Britain 'sleepwalking into a retirement crisis' as millions lose track of pension savings

Britons are being urged to being proactive in handling their pension savings

Don't Miss

Most Read

Latest

Britain is heading towards a "retirement crisis" with millions of Britons having lost track of their pension pots, according to shocking new research conducted by Moneyfarm.

The firm's survey of 2,000 adults found that nearly eight in ten people having no real understanding of how much they have set aside for their later years, with the typical Briton hoping to stop working at 62 and enjoy an annual income of approximately £30,000.

However, this is an aspiration that financial experts have described as "wildly unrealistic" and people of working-age are being urged to prioritise pension saving to make their retirement go further.

Carina Chambers, a financial expert at Moneyfarm, said: "The research shows that we're sleepwalking into a retirement crisis with too many people thinking their pensions will magically sort themselves out."

Britain is 'sleepwalking into a retirement crisis'

|GETTY

She warned that failing to monitor pension savings could significantly damage long-term financial security. More than a third of those surveyed admitted to having a pension scheme somewhere that they have entirely lost contact with or misplaced the documentation for.

The confusion surrounding retirement planning appears widespread, with 87 per cent of respondents agreeing that pensions are simply too complicated to understand.

Nearly three-quarters of participants had no idea what the state pension actually pays out each month, while more than two-thirds confessed they could not distinguish between the various retirement plan options available.

Perhaps most concerning, over half of those polled by Moneyfarm expressed doubt that they would accumulate sufficient funds to retire comfortably once they leave the workforce.

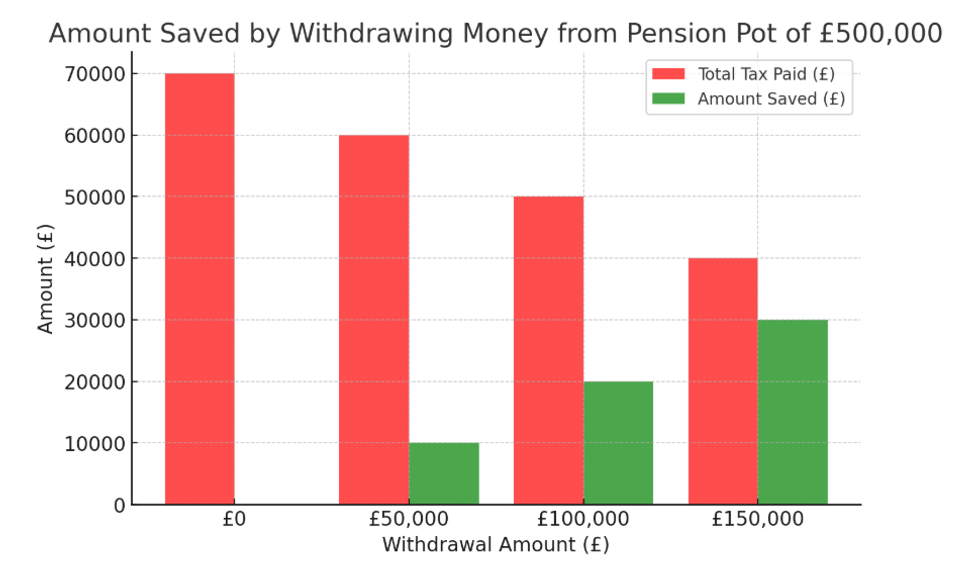

How much you could save by withdrawing money from your pension | GBN

How much you could save by withdrawing money from your pension | GBNThe research also revealed that 27 per cent of people were unable to identify their pension provider, and 49 per cent had lost track of workplace pension pots from previous employment.

Despite the widespread uncertainty, the majority of Britons are actively putting money away for retirement, with 61 per cent making regular monthly contributions to a pension scheme.

On average, British workers hold at least two separate pension pots and deposit around £258 each month towards their future.

However, nearly six in ten people admitted they simply bury their heads in the sand when confronted with retirement planning decisions.

Workplace pension pots are being forgotten

| GETTYLATEST DEVELOPMENTS

The survey highlighted that three quarters of respondents had never received guidance from a qualified pensions specialist about their options.

When asked what they found most baffling about retirement schemes, 44 per cent pointed to the different pension types available, while 30 per cent struggled with tax implications and 26 per cent were confused about how to actually claim their pension.

Chambers urged people to take immediate action rather than waiting until retirement approaches, emphasising that small steps now could shape their financial future.

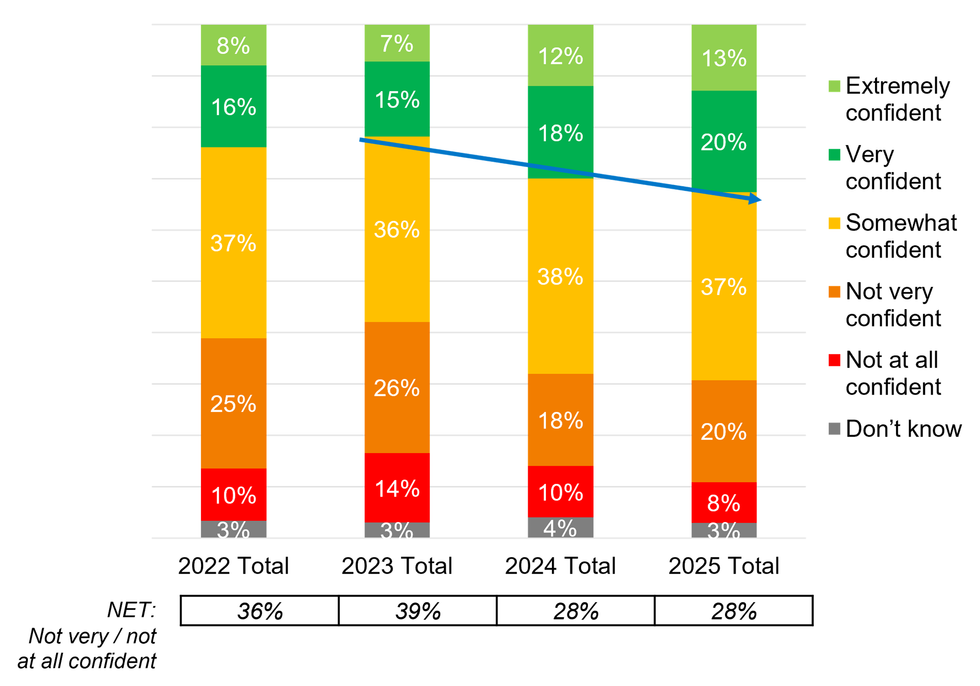

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON She recommended using pension tracing services to locate forgotten workplace schemes from previous jobs and consolidating multiple pots into a single, more manageable account.

Checking state pension forecasts online offers a quick and free way to understand future entitlements, she advised.

The expert also suggested that when receiving pay rises or bonuses, workers should maintain the same percentage contribution to their pension so savings grow alongside earnings.

For those finding the system overwhelming, Chambers encouraged seeking help from qualified pension advisers or digital services, noting that confusion about retirement planning is extremely common.

More From GB News