Pension tax crisis as Rachel Reeves 'rule change' to slap Britons with 40% inheritance bill

Inheritance tax is a levy charged on the estates of individuals who have passed away, which will include pension assets

Don't Miss

Most Read

A large proportion of UK financial advisers have expressed alarm over forthcoming changes that will bring pension pots within the inheritance tax regime (IHT), according to new research from Quilter.

The adviser platform surveyed more than 770 independent financial advisers and found that 95 per cent harbour concerns about pensions becoming subject to IHT and income tax when savers die after age 75, with these rules taking effect from April 2027.

The level of anxiety is particularly striking, with close to half of those polled describing themselves as extremely worried about the impending changes.

Financial advisers anticipate the impact will be far-reaching, with two-thirds of their client base expected to require inheritance tax guidance once the new rules come into force.

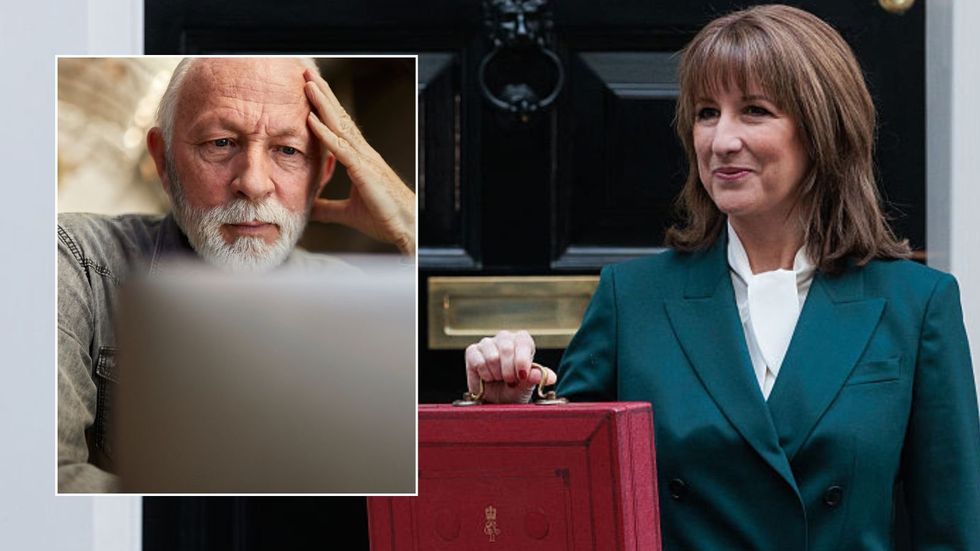

Financial advisors are increasingly concerned about the Chancellor's looming tax raid on pensions

|GETTY

This represents a significant jump from earlier in 2025, when advisers estimated that 52 per cent of clients would be affected by the changes.

As it stands, IHT is levied on the estates, including money, possessions and property, of people who have passed away at a rate of 40 per cent.

These pension reforms arrive alongside a series of other fiscal pressures weighing on households, including thresholds that remain frozen, reductions to capital gains tax (CGT) allowances, and higher dividend taxation on the horizon.

Together, these measures have already increased the tax burden for many families, and incorporating pensions into the IHT framework introduces yet another layer of complexity for those planning wealth transfers between generations.

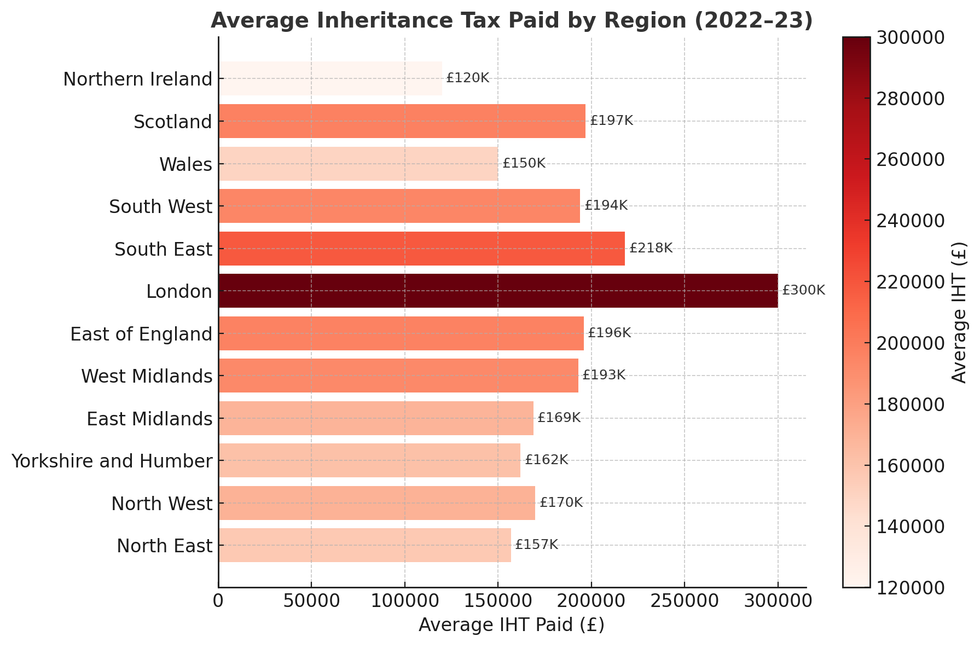

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSThe shifting landscape is forcing advisers to rethink the conventional wisdom that pension savings should remain untouched until all other assets have been depleted during retirement. A 93 per cent of those surveyed now consider planning for the pension and inheritance tax changes to be among their most pressing priorities.

Many professionals believe their clients will need far more sophisticated estate planning arrangements going forward, potentially utilising alternative investment wrappers and trust structures to safeguard family wealth.

The demand for expertise in this area is clear, with nine in ten advisers indicating they want additional support around trusts and broader estate planning strategies.

Roddy Munro, the head of Technical Sales at Quilter, said: "Bringing pensions into the ambit of IHT has changed the rules of the game for retirement and estate planning.

For years, advisers have helped clients build pensions that could provide support both in later life and for loved ones when they are gone.

Mr Munro shared: "The shift to bring pensions within IHT means those long-held assumptions need to be revisited and strategies adapted in good time".

He added that people want reassurance their hard-earned wealth will benefit their families rather than be eroded by avoidable taxation, and that advisers are seeking the right guidance to determine optimal wealth structures going forward.

The changes to inheritance tax rules for pension assets will come into effect from April 2027.

Region by region, which areas pays the most inheritance tax | TaxPayers' Alliance

Region by region, which areas pays the most inheritance tax | TaxPayers' AllianceWhat are the inheritance tax rule changes

From April 6, 2027, most unused pension funds and death benefits will be included in your estate and count toward inheritance tax, ending their long-standing exemption.

Beneficiaries and personal representatives administering the estate may now have to pay IHT on pension death benefits if the total estate exceeds the nil-rate band, increasing typical tax bills.

The rules also shift reporting and payment responsibilities to personal representatives rather than pension administrators.

Most estates still will not pay IHT, but a notable minority that previously paid nothing will face new liabilities because of pension inclusion for pensions.

More From GB News