that three out of five adults have never brought their workplace retirement savings together into a single account. This reluctance to combine pension funds spans all age groups, though older generations show the highest resistance.

Nearly three-quarters of the Silent Generation have avoided merging their retirement accounts, while approximately two-thirds of both baby boomers and Generation X have similarly kept their pensions separate.

Younger workers display comparable patterns, with half of millennials and 55 per cent of Generation Z maintaining multiple uncombined pension accounts.

Despite the substantial sums involved, most people who maintain separate accounts have made no effort to locate their missing retirement money.

The majority of pensioners living in poverty in the UK are women, research has found

| GETTYAmong individuals who haven't merged their retirement accounts, two-thirds have made no effort to locate missing funds.

While 27 per cent express intentions to search for lost pensions, 39 per cent have no such plans.

Nearly a third indicate they lack knowledge about how to begin searching, whilst almost a fifth consider the process not worthwhile.

Time constraints affect over one in ten, and a similar proportion view the task as excessive trouble, according to Standard Life.

Mike Ambery, retirement and savings director at Standard Life, part of Phoenix Group, shared: "Millions of people risk losing out on valuable retirement savings simply because they've lost track of their pensions. With multiple job moves now the norm, it's easy for pots to slip through the cracks."

The Government offers several resources to help individuals recover missing retirement funds.

People can utilise the free Pension Tracing Service to obtain current contact information for former employers and pension administrators, requiring only National Insurance numbers and employment dates.

Maintaining current personal information across all pension accounts proves essential for receiving important communications.

LATEST DEVELOPMENTS:

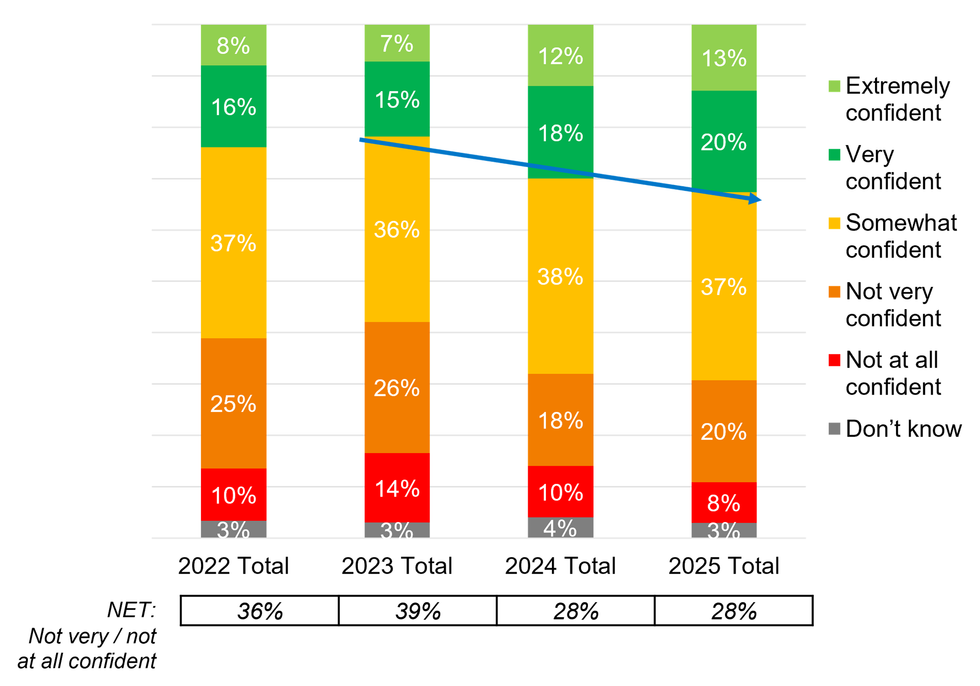

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Workers should ensure providers hold their home addresses and personal email accounts, particularly when leaving employment and losing access to workplace email systems.

Mr Ambery added: "Each individual pot might not seem significant on its own, but together they can add up to a substantial boost to your retirement income.

"By finding and managing lost pots, people could significantly improve their retirement lifestyle and make sure no hard-earned savings go to waste."

Individuals can also review their State Pension projections through GOV.UK to understand their entitlements and determine whether voluntary National Insurance contributions might prove beneficial.